Island Raises $250 Million Pushing Valuation to $4.85 Billion as Enterprise Browsers Gain Ground

A Bold Browser Bet: Island's $4.85 Billion Gamble to Redefine Enterprise Security

A New Front in the Cybersecurity Wars

In a quiet but consequential shift, a once-overlooked corner of enterprise infrastructure—the browser—has exploded into the center of cybersecurity innovation and investor intrigue. This month, Island, a startup that builds a secure, enterprise-grade browser, raised a staggering $250 million in Series E funding, pushing its valuation to $4.85 billion. Led by Coatue and joined by Insight Partners, Sequoia, and Canapi Ventures, the raise brings Island’s total funding to $730 million.

For many in the cybersecurity and enterprise IT world, this isn’t just another capital injection—it’s a signal flare marking the browser as the next critical battleground in digital defense. Island isn’t simply selling security; it’s rewriting assumptions about how companies should secure the very point where work gets done: the browser window.

But with that valuation comes scrutiny. This is not a modest play. Island is waging war against deeply entrenched behaviors, trillion-dollar incumbents like Google and Microsoft, and a marketplace still trying to decide if it truly needs what Island is offering.

Why Now? The Browser’s Unlikely Rise as an Enterprise Endpoint

The browser, once merely a portal to the internet, has become the operating system of the modern workplace. As remote work, BYOD (bring your own device), and SaaS applications surged, companies realized that existing network-centric security models no longer fit a perimeter-less world.

Did you know that in today's cybersecurity landscape, the concept of a "perimeter-less security world" has emerged? This shift means that traditional network boundaries are no longer effective due to the rise of cloud computing and remote work. Organizations are adopting a Zero Trust Architecture, which operates on the principle of "never trust, always verify," focusing on continuous authentication and authorization of users and devices. As sensitive data is distributed across various locations, including mobile devices and cloud services, security measures now emphasize identity-based access, least privilege permissions, and adaptive security to protect information regardless of its location.

"Enterprises are now facing a paradox," one security analyst observed. "The most important business activities happen inside the browser, yet it’s one of the least protected layers in the stack."

Gartner projects that enterprise browsers will factor into 25% of web security decisions by 2025—up from just 5% in 2022. By 2030, the firm forecasts browsers will become core platforms for both productivity and security, potentially displacing or consolidating several point solutions.

Projected Growth of Enterprise Browsers in Web Security Decisions (Based on Gartner Forecast)

| Forecast Year | Prediction |

|---|---|

| By 2025 | Enterprise browsers or extensions will be featured in 25% of web security competitive situations. |

| By 2026 | 25% of enterprises will be using managed browsers or extensions. |

| By 2027 | Enterprise browsers will be the core platform for delivering workforce productivity and security software on managed and unmanaged devices for a seamless hybrid work experience. |

| By 2030 | The browser will become a platform from which enterprises can distribute software, collect intelligence, control access, and securely enable remote work. |

| By 2030 | The enterprise browser will be a central component of most enterprise superapp strategies as productivity capabilities drive adoption. |

| This is the context in which Island has emerged, and why its pitch—essentially: “let’s replatform security into the browser itself”—has captured investor and customer imagination. |

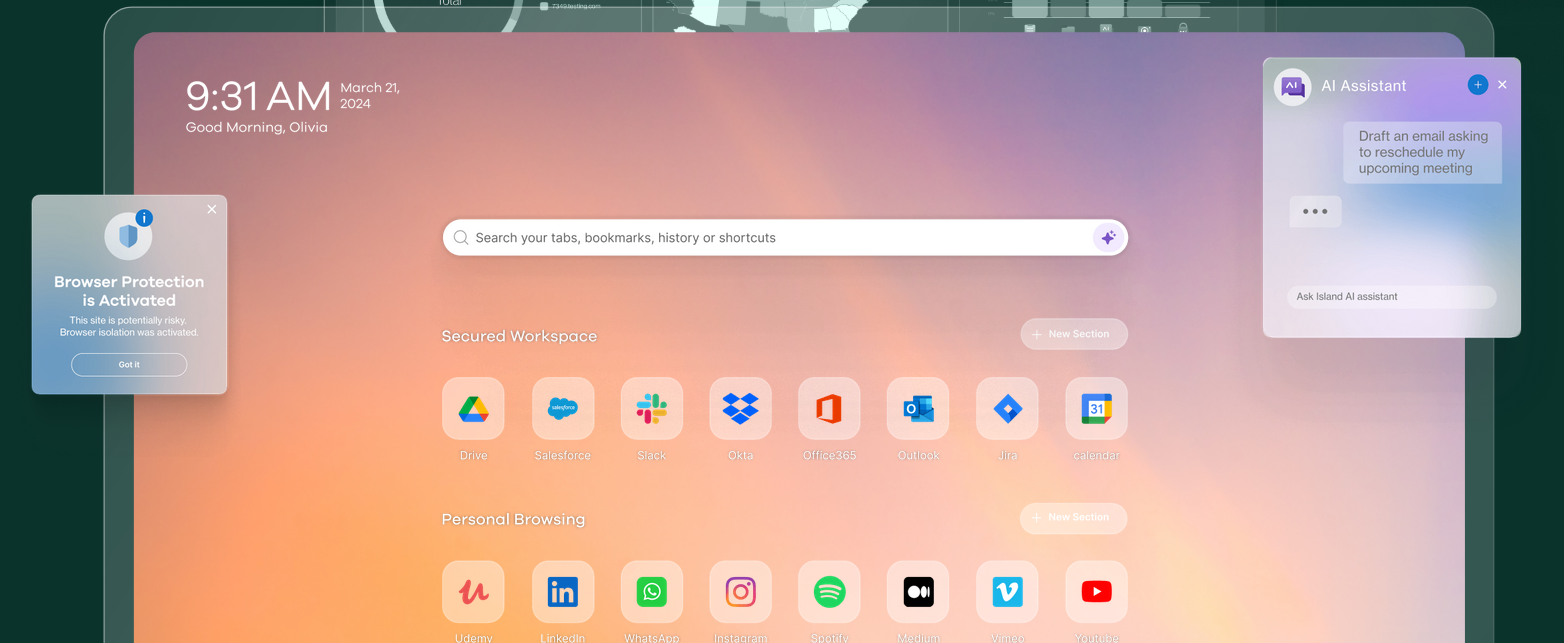

Inside Island’s Playbook: A Purpose-Built Browser for a Post-VPN World

Founded by Dan Amiga, a veteran Israeli technologist, and Mike Fey, a seasoned U.S. security executive, Island’s product is a Chromium-based browser rebuilt from the ground up with enterprise controls at its core.

It’s not just about locking down the browser—it’s about embedding policy enforcement within the interface. Island allows companies to control everything from clipboard access to screenshot prevention, automate app behaviors, enforce zero-trust policies, redact sensitive data in real time, and gain visibility across managed and unmanaged devices.

Zero Trust Security is a modern security model operating on the core principle of "never trust, always verify." Unlike traditional approaches, it assumes no user or device is inherently trustworthy, requiring strict verification for every access request, regardless of whether it originates inside or outside the network perimeter.

“Island is betting that the browser becomes the control plane,” said a venture investor familiar with the company. “And that you don’t need five tools if one browser can enforce your policy stack natively.”

It’s an ambitious thesis—and one with implications for endpoint security, DLP, VDI, VPNs, and more. By placing security at the point of interaction, Island argues it can replace or simplify many bloated enterprise security architectures.

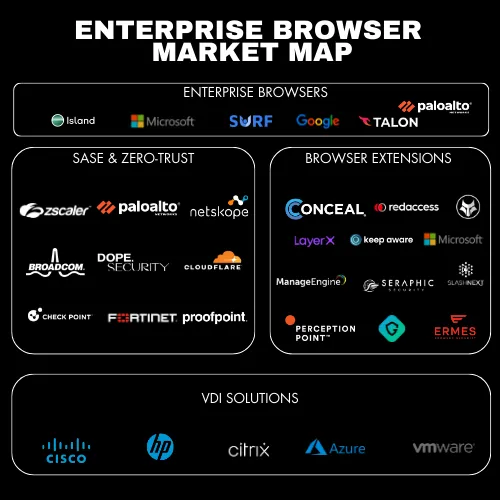

Competitive Fires: Tech Giants, Talon, and the Challenge of Friction

Island may be first out of the gate, but it’s running into a buzzsaw of competitors.

Most notably, Palo Alto Networks’ acquisition of rival Talon Cyber Security for a reported $625 million has shifted the dynamics dramatically. With PANW’s distribution and platform integration, Talon now offers a bundled alternative inside a larger security ecosystem—a sharp contrast to Island’s standalone approach.

Then there are the tech titans. Google and Microsoft are quietly turning Chrome Enterprise and Edge for Business into secure workplace environments. While Island may still lead in features, it’s hard to ignore the incumbents’ user base and native OS integration. “Google can ship a new policy to millions overnight,” one enterprise CTO noted. “Island can’t.”

LayerX, another contender, takes a different route entirely. Rather than launching a standalone browser, it deploys security as a lightweight extension atop existing browsers—minimizing user disruption and deployment pain. Its traction is limited for now (estimated 3% mindshare), but its frictionless model could resonate with risk-averse buyers.

Island still commands around 36.7% of market mindshare among dedicated enterprise browsers, according to recent PeerSpot data. But the threat from tech giants embedding “80% good enough” functionality cannot be underestimated.

Estimated Market Mindshare Among Dedicated Enterprise Browser Solutions

| Solution | Market Position (March 2025) | Key Features |

|---|---|---|

| Island | Ranked #2 (36.7%) | • Balance of security and usability • Advanced DLP controls • AI assistant integration • BYOD support • Extensive customization |

| Talon Cyber Security | Ranked #3 (23.5%) | • Cost-effective solution • Intuitive design • Acquired by Palo Alto Networks • Strong third-party access controls • VDI replacement capabilities |

| LayerX Security | Ranked #6 (3.0%) | • Browser extension approach • Compatible with existing browsers • GenAI tool security • Phishing protection • Web/SaaS DLP |

The Island Gamble: Can a New Browser Truly Stick?

Island reports a customer count of 450 organizations, including recognizable brands like Mattress Firm, Fiverr, and Swiss Life. That figure reflects solid traction just three years after emerging from stealth. Moreover, with over $530 million in cash on hand, Island is well-capitalized for an extended campaign.

But raw numbers only tell part of the story.

How many seats per customer? Are deployments wall-to-wall, or limited to sensitive departments? Are customers using the full security stack or just basic features? These questions remain unanswered.

Analysts caution that hype can mask depth. “What matters isn’t just how many logos they have—it’s how deeply embedded they are,” one cybersecurity VC said. “Island’s value is maximized when companies go all in. Anything less, and you’re not realizing the full return on the security investment.”

Furthermore, the deployment model creates natural friction. Introducing a new browser into an enterprise is no small feat. Users are notoriously resistant to switching from Chrome or Edge. Compatibility issues can arise with legacy web apps. Training is required. Change management is non-trivial.

Some CISOs may choose to wait—testing the waters, demanding deeper native features from Google or Microsoft, or opting for less disruptive models like LayerX.

Valuation vs. Reality: A $4.85 Billion Tightrope

Island’s meteoric rise—from $2.9 billion to $4.85 billion in less than a year—suggests overwhelming investor confidence. But it also implies enormous expectations.

“This is a market-pricing-for-perfection moment,” one VC analyst said. “To justify that valuation, Island must dominate the category and hold off Google, Microsoft, and a freshly armed Palo Alto.”

Failure to expand deeply within customers—or a single major security lapse—could jeopardize its trajectory. Moreover, the burden of proving ROI at scale is real. As economic pressures mount, CISOs will ask hard questions about every line item. Can Island reduce other tooling? Is the value worth the change management headache?

In many ways, Island’s valuation reflects not where the company is—but where investors hope the entire category is going. If browsers truly become the new security perimeter, then Island is a frontier outpost on the edge of something massive. If not, it may be remembered as a bold—but premature—bet.

The 18-Month Crucible: What Comes Next

Island’s success or failure will hinge on the next 12 to 24 months. Three core challenges loom:

- Winning the User Experience Battle: Can Island make switching browsers feel seamless—or even beneficial—for employees? Unless it can match or exceed Chrome/Edge performance and compatibility, user resistance will remain a drag on adoption.

- Staying Ahead of Feature Creep: Google and Microsoft can build fast. Island’s moat must be its depth—out-innovating the giants in enterprise-specific controls, policy integration, and threat protection.

- Proving Consolidation Value: If Island can displace VPNs, parts of DLP, and secure gateways, it can build a compelling TCO (total cost of ownership) story. But that requires enterprises to go deep—not shallow.

As one security architect put it: “Island is betting against inertia—and against the gravitational pull of Microsoft and Google. That’s a very big bet.”

Island’s Position in a Reshaping Security Landscape

Island is not just a startup with momentum—it’s a provocation. Its rise challenges assumptions about what enterprise security looks like, where control should live, and how organizations manage trust in a distributed, SaaS-first world.

Whether it becomes the category king, a high-priced acquisition, or an overfunded cautionary tale depends not only on technology but on psychology—of CISOs, of users, of the broader IT ecosystem.

Island's success is far from guaranteed. But in an age where the browser has quietly become the enterprise’s beating heart, its ambition is at least in the right place.

The bet is audacious. The market is real. The road is narrow.