Copper on the Brink: Tariff Tensions Set Stage for a Historic Price Surge

Extraordinary Shifts in the Global Copper Market: Tariff Tensions and Record-High Predictions

In a dramatic twist to global commodity markets, well-known copper bull Kostas Bintas has once again signaled an impending revolution in copper pricing. With U.S. tariff threats reshaping trade dynamics and depleting global inventories, market observers now face the prospect of copper prices soaring to unprecedented levels.

A Market on the Brink: Tariff Turbulence and Inventory Strains

As trade policies tighten under renewed tariff threats, the copper market is experiencing a seismic shift. Bintas, whose insights are closely followed by traders and analysts alike, outlined the emerging scenario: large volumes of copper are being redirected into the United States—a move that, he warns, will likely lead to severe shortages in other parts of the world. He expressed the view that remarkable developments are occurring in the copper market. He suggested that price targets of $12,000 or $13,000 might be reasonable possibilities. He acknowledged the challenge of providing precise price predictions given the unprecedented nature of the current market situation. These remarks underscore a profound reordering in the global copper supply chain, one that could set the stage for historically high prices.

Historical copper prices over the last 5 years (Trading Economics)

Voices from the Field: Multiple Perspectives on a Tightening Market

A parallel narrative is emerging from other market experts and financial analysts. An anonymous analyst, reflecting on recent developments, noted that geopolitical tensions combined with aggressive tariff measures have created a market environment unlike any seen in recent memory. Another expert, speaking on condition of anonymity, remarked that the massive influx of copper into the U.S. could drastically alter supply dynamics, potentially offering remarkable profit opportunities for those positioned to navigate the shifting landscape.

Adding further weight to these assessments, a report from a leading financial research outlet emphasized that the current trajectory is supported by concrete data: domestic inventories in the United States are tightening at an alarming rate, thereby constraining global supplies. This phenomenon, driven by trade policy maneuvers, suggests that the copper market is on the cusp of a record surge.

Tariffs directly influence commodity prices by adding to import costs, ultimately affecting global trade patterns. These taxes on imported goods can distort international trade by making some goods more expensive and less competitive. Understanding how tariffs function is crucial for analyzing their wide-ranging economic consequences.

Analyzing the Data: The Implications of a Copper Shortage

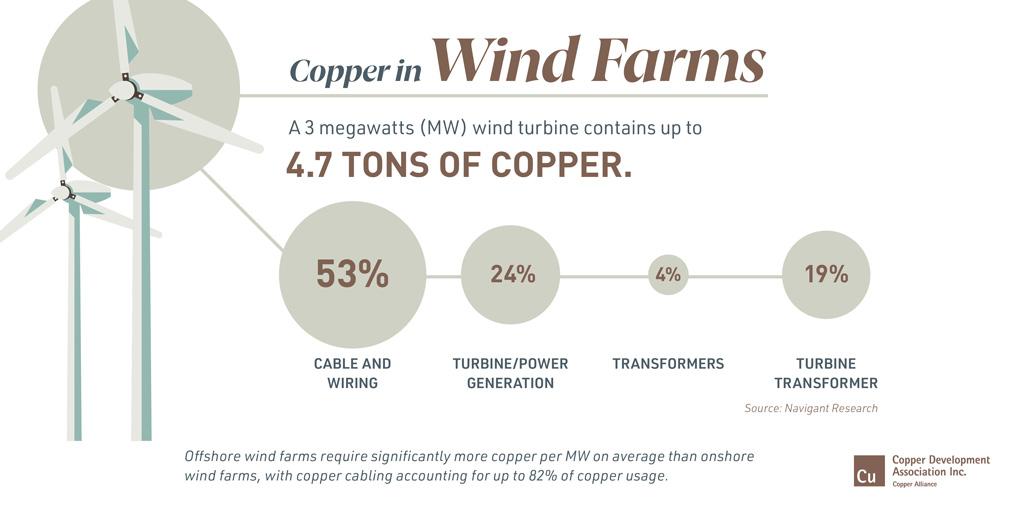

The implications of these developments extend beyond mere price speculation. As copper becomes increasingly scarce on the international market, industries dependent on this critical metal—from electronics to renewable energy—may face significant challenges. The confluence of aggressive tariff policies and strategic stockpiling in the U.S. has set in motion a chain reaction that could lead to global supply bottlenecks. While Bintas stops short of pinpointing an exact figure, the projection that prices could climb to the $12,000–$13,000 per tonne range offers a stark warning to investors and policy makers alike.

Looking Ahead: Navigating Uncharted Territory

As market participants brace for what could be a historic reconfiguration of copper trading, all eyes remain on the evolving interplay between policy decisions and supply chain dynamics. The narrative emerging from today’s reports is clear: the copper market is at a crossroads, and the decisions made in the coming weeks could redefine its trajectory for years to come. Analysts caution that while the situation presents lucrative opportunities, it also carries inherent risks that require careful management and strategic foresight.

In summary, the unfolding scenario in the copper market—fueled by Trump’s tariff threats and the resultant reallocation of global inventories—demands close scrutiny. With experts like Kostas Bintas painting a picture of record-high pricing amid tightening supply, stakeholders across industries are urged to prepare for a period of unprecedented market volatility and transformation. Future developments will likely hinge on the interplay between evolving trade policies and the relentless global demand for copper, setting the stage for a new chapter in commodity trading.