Microsoft Slams the Brakes on 2 GW of Data Center Expansion: A High-Stakes Reset in the AI Infrastructure Race

In a move sending ripples through global tech and infrastructure markets, Microsoft has halted plans for data center expansions amounting to nearly 2 gigawatts of power capacity across the United States and Europe. The decision, confirmed through multiple analyst reports and corroborated by power industry sources, marks a significant pause in what had been an unrelenting buildout of hyperscale infrastructure to support the surging demand for AI and cloud services.

The implications are profound. Behind the headlines is a deeper recalibration—one that hints at evolving market expectations for generative AI, shifting partner dynamics, and the dawning realization that last year’s fervor may have raced ahead of reality.

A Sudden Chill in a Once-Blistering AI Infrastructure Boom

At the heart of Microsoft’s decision lies a revised forecast for AI demand, particularly that related to workloads from OpenAI, the firm’s most prominent AI partner. Analysts at TD Cowen, who closely track hyperscaler behavior, described the move as a quiet but seismic shift. Microsoft, they noted, has recently backed out of “a couple of hundred megawatts” of leased data center capacity and allowed over 1 gigawatt of early-stage commitments—such as letters of intent and qualification documents—to lapse.

Did you know that hyperscaler capital expenditures (CapEx) have experienced remarkable growth over the past decade? From $24.8 billion in 2013, CapEx has surged to over $150 billion annually by 2024, with projections reaching $335 billion by 2025. This rapid expansion is largely driven by the increasing demand for AI infrastructure and cloud computing. Major players like Amazon, Microsoft, Google, Meta, and Oracle are leading the charge, with Amazon alone planning to spend $100 billion in 2025. The rise of AI technologies, particularly generative AI, has become a key driver of these investments, as companies race to build and enhance their data centers and AI capabilities. This trend is expected to continue, with total spending potentially exceeding $1 trillion in the coming years as hyperscalers push the boundaries of AI innovation.

“Our checks indicate that in some situations, Microsoft is using facility and power delays as a justification for termination,” the analysts wrote. But beneath the surface, a more fundamental recalibration is underway. The company, it seems, had overestimated the infrastructure needed to fuel OpenAI’s AI engines—or, more precisely, misjudged how much of that workload would remain within its own Azure ecosystem.

From Frenzy to Filters: The Risks of Overcommitting

Oversupply Becomes a Liability

Throughout 2023 and 2024, Microsoft was one of the most aggressive hyperscalers in the market, racing to sign leases and construct data center space across key U.S. and European markets. That strategy was largely justified by the astronomical growth projections tied to generative AI. But now, the company is pumping the brakes.

“This is not a retreat,” said one infrastructure analyst who declined to be named due to non-disclosure agreements with major hyperscalers. “It’s a reversion to rationality.”

The decision comes as many in the industry begin to question the sustainability of building capacity purely on speculative future demand. Some now believe Microsoft simply built faster than its partners could deploy or monetize AI workloads, particularly in the case of OpenAI.

A Potential Break in the Azure-OpenAI Pipeline

Microsoft’s infrastructure frenzy was fueled in large part by its exclusive cloud partnership with OpenAI—a partnership that appears to be subtly evolving. Analysts have begun to note signals that OpenAI may be hedging its bets. Reports of increased infrastructure sourcing from Oracle, as well as financial backing from SoftBank, suggest a growing interest in diversification.

Did you know that a multi-cloud strategy allows businesses to use services from multiple cloud providers like AWS, Azure, or Google Cloud? This approach helps organizations avoid vendor lock-in, enhance resilience by distributing workloads across providers, and optimize costs by choosing the best services for each task. While it offers flexibility and scalability, managing multiple cloud environments can be complex and costly. Despite these challenges, many companies adopt multi-cloud strategies to leverage specialized tools, improve performance, and ensure compliance with regional regulations. By spreading their digital footprint across multiple providers, businesses can innovate more effectively and respond better to changing market conditions.

Such shifts matter. If Microsoft no longer captures the lion’s share of OpenAI’s growth, then it no longer requires lion-sized capacity expansions.

“This could be a strategic shift in incremental OpenAI workloads,” TD Cowen noted, hinting at how even slight rebalancing in partner dependencies can dramatically alter infrastructure needs.

The Hidden Challenges of Scaling: Power, Permits, and Physical Limits

Adding to Microsoft’s restraint is the mounting friction in building power-hungry infrastructure. In several regions, regulatory hurdles, grid constraints, and permit delays have slowed hyperscale deployments. Microsoft has tactically used these “facility and power delays” as reasons to back out of leases or push projects into indefinite limbo—a maneuver previously seen from other tech giants like Meta.

But industry insiders suggest this isn’t just about red tape or grid capacity.

“The megawatts per month model breaks down when you hit power constraints,” said one executive at a European infrastructure advisory firm. “What’s different now is that Microsoft isn’t trying to brute-force through it. They’re stepping back.”

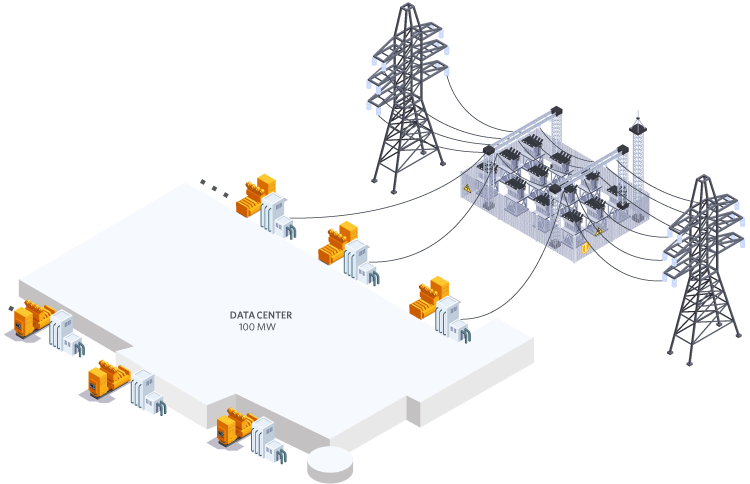

Did you know that a data center's power capacity, measured in Megawatts (MW) or Gigawatts (GW), is more than just a number? It signifies the total electrical power available to support IT equipment, cooling systems, and infrastructure, essentially defining the data center's size and operational capabilities. This capacity is crucial for handling computational demands, planning for future growth, and ensuring energy efficiency. It also impacts operational costs and is often used as a basis for charging customers. With the rise of AI and high-performance computing, some data centers are now being planned with capacities of 1-2 GW, highlighting the importance of power capacity in the digital infrastructure landscape.

Strategic Reallocation: From Growth at All Costs to Smart Deployment

Microsoft’s retreat from new builds doesn’t mean it’s exiting the infrastructure race. Far from it. The company is still expected to spend more than $80 billion on AI-related infrastructure this fiscal year—one of the largest capex plans in corporate history.

But that investment is now being filtered through a more selective lens.

Strategic Focus Areas:- Redirecting data center investments toward U.S. markets where demand is tangible and permits are in place.

- Doubling down on efficiency upgrades—such as advanced cooling and smarter power management—in existing facilities.

- Waiting for clearer demand signals from upcoming earnings (notably from Nvidia) before greenlighting additional projects.

Projected global data center power demand from 2023 to 2030

| Year | Global Data Center Power Demand | % of Global Electricity Use | Key Drivers |

|---|---|---|---|

| 2023 | 340 TWh | 1.3% | Cloud computing, digital transformation |

| 2025 | 536 TWh | 2.0% | AI workloads, cloud expansion |

| 2027 | ~600-700 TWh (est.) | ~2.3-2.7% (est.) | AI-specific workloads (146.2 TWh) |

| 2030 | 857-1,065 TWh | ~3-4% (est.) | AI, cloud computing, digital infrastructure |

“The magnitude of potential capacity Microsoft walked away from indicates a loss of a major demand signal,” analysts noted, adding that the firm now prefers demand validation before capital deployment.

The Second-Order Effects: Market Shockwaves and Investment Repricing

Microsoft’s recalibration is not an isolated event—it’s a market-moving signal. The sudden freeze in 2 GW of planned capacity has triggered alarms across multiple industries.

Fallout for Data Center Operators and Suppliers

Companies that lease hyperscale space—especially data center REITs and colocation providers—are facing pressure. Some had already factored Microsoft’s pipeline into their own growth forecasts. Now, those numbers look too optimistic.

“We’re already seeing softness in new lease rates,” said a senior advisor at a major infrastructure consultancy. “The hyperscalers are in wait-and-see mode, and that changes the game for everyone downstream.”

Energy providers and infrastructure firms, too, are adjusting their expectations. Suppliers of switchgear, cooling, and backup systems—such as Siemens Energy and Schneider Electric—could see reduced order volume in the near term.

Investor Reaction: From Optimism to Caution in AI Infrastructure Stocks

The decision has cast a shadow over tech-sector exuberance. If Microsoft is rethinking the pace of AI expansion, investors wonder whether others will follow. Some traders are already repricing expectations for aggressive capex plays.

Yet this pullback may, paradoxically, offer reassurance to long-term investors.

“This is Microsoft acting like an adult in the room,” said a portfolio manager who tracks hyperscaler capex. “It’s prioritizing ROI over bravado—and that’s a healthy sign for the market.”

What Comes Next? Three Scenarios for an Industry at an Inflection Point

1. The Efficiency Pivot

Microsoft’s reset could catalyze an industry-wide move away from indiscriminate expansion toward optimized, efficiency-driven investments. With data center energy usage under scrutiny and regulatory pressure mounting, smart capex—rather than big capex—may define the next phase of AI infrastructure growth.

Expect surging interest in thermal innovation, specialized chips, and edge computing architectures that reduce strain on hyperscale hubs.

Did you know that Power Usage Effectiveness (PUE) is a key metric for measuring data center efficiency? It calculates how much of the total energy used by a data center actually powers the computing equipment, with a perfect score being 1.0. The average PUE is around 1.59, indicating that nearly 60% of the energy is used for cooling, lighting, and other non-computing purposes. By improving PUE, data centers can significantly reduce energy consumption and costs, contributing to sustainability while enhancing operational efficiency. This metric, introduced by The Green Grid, has become a global standard for evaluating and optimizing data center performance.

2. The Multi-Cloud Realignment

If OpenAI—and potentially other major AI players—are beginning to diversify cloud providers, the era of single-cloud dependency may be ending. Microsoft’s dominance in the AI-hosting space could be challenged by more modular, federated infrastructure strategies. This shift would favor flexibility over vertical integration.

3. The Reality Check

Perhaps the most sobering possibility: that AI demand itself has been overstated. Microsoft’s recalibration may reflect a broader reevaluation of the monetization timeline for generative AI. If the “AI hype curve” flattens faster than expected, hyperscaler valuations and infrastructure projections may face a longer, bumpier road ahead.

The Technology Hype Cycle: A Summary Table

| Phase of Hype Cycle | Description | Key Features |

|---|---|---|

| Innovation Trigger | Emergence of a new technology, generating media interest and publicity. | No usable products, unproven commercial viability. |

| Peak of Inflated Expectations | Hype reaches its peak with amplified marketing and early success stories. | Overemphasis on potential benefits, numerous failures. |

| Trough of Disillusionment | Interest wanes due to real-world failures and unmet expectations. | Disillusionment, reduced investment unless improvements are made. |

| Slope of Enlightenment | Lessons learned lead to improved products and solutions. | Better understanding of benefits, second-generation products emerge. |

| Plateau of Productivity | Mainstream adoption with real-world solutions and broad applicability. | Established ecosystem, widespread adoption, proven benefits. |

A Reset That May Redefine the AI Infrastructure Playbook

Microsoft’s retreat from 2 gigawatts of data center expansion is not a sign of weakness—it’s a strategic realignment. In a sector addicted to growth, the willingness to pause, reassess, and refine is an act of rare discipline.

By focusing on proven demand, operational efficiency, and capital optimization, Microsoft may be paving a smarter, more resilient path forward—not just for itself, but for the entire AI infrastructure ecosystem.

And as the dust settles, the market will need to ask a more sober question: In the race to build the future, how much capacity is too much?