Japan Presses US to Rethink Tariffs After Ishiba and Trump Hold Strategic Phone Call

A Fragile Alliance: Inside Japan’s High-Stakes Bid to Reverse U.S. Tariff Pressure

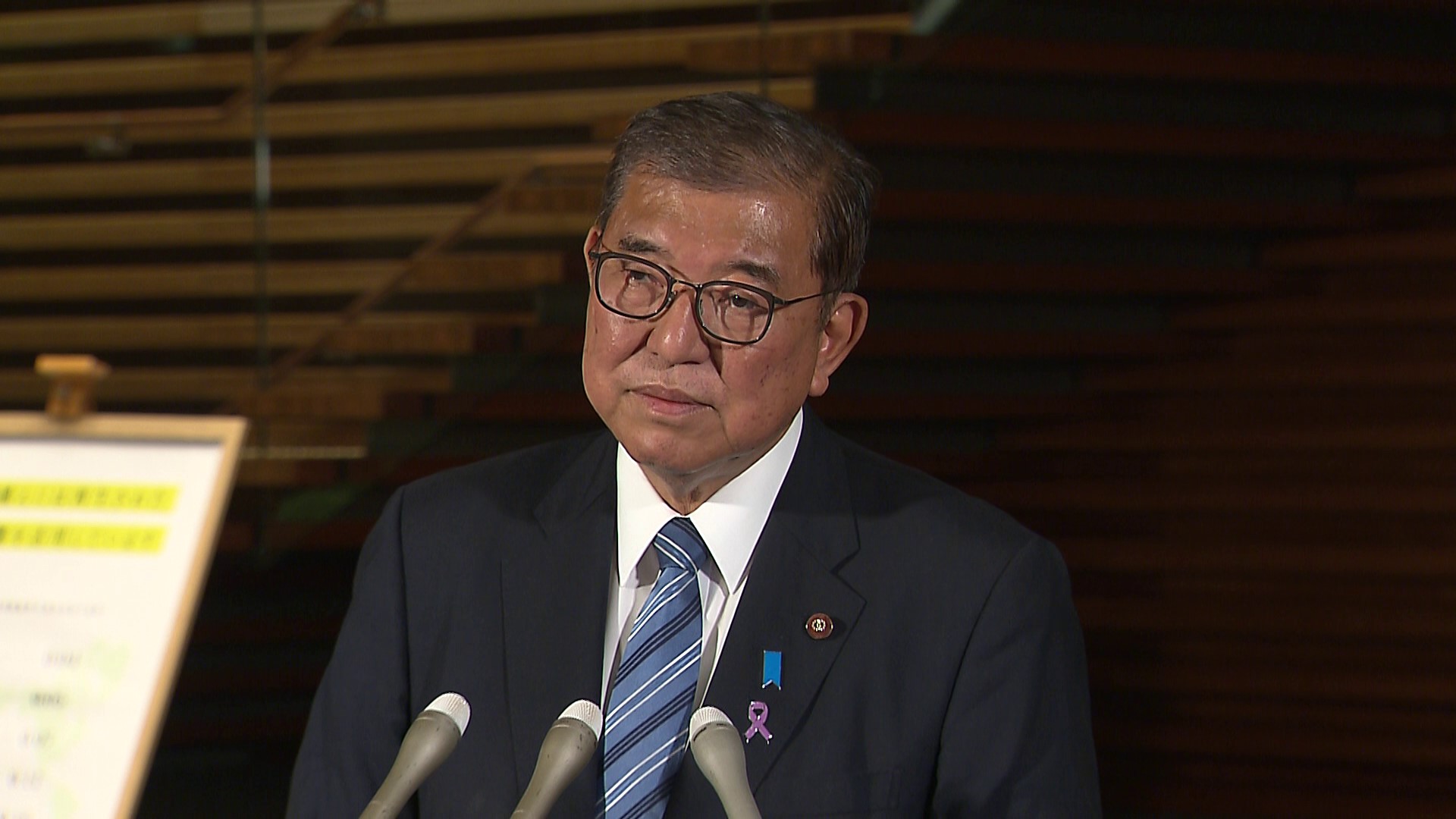

TOKYO — On Monday night, Japanese Prime Minister Shigeru Ishiba stepped before the press with a message as urgent as it was strategic: Japan, the largest investor in the United States for five consecutive years, was demanding a reset. And on the other end of the phone, listening intently from Washington, was President Donald J. Trump.

The two leaders engaged in a phone call that may define the trajectory of U.S.–Japan economic relations in the year ahead. At the center of the conversation: sweeping U.S. tariffs that have chilled Japanese corporate appetite for American investments—and Tokyo’s counter-offensive to regain economic leverage through diplomacy, strategy, and data-backed resolve.

“Strong Concern”: Japan Draws a Red Line on Tariff Damage

Prime Minister Ishiba, visibly resolute, laid out the stakes.

“I expressed to President Trump that we are gravely concerned about the decline in Japanese investment appetite due to U.S. tariff measures,” he said during his press briefing. “We should not pursue unilateral tariffs. Rather, we must seek broad cooperation that benefits both nations, including through investment expansion.”

Essentially, tariffs are taxes levied on imported products, often used as a tool of trade protectionism. By increasing the cost of foreign goods, they aim to shield domestic industries, though this can raise consumer prices and disrupt international trade patterns.

The numbers support Ishiba’s stance. Japan has maintained its status as the top foreign investor in the U.S. for half a decade, channeling billions annually into American manufacturing, technology, and infrastructure.

Japan's Foreign Direct Investment (FDI) stock in the United States over the past decade.

| Year | FDI Stock (USD Billions) | Data Source Note |

|---|---|---|

| 2023 | 783.3 | Ultimate Beneficial Owner (UBO) Basis - BEA |

| 2022 | 775.2 | Ultimate Beneficial Owner (UBO) Basis - SelectUSA/BEA |

| 2021 | 768.9 | Ultimate Beneficial Owner (UBO) Basis - SelectUSA/BEA |

| 2020 | 694.2 | Ultimate Beneficial Owner (UBO) Basis - SelectUSA/BEA |

| 2019 | 663.2 | Ultimate Beneficial Owner (UBO) Basis - SelectUSA/BEA |

| 2018 | 522.3 | Ultimate Beneficial Owner (UBO) Basis - SelectUSA/BEA |

| 2012 | 301.0 | Historical Cost Basis - ITA |

Note: FDI stock figures represent the cumulative level of investment at year-end. Data from 2018-2023 is based on the Ultimate Beneficial Owner (UBO), which identifies the entity at the top of the ownership chain. The 2012 figure is based on historical cost.

But that momentum now faces a growing headwind, as U.S. tariffs—especially on automobiles, steel, and semiconductors—threaten cross-border supply chains and capex plans.

According to several industry sources, capital deployment decisions by major Japanese corporations have already been delayed, pending clarity on trade terms. The risk, experts warn, is a multi-billion-dollar contraction in bilateral economic flows if the impasse drags on.

Behind the Call: Diplomacy Meets Uncertainty

Though no immediate concessions were made, the call concluded with a rare alignment: both leaders agreed to appoint cabinet-level negotiators and maintain what Ishiba termed “candid and constructive discussions” moving forward.

“From President Trump, there was a direct acknowledgment of America’s current international economic position,” Ishiba noted. “We agreed to continue frank dialogue and to monitor the discussions led by our designated officials.”

President Trump's approach to international trade appears driven more by political calculations than traditional diplomacy. Following his call with the Japanese Prime Minister, Trump posted on his Truth Social platform:

"Countries from all over the World are talking to us. Tough but fair parameters are being set. Spoke to the Japanese Prime Minister this morning. He is sending a top team to negotiate! They have treated the U.S. very poorly on Trade. They don't take our cars, but we take MILLIONS of theirs. Likewise Agriculture, and many other "things." It all has to change, but especially with CHINA!!!"

This public stance has prompted fresh concerns among analysts. "It's not really a negotiation—it's performance art designed for personal advantage rather than mutual benefit," observed one Tokyo-based trade strategist. "The optics cannot be ignored. Trump's base interprets these messages as demonstrations of strength. The challenge lies in translating diplomatic engagement into substantive policy reforms."

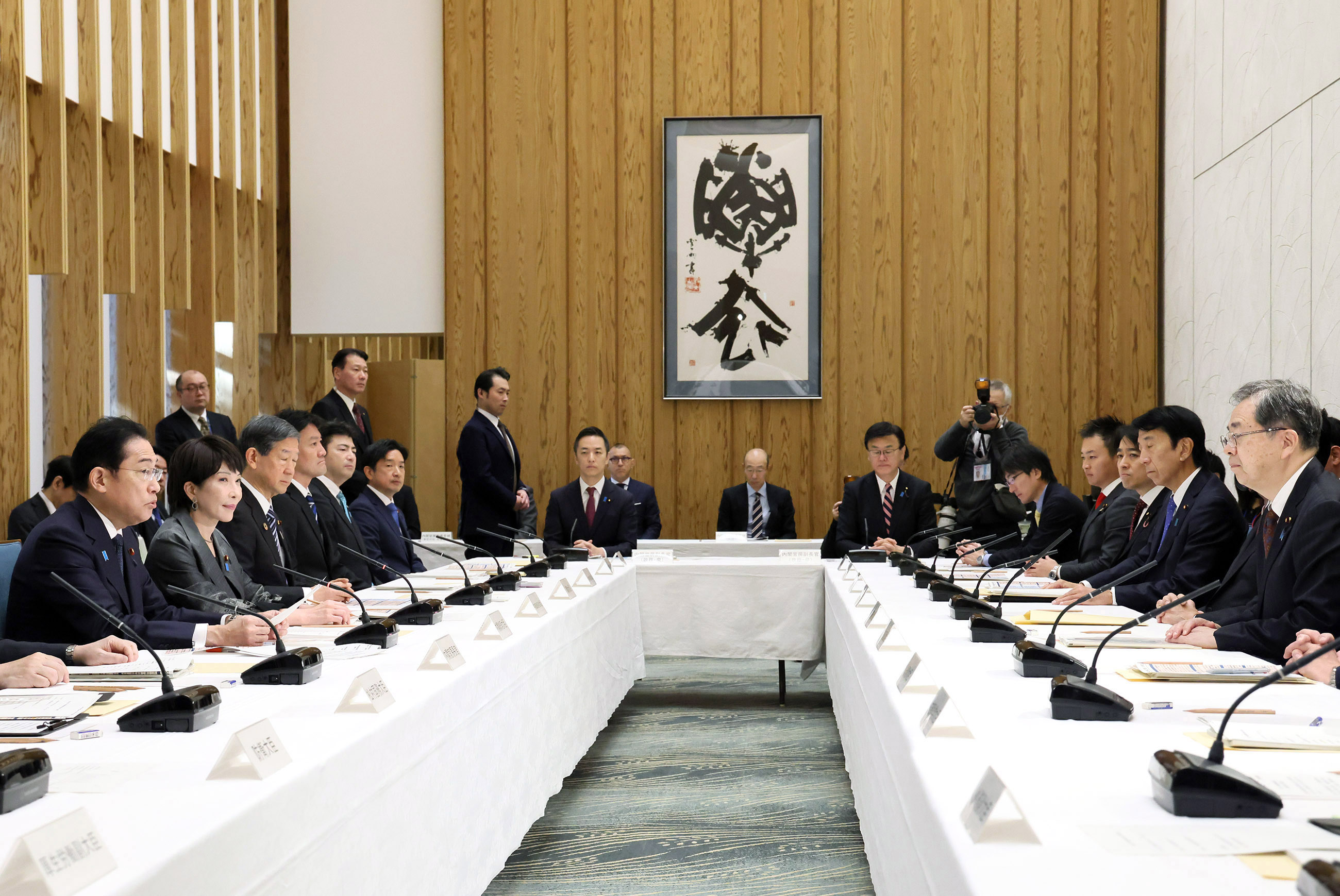

From Phone Lines to Front Lines: Japan Mobilizes Its Cabinet

At dawn the following day, Ishiba will convene a full Cabinet session to address what he has termed “a national crisis.” The agenda: establish a comprehensive task force on U.S. tariff measures and explore all available responses.

“Government must act with unity for the people and businesses who now face uncertainty,” Ishiba said. “We will exhaust every option.”

In addition to the task force, Ishiba floated the idea of a future visit to the United States, emphasizing that while the timing would depend on the progress of ministerial talks, a face-to-face with President Trump was “naturally being considered.”

This stepwise approach—assigning negotiators before escalating to a summit—reflects Japan’s desire to defuse tensions without appearing reactive. As one former trade official put it, “They’re playing for leverage, not just headlines.”

Investment as Leverage: Can Japan’s Economic Muscle Shift the Tariff Equation?

Some economists argue Ishiba’s best card is already on the table: Japan’s financial footprint in the U.S. economy. By framing Tokyo not as a trade rival but as a top investor and job creator, Japan may be able to shift the narrative in Washington.

“This is no longer about exports. It’s about factories in Ohio, tech labs in California, infrastructure in Texas,” said one international business professor. “Japanese money underwrites American growth. That’s power.”

Supporters of Ishiba’s approach say the combination of rapid diplomatic mobilization and data-driven argumentation could prove effective—especially if paired with sector-specific proposals aimed at increasing U.S.-bound capital investment in exchange for tariff relief.

Some analysts noted that Japan’s shift toward emphasizing mutual benefit rather than retaliatory pressure marks a strategic evolution. “This isn’t 2018. Japan is trying to write a different playbook—one that makes itself indispensable to the U.S. economy.”

Deep Fault Lines: Why the Road Ahead Remains Treacherous

But others are skeptical. Trump’s unpredictability—and his long-standing protectionist instincts—cast a long shadow over even the best-laid plans.

Economic protectionism refers to government policies, such as tariffs and quotas, aimed at restricting international trade to shield domestic industries from foreign competition. Countries implement these measures primarily to protect emerging industries, safeguard domestic employment, and sometimes for national security reasons.

“We’ve seen this movie before,” said one veteran Asia policy expert. “Trump listens, nods, then tweets something bragging but contradictory. Until action follows, there’s no reason to assume this time is different.”

The U.S. tariffs, many argue, are less about economics and more about domestic optics. Seen by Washington insiders as a political signal to American manufacturing workers, the policies may not be easily reversed, no matter how strong Japan’s economic case.

Add to that the rising structural tensions between the two economies—ranging from intellectual property disputes to concerns over critical technology exports—and the path toward resolution begins to look narrow.

Then there is the domestic picture. Ishiba, while praised for his composure, is managing a volatile political environment at home, with approval ratings under pressure and opposition parties eager to frame the tariffs as proof of waning diplomatic clout.

Financial Markets React: Volatility, Hedging, and Selective Bets

Investors, already sensitive to trade headlines, are responding with guarded interest. While Ishiba’s announcement of ongoing talks provided a temporary lift to the Nikkei, analysts say true stability will require tangible progress.

Recent performance and volatility index in Japan.

| Index | Current Level | Change | % Change | Date/Time (Tokyo) |

|---|---|---|---|---|

| Nikkei 225 | 31,136.58 | -2,644.00 | -7.83% | Apr 07, 2025 (Close) |

| Nikkei Stock Average Volatility Index | 58.39 | +22.81 | +64.11% | Apr 07, 2025 (15:50) |

| TOPIX | 2,289 | (Not specified) | -7.8% | Apr 07, 2025 (Close) |

| JPX-Nikkei Index 400 | 20,855.98 | -1,744.47 | -7.72% | Apr 07, 2025 (15:30) |

Sector Watch: Winners and Losers

- Winners: Japanese automakers and high-tech manufacturers stand to gain if tariff relief materializes. In the U.S., sectors that depend on Japanese FDI—like infrastructure and clean tech—could also benefit.

- Losers: Protectionist U.S. industries and politically sensitive sectors may resist any rollback, potentially facing backlash or strategic disadvantage.

Currency Outlook

If talks gain traction, the yen could appreciate modestly, reflecting greater investor confidence in the bilateral relationship. A collapse in negotiations, by contrast, would likely trigger a flight to safety, spiking demand for Japanese bonds and gold.

Volatility Trades

Expect increased movement in options markets and volatility indexes. Traders are eyeing key inflection points: ministerial announcements, Trump’s statements, and the potential scheduling of an in-person summit.

A Tipping Point in Global Trade Strategy

This is more than a bilateral tiff. At stake is a broader question of how countries recalibrate economic relationships in an age of volatility, nationalism, and high-stakes diplomacy.

If Ishiba’s approach succeeds, it may mark the start of a new paradigm—where foreign investment, not trade balances, become the true barometer of alliance strength. If it fails, it could signal a new wave of global protectionism, with ripple effects far beyond Tokyo and Washington.

For now, all eyes remain on two capitals—and on the markets in between—watching, hedging, and waiting for the next move in a high-stakes geopolitical chess game that is only just beginning.