EU Fines Apple €500M and Meta €200M for First Digital Markets Act Violations

EU's Historic Tech Crackdown: €700 Million Fines Signal New Era for Silicon Valley Giants

BRUSSELS — Standing before a bank of microphones in the European Commission's Berlaymont headquarters, EU regulators delivered what many industry observers are calling a watershed moment in global tech regulation: landmark fines totaling €700 million against American tech behemoths Apple and Meta for violations of the bloc's Digital Markets Act.

"This sends a strong and clear message that the European Union is serious about enforcing its digital competition rules," said the Commission's spokesperson, announcing the first enforcement actions under the new regulatory framework designed to curb the power of digital "gatekeepers."

The Digital Markets Act (DMA) is European Union legislation aimed at regulating large online platforms designated as "digital gatekeepers." Its core purpose is to ensure fairer competition in digital markets and prevent these dominant companies from imposing unfair conditions on businesses and consumers.

The penalties — €500 million for Apple and €200 million for Meta — represent more than just monetary punishment. They signal Brussels' determination to fundamentally reshape how Silicon Valley's giants operate within the world's largest trading bloc, with potential ripple effects across global technology markets and transatlantic relations already strained by tariff tensions.

Inside the Ruling: How Apple and Meta Ran Afoul of Europe's New Digital Sheriff

The Commission's investigation into Apple centered on the company's "anti-steering" practices, which prevented app developers from directing users to alternative payment options outside the App Store. This restriction, according to EU regulators, limited consumer choice and forced developers to accept Apple's terms and fees, including a controversial new "Core Technology Fee."

Anti-steering provisions are rules, often imposed by digital platforms like app stores, that restrict developers from directing users to alternative payment methods or purchasing options outside the platform's ecosystem. These rules prevent developers from informing users about potentially cheaper ways to subscribe or purchase content directly, thereby keeping transactions within the platform's payment system.

"These practices essentially created a closed ecosystem where Apple maintained complete control over user transactions," explained a senior EU competition analyst who requested anonymity due to the sensitivity of ongoing investigations. "Developers had no choice but to play by Apple's rules and pay Apple's fees, regardless of whether better options existed elsewhere."

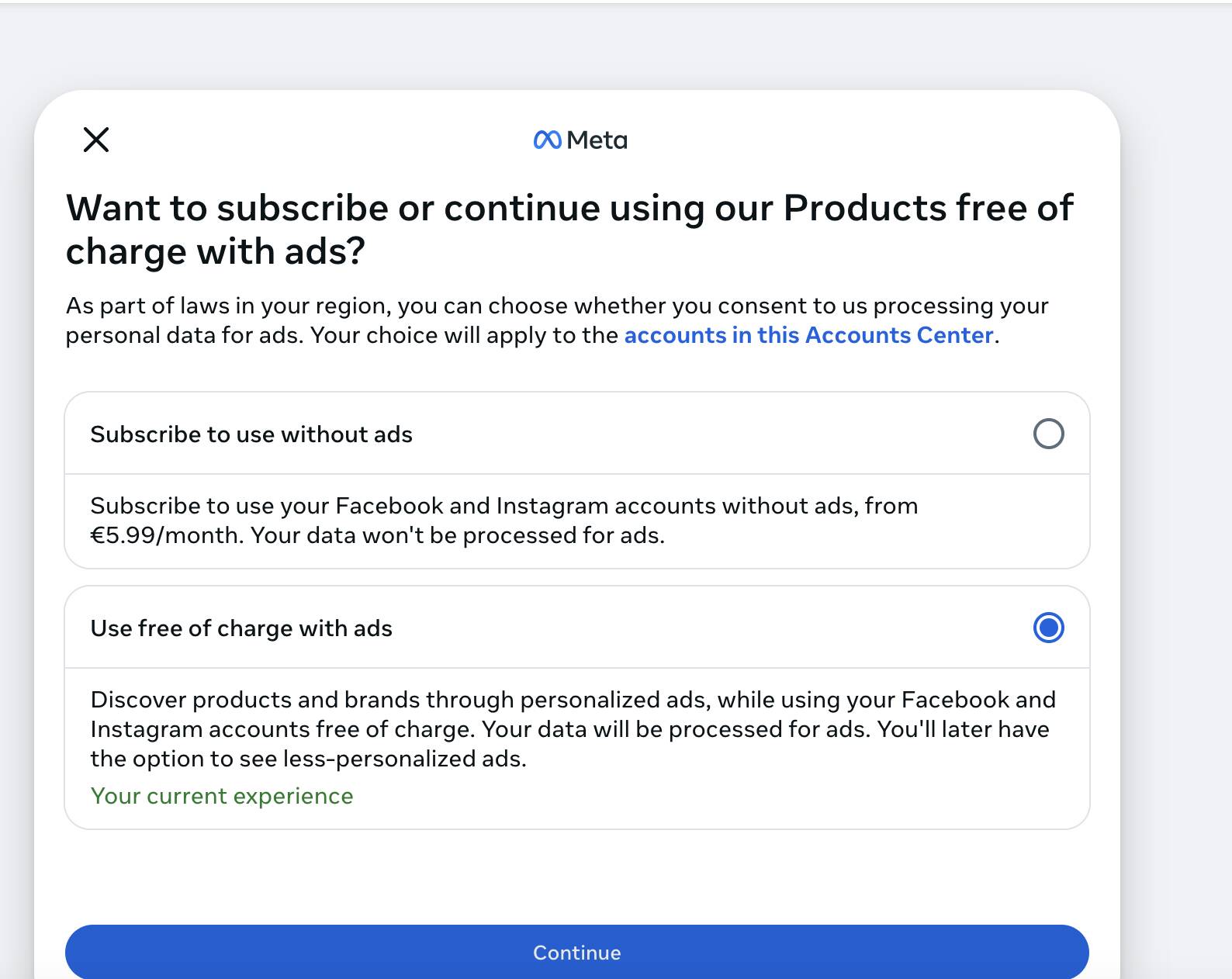

Meta's violation stemmed from its "pay or consent" model introduced in November 2023, which gave Facebook and Instagram users in Europe two options: consent to personal data collection for targeted advertising or pay a subscription fee for an ad-free experience. The Commission ruled that Meta failed to provide a less personalized but equivalent alternative for users who did not consent to data tracking, as required by the DMA.

Both companies have been given two months to bring their practices into compliance or face additional penalties that could escalate dramatically. Under DMA provisions, continued non-compliance could trigger periodic penalties reaching up to 20% of global daily revenue.

DMA Fines: Potential vs. Actual (Apple & Meta)

| Company/Rule | Max Potential Fine (% of Global Turnover) | Actual Fine (as of Apr 23, 2025) |

|---|---|---|

| DMA Rule | Up to 10%; up to 20% for repeat offenses | N/A |

| Apple | Up to 10–20% (~>$38B based on 2023) | €500M – Anti-steering violation (App Store) |

| Meta | Up to 10–20% (~>$13B based on 2023) | €200M – User choice breach ("pay or consent" model) |

| Notes | Potential fines can reach tens of billions | First DMA fines issued; more investigations ongoing |

Walking a Diplomatic Tightrope: Balancing Enforcement and Geopolitical Realities

The timing and scale of the fines reveal a careful calibration by Brussels, according to policy experts. Coming amid heightened trade tensions between the EU and United States, the penalties could have been substantially higher — up to 10% of global turnover, potentially reaching tens of billions for Apple alone.

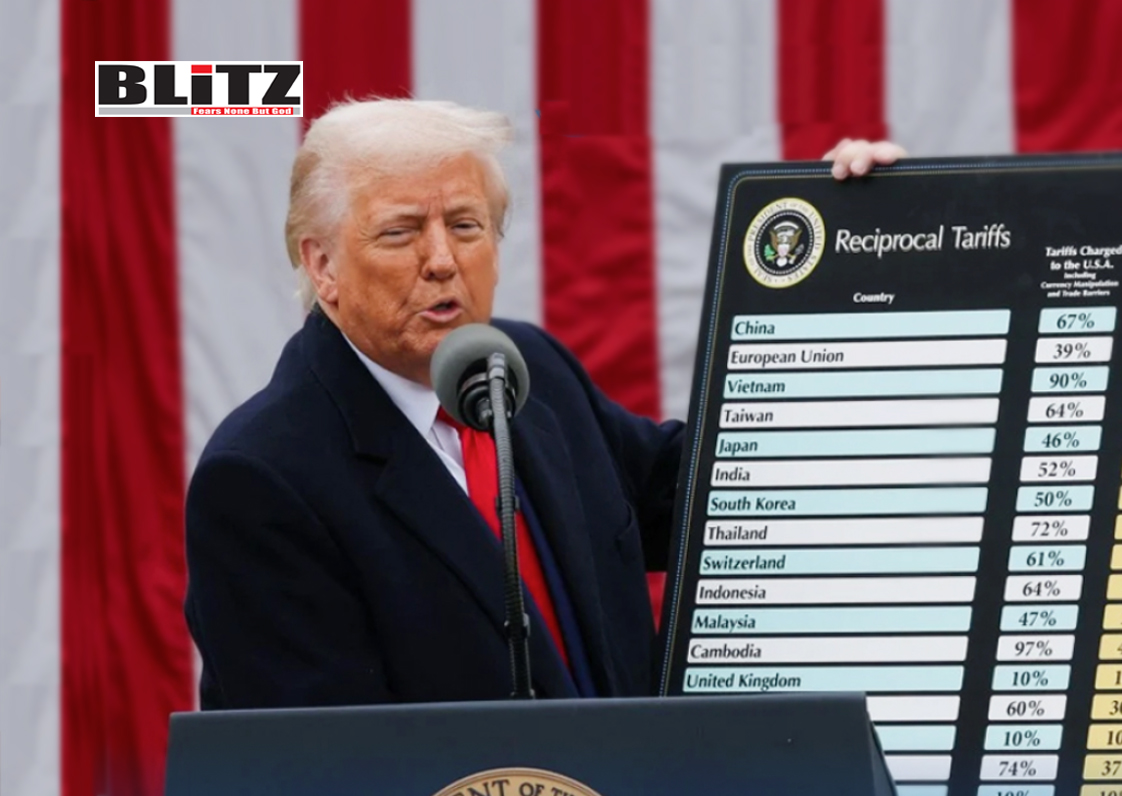

"The Commission appears to have deliberately set these fines below the maximum to avoid further inflaming transatlantic tensions," noted a European policy researcher specializing in digital regulation. "With President Trump back in the White House and already threatening reciprocal tariffs against what he's previously called 'overseas extortion,' EU regulators are treading cautiously while still asserting their authority."

The European Commission, under new leadership since December, has emphasized a "firm but balanced" enforcement approach, describing these as "first decisions" under a "very new regulation." This measured stance suggests awareness of the potential economic consequences of a full-blown trade conflict with the United States.

Silicon Valley's Counterpunch: Tech Giants Prepare for Battle

The companies have not accepted the rulings quietly. Both have announced plans to appeal, setting the stage for protracted legal battles that could take years to resolve.

Apple has framed its resistance in terms of user protection, arguing that forced changes to its business model would compromise privacy and security. "Our priority has always been to create the most secure, privacy-protective experience for our users," read a statement from the company. "The Commission's decision risks undermining these principles to the detriment of European consumers."

Meta's response has been more directly confrontational. Joel Kaplan, Meta's global affairs chief, characterized the EU's requirements as a "multi-billion-dollar tariff" on American innovation. "These changes will force us to deliver an inferior service to European users while giving Chinese and European competitors a structural advantage," he stated.

The appeals process is expected to stretch two to three years, significantly delaying any immediate cash-flow impact. This timeline has contributed to relatively muted market reactions, with Apple's stock ticking up 0.4% and Meta adding 1.2% following the announcement.

Beyond the Headlines: The Real Economic Stakes

While the headline fine figures appear manageable for companies with cash reserves measured in hundreds of billions, the potential long-term economic implications run much deeper.

For Apple, the Commission's scrutiny extends beyond anti-steering to the entire structural foundation of its App Store business model in Europe. The iOS ecosystem may eventually be forced to resemble macOS, with greater openness to side-loading and alternative app stores. Financial analysts estimate that full compliance could put approximately 2% of Apple's services revenue at risk in the near term, with potentially deeper impacts on its ecosystem control longer-term.

Table: Breakdown of Apple’s 2024 Revenue Sources, highlighting the significant contribution and growth of the Services segment.

| Segment | Revenue (FY 2024) | Share of Total Revenue | Key Notes |

|---|---|---|---|

| iPhone | $201.2 billion | 51% | Largest revenue source, sales flat YoY |

| Services | $96.2 billion | 25% | Fastest-growing, 74% margin, 1B+ paid subscriptions |

| Wearables, Home & Accessories | $37.0 billion | 9% | Slight YoY decline |

| Mac | $30.0 billion | 8% | Modest growth |

| iPad | $26.7 billion | 7% | Declined YoY |

| Total | $391 billion | 100% |

"The real question isn't the €500 million fine — it's whether this is the beginning of the end for Apple's walled garden in Europe," observed a technology investment strategist. "If forced to truly open up, we could see lower lock-in but also higher security costs and, critically, a fundamental shift in how iOS monetizes."

Meta faces an even more direct challenge to its core business model. With the EU contributing approximately 22% of Meta's ad sales, a forced shift away from hyper-targeted advertising could reduce CPMs (cost per thousand impressions) by 10-15%, potentially trimming earnings per share by around 4%.

Table: Meta's 2024 Advertising Revenue by Geographic Region, Highlighting Europe’s Share and Growth

| Region | Revenue (USD Billions) | % of Total Revenue | Year-over-Year Growth |

|---|---|---|---|

| US & Canada | 63.21 | 38% | 18% |

| Asia Pacific | 45.01 | 27% | 22% |

| Europe | 38.36 | 23% | 26% |

| Rest of World | 17.92 | 11% | 31% |

| Total | 164.5 | 100% | 22% |

Did you know? CPM, or Cost Per Thousand Impressions, is a common advertising metric that tells you how much it costs to show your ad 1,000 times. It's ideal for brand awareness campaigns where visibility is key, not clicks. For example, if you spend $500 on a campaign that gets 100,000 views, your CPM is $5—meaning it costs $5 to reach every 1,000 people.

Paradoxically, some financial analysts suggest that if Meta embraces a subscription model globally in response to these pressures, it could actually prove bullish for free cash flow if churn rates remain manageable.

Winners and Losers in a Reshuffled Digital Landscape

As the tech giants adapt to the new regulatory reality, a complex ecosystem of winners and losers is emerging.

Payment processors and fintech aggregators like Adyen, Stripe, and PayPal stand to benefit significantly if developers can redirect in-app payments away from Apple's payment system, which currently commands a 15-30% commission. Alternative app store providers and web app developers, including Epic Games, Setapp, and Microsoft, could see accelerated growth as platform friction decreases.

Epic Games CEO Tim Sweeney has already hailed the EU's ruling as a model for U.S. lawmakers to consider. "This landmark decision recognizes what developers worldwide have known for years — that mandatory platform fees and restrictive policies harm innovation and consumer choice," he stated.

The emerging field of privacy-preserving ad technology, including companies like The Trade Desk and Criteo, as well as open-source "clean room" solutions, may experience surging demand as platforms seek compliant alternatives to personal data tracking.

Did you know? Privacy-preserving ad technology is designed to deliver relevant ads without compromising user privacy. Instead of tracking individuals across the web, it uses techniques like aggregated data, anonymization, and on-device processing to target ads in a way that respects personal data. A key example is the use of data clean rooms—secure environments where brands and platforms can combine and analyze user data without exposing individual identities. These clean rooms let advertisers understand audience behavior and measure performance while keeping personal information private and compliant with regulations like the GDPR and DMA.

However, small and medium-sized businesses heavily reliant on granular ad targeting could face higher customer acquisition costs until contextual advertising technology matures. Apple's brand moat in Europe could also weaken if increased side-loading exposes hardware parity with competitors.

Geopolitical Chess: Trump, Tariffs, and Tech Sovereignty

The EU's enforcement actions come at a particularly sensitive moment in transatlantic relations. Brussels appears to have calibrated these first fines to avoid triggering a severe response from the Trump administration, which has threatened 20% tariffs against European goods in retaliation for what it perceives as unfair targeting of American companies.

"These fines reflect a careful balancing act," said an international trade expert with knowledge of EU-US negotiations. "The Commission wants to establish the DMA as a credible regulatory framework without igniting a full-scale trade war that would harm both economies."

Market analysts are nonetheless pricing in the risk of escalation, with some models suggesting a potential 2-3 percentage point drag on EU export earnings under a full trade war scenario. This geopolitical overlay adds another layer of complexity for investors attempting to gauge the true impact of the DMA enforcement.

Historical overview of EU exports to the US.

| Year | EU Exports to US (Goods) | Source |

|---|---|---|

| 2024 | €531.6 billion / $571.11 billion | Eurostat / UN Comtrade |

| 2023 | €504.0 billion (approx. €531.6bn / 1.055) | Eurostat |

| 2021 | $271.6 billion (converted from US Imports value) | U.S. Bureau of Industry and Security |

Investment Implications: Navigating the New Tech Regulatory Landscape

Financial strategists have outlined three potential scenarios for investors to consider:

The base case, assigned approximately 60% probability, envisions Apple and Meta implementing compliance changes after some modifications, limiting EBIT impact to less than 3% each, with price-to-earnings multiples holding steady at approximately 30× and 26× respectively.

A bear case scenario (25% probability) contemplates non-compliance triggering step-up fines and U.S. retaliatory tariffs, potentially reducing earnings per share by 8-10% and compressing P/E ratios by 3-5 turns.

The bull case (15% probability) suggests that pre-emptive ecosystem opening could stimulate usage and developer innovation, with upside potentially offsetting fee losses.

Comparison of Price-to-Earnings (P/E) ratios for major tech companies like Apple, Meta, Google, Amazon.

| Company | Ticker Symbol | P/E Ratio (TTM, as of April 2025) |

|---|---|---|

| Apple | AAPL | ~31.7 - 31.9 |

| Meta Platforms | META | ~14.7 - 28 |

| Alphabet (Google) | GOOGL/GOOG | ~25 - 29.3 |

| Amazon | AMZN | ~31.3 - 36.2 |

"The smart tactical play might be a pairs trade — going long privacy-centric ad platforms while shorting Meta during the two-month compliance window," suggested a senior portfolio manager at a global asset management firm. "For the longer term, consider allocating 1-2% to European SaaS and app monetization companies poised to benefit from lower platform taxes."

The Road Ahead: Key Milestones to Watch

As this regulatory saga unfolds, several critical milestones loom on the horizon. July 2025 will bring the Commission's compliance verdict, potentially triggering daily fines for continued violations. U.S. election rhetoric could introduce volatility, with tariff-related comments capable of causing significant intraday market swings.

Perhaps most consequentially, pending DMA probes into Google and Amazon expected to conclude in Q3 could establish broader precedents for the entire tech sector. These decisions will provide further clarity on how aggressively the EU intends to reshape digital markets.

EU Digital Markets Act (DMA) – Key Enforcement Timeline

| Date | Milestone |

|---|---|

| Nov 1, 2022 | DMA entered into force. |

| May 2, 2023 | Most provisions became applicable; gatekeepers had until July 3 to notify the Commission. |

| Sep 6, 2023 | First six gatekeepers designated: Alphabet, Amazon, Apple, ByteDance, Meta, Microsoft (22 services). |

| Mar 6/7, 2024 | Compliance deadline for gatekeepers; first reports on obligations and consumer profiling due. |

| Mar 25, 2024 | Non-compliance probes launched into Alphabet, Apple, and Meta. |

| Mar 7, 2025 | Annual updated compliance and profiling reports due; public versions published online. |

| Ongoing | Monitoring, investigations, and possible new gatekeeper designations continue. |

| May 3, 2026 | EC to review and report on DMA effectiveness and propose updates. |

"We're witnessing the beginning of a fundamental realignment in how technology platforms operate globally," reflected a digital policy expert. "The question isn't whether change is coming — it's how profound that change will be, and whether it ultimately benefits or hinders innovation and consumer choice."

As Brussels and Silicon Valley square off in this high-stakes regulatory battle, the repercussions will extend far beyond Europe's borders, potentially redefining the relationship between governments and technology platforms worldwide.