A Quiet Revolution in Drug Testing: FDA's Break with Animal Models Promises Faster, Cheaper, and More Ethical Biopharma Pipeline

The U.S. Food and Drug Administration today announced its intent to phase out mandatory animal testing for monoclonal antibodies and other drugs. The decision, years in the making and long demanded by both ethical advocates and clinical scientists, sets in motion a dramatic transition toward more predictive, efficient, and human-relevant methods of assessing drug safety and efficacy.

“It’s the unraveling of a century-old scientific assumption,” said one regulatory analyst familiar with the process. “We’re moving away from animal proxies and into the realm of computational biology and engineered human systems. The implications are vast.”

From Animal Lab to Silicon Chip: The FDA’s Breakthrough Roadmap

A New Era of Toxicology

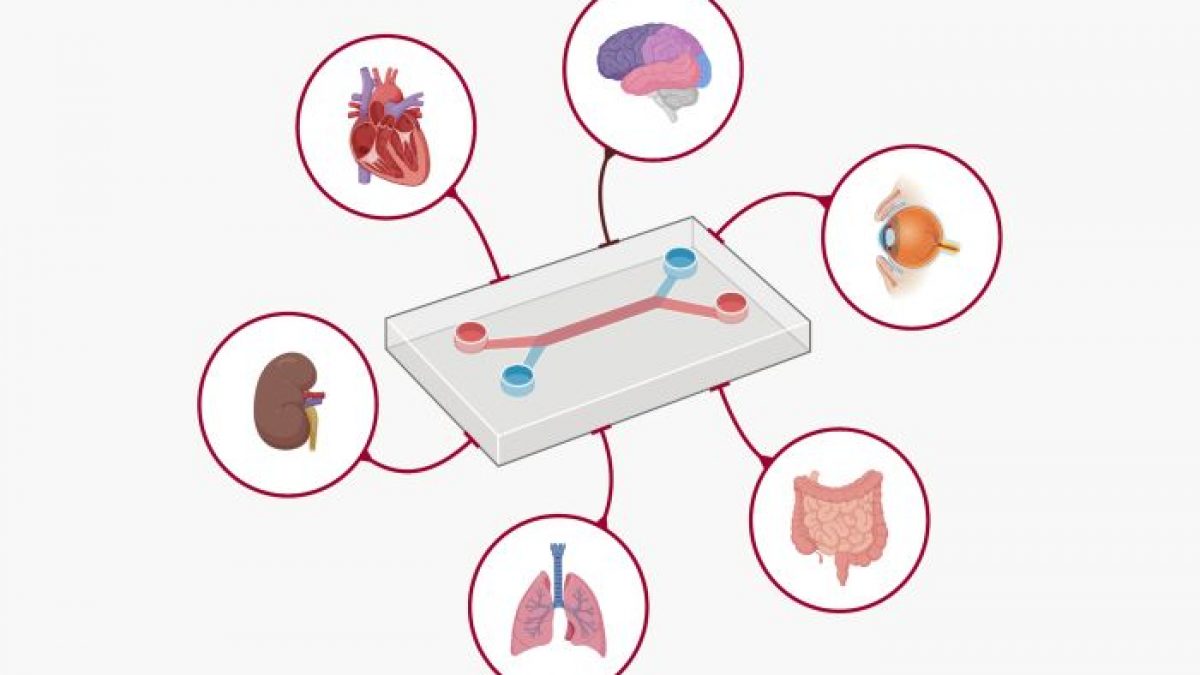

The FDA’s newly unveiled roadmap outlines the use of New Approach Methodologies (NAMs)—a suite of tools ranging from AI-driven computational models to human-derived organoids and organ-on-chip technologies. These tools aim to replicate human biology with far greater fidelity than the current standard: animal testing.

New Approach Methodologies (NAMs) refer to a variety of modern techniques used primarily in toxicology and safety assessment. They encompass in vitro, in silico, and other non-animal methods developed as alternatives to replace, reduce, or refine traditional animal testing procedures.

Key components of the policy include:

- Immediate encouragement of NAMs data in investigational new drug (IND) applications.

- Acceptance of real-world human safety data from comparable international regulators.

- Pilot programs beginning this year, allowing select developers to submit monoclonal antibodies evaluated primarily with non-animal methods.

- Regulatory incentives, including streamlined reviews, for developers that present validated non-animal test data.

“This is a win-win,” said one senior toxicologist. “Drugs get to patients faster. Development costs are lower. And we move away from ethically fraught, often poorly predictive animal models.”

The Status Quo: Flawed, Expensive, and Ethically Fraught

The Hidden Costs of Animal Testing

For decades, animal testing has been the regulatory gold standard. From mice and rats to dogs and primates, animals have been used to simulate human responses to investigational drugs. But these models often fall short. A molecule that performs well in a rodent might behave unpredictably in humans—a translational gap that has contributed to countless late-stage clinical trial failures and post-approval safety withdrawals.

| Metric | Statistic/Finding | Source/Context |

|---|---|---|

| Overall Clinical Trial Failure Rate (Post-Preclinical Tests) | Approximately 90% to 92% of drug candidates that enter human clinical trials fail to gain regulatory approval. | Multiple sources cite this range, including BIO, Cruelty Free International, and academic papers referencing industry data (e.g., Sun et al., 2022). |

| Primary Reasons for Failure in Clinical Trials | Lack of clinical efficacy (40-50%), unmanageable toxicity/safety issues (approx. 30%), poor drug-like properties (10-15%). | Analysis cited in Sun et al. (2022) and corroborated by findings that over half of Phase II/III failures are due to lack of efficacy. |

| Predictivity of Animal Models | High failure rates in humans (e.g., 92%) occur despite promising results in preclinical tests, including animal tests. | Cruelty Free International, PETA, Humane Society International, and academic reviews highlight the disconnect (translational gap). |

| Success Rate by Clinical Phase (Approx. 2011-2020 data) | Phase I: ~52% success; Phase II: ~29% success; Phase III: ~58% success. | Data reported by BIO (Biotechnology Innovation Organisation) indicates Phase II is a major bottleneck. |

| Failure Rate by Therapeutic Area (Approx. 2011-2020 data, entering trials) | Urology (~96% failure), Cardiology (~95% failure), Oncology (~95% failure), Neurology (~94% failure). | Data reported by BIO shows very high failure rates across different disease areas. |

The "translational gap" in drug development refers to the significant difficulty and high failure rate encountered when attempting to translate promising basic science discoveries from the lab ("bench") into effective and safe treatments for human patients ("bedside"). A primary challenge is that preclinical models, particularly animal studies, often fail to accurately predict how a potential drug will perform in humans.

Moreover, animal testing is notoriously expensive and slow. Estimates suggest it can add months or even years to the development timeline and inflate R&D costs by hundreds of millions of dollars.

Table: Comparison of Costs and Timelines for Traditional Animal Testing vs. NAMs in Preclinical Drug Development

| Aspect | Traditional Animal Testing | New Alternative Methodologies (NAMs) |

|---|---|---|

| Cost | $2–$4 million per study; high variability | Lower costs due to automation and efficiency |

| Timeline | 4–10 years for comprehensive studies | Rapid outputs (weeks to months) |

| Efficiency | Limited predictive value for human biology | High-throughput and human-relevant |

| Challenges | Necessary for complex, long-term assessments; regulatory requirements | Cannot fully replicate complex systems; limited regulatory adoption |

Then there’s the ethical calculus. Each year, tens of thousands of animals are used in U.S. drug development. Many of these experiments involve invasive procedures with no possibility of recovery. In this light, the FDA’s move is not just a scientific leap—but an ethical inflection point.

Human-Relevant Testing: Precision Without the Pain

AI Models and Organoids Take Center Stage

What replaces the old model? A powerful confluence of technologies once considered futuristic:

-

Artificial Intelligence Toxicology: AI tools trained on millions of data points can now simulate how drugs behave in human tissues, predicting side effects and organ toxicity with increasing accuracy. Some models can map monoclonal antibody distribution through the human body in silico—without a single lab animal.

-

Organoids and Organ-on-Chip Systems: These lab-grown human tissues—tiny versions of organs like the liver, heart, or immune system—offer a direct window into human biology. Researchers can now observe how drugs affect actual human cells in real time.

One early adopter at a mid-size biotech firm noted, “In our recent monoclonal antibody program, the organoid models picked up hepatotoxicity that our rat models completely missed. That’s not just efficiency. That’s patient safety.”

Who Wins, Who Loses: An Industry Rebalanced

Winners: Tech-Powered Innovators and Nimble Biotechs

For companies that have long invested in human-relevant testing, the FDA’s decision is vindication—and a clear tailwind. These include:

- Biotechs leveraging organoid and in vitro systems, able to reduce their preclinical timelines by up to 40%.

- AI platform developers, building predictive toxicology models that major pharma is now racing to license.

- Contract Research Organizations (CROs) that pivoted early from animal testing to cell-based assays and silicon simulations.

Investors have already taken note. “We see this as a five-year secular tailwind for any player involved in alternative testing,” said one portfolio manager at a life sciences-focused hedge fund.

Losers: Legacy Animal Testing Firms at Risk

The impact on traditional animal testing CROs is more sobering. Reports indicate a 28% drop in shares of Charles River Laboratories, a bellwether for the animal testing industry, following the FDA's announcement. These firms now face a stark choice: transform or fade.

Recent stock price performance chart for Charles River Laboratories (CRL).

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) | Closing Price (USD) | Volume |

|---|---|---|---|---|---|

| 2025-04-09 | 121.71 | 139.31 | 117.26 | 139.07 | 1,974,894 |

| 2025-04-08 | 136.86 | 137.96 | 122.06 | 123.61 | 1,586,299 |

| 2025-04-07 | 132.79 | 139.16 | 128.03 | 134.07 | 1,984,859 |

“It’s like the film-to-digital transition in photography,” one analyst said. “Only this time, the stakes are billions in R&D revenue.”

The Road Ahead: Validation, Transition, and Resistance

Regulatory Coordination and Global Implications

While the roadmap offers clarity, the transition is far from complete. A key challenge will be validation—proving that these new methods predict human outcomes better than animals, consistently and across drug types.

Validation for New Approach Methodologies (NAMs) refers to the process of establishing their scientific reliability and relevance for a specific intended purpose, such as toxicity testing. This typically involves adhering to defined scientific criteria and formal processes, often guided by regulatory bodies like the FDA, to ensure the alternative method is fit-for-purpose.

The FDA, in partnership with NIH, the National Toxicology Program, and the Department of Veterans Affairs, is convening a public workshop later this year. It will solicit feedback and refine implementation timelines. A pilot program launching this year will test the roadmap in real-world conditions, likely shaping broader guidance in 2026 and beyond.

Other regulatory agencies are watching closely. Should the FDA’s initiative succeed, global harmonization may follow, with European, Canadian, and Asian regulators potentially moving to align standards—a shift that would dramatically streamline international drug development.

Market Analysis: Risk, Rotation, and Reward

The Biopharma Investment Thesis in the Wake of Regulatory Upheaval

From a capital markets perspective, the FDA’s move is one of the most consequential regulatory shifts in decades.

- Biopharma R&D models will be compressed, with timelines shrinking by months—if not years.

- Profit margins may widen as companies reduce costs associated with long animal test cycles and redundant safety protocols.

- M&A activity is likely to surge, with tech-savvy CROs and AI modeling firms becoming attractive targets.

Projected market growth for New Approach Methodologies (NAMs) vs. traditional animal testing market forecast.

| Market Segment | Region/Scope | Base Year Value (Approx.) | Projected Value (Approx.) | CAGR (Approx.) | Forecast Period | Source Notes |

|---|---|---|---|---|---|---|

| Non-Animal Alternative Testing (NAMs) | Global | USD 1.11 Billion (2019) | - | 6.34% | 2023-2028 | Various reports indicate significant growth, driven by ethical concerns and regulatory pushes (e.g., 3R principles). Includes in-vitro, in-silico, organ-on-chip methods. |

| Non-Animal Alternative Testing (NAMs) | Global | USD 9.8 Billion (2021) | USD 29.4 Billion (2030) | 13.5% | 2022-2030 | Another forecast showing even higher growth, potentially including a broader definition of NAMs or different market scope. Emphasizes government support and tech like organs-on-chip. |

| Non-Animal Alternative Testing (NAMs) | Global | USD 1.8 Billion (2023) | - | 11.9% | 2024-2032 | Highlights growing investments, ethical concerns, regulatory support (FDA/EU), and technological advances (organ-on-a-chip, 3D tissue models) as key drivers. |

| In-Vitro Toxicology Testing (Component of NAMs) | Global | USD 10.99 Billion (2023) | USD 30.06 Billion (2033) | 10.82% | 2024-2033 | Represents a significant part of the NAMs market, showing strong growth driven by drug discovery, chemical safety, and regulatory acceptance. Multiple sources show similar CAGRs (10.8%-11.2%). |

| Organoid Market (Specific NAM technology) | Global | - | USD 3.3 Billion (2027) | 21.7% | Next 3 years | Specific NAM technology showing very high growth potential, reflecting advancements in complex biological modeling. |

| Traditional Animal Testing | Global | USD 10.74 Billion (2019) | - | 1.03% | 2023-2028 | Shows significantly slower growth compared to NAMs, attributed to ethical pressures, adoption of 3R principles, and regulatory shifts (e.g., EPA goal to end mammal testing by 2035). |

| Traditional Animal Testing | Global | USD 10.74 Billion (2019) | - | 2.64% | 2028-2035 | Forecast indicates slightly increased growth in the later period but still substantially lower than NAMs. |

| Animal Model Market | Global | USD 1.9 Billion (2022) | USD 3.6 Billion (2032) | 6.6% | 2023-2032 | This forecast focuses specifically on the market for the animals themselves, showing moderate growth, likely driven by ongoing R&D needs despite the push for alternatives. |

At the same time, risk looms large for slow adopters. “Investors need to be ruthlessly selective,” said one fund manager. “This is not a rising tide. It’s a tidal shift. Some boats will rise. Others will sink.”

A Quiet, Humane Revolution

The FDA’s decision to end mandatory animal testing for monoclonal antibodies is more than a regulatory update. It is the quiet beginning of a biomedical transformation, one that promises faster cures, lower drug prices, better science, and fewer cages.

And for the world’s most sophisticated investors, it marks the start of a new investment epoch—one that rewards technological foresight, ethical leadership, and human-first science.

In a world of noise, sometimes the most meaningful revolutions begin with the soft hum of a silicon chip—replacing the squeak of a lab rat.