Silicon Sovereignty - NVIDIA's Bold Onshoring Bet Reshapes the AI Supply Chain

Silicon Sovereignty: NVIDIA's Bold Onshoring Bet Reshapes the AI Supply Chain

As Trump’s tariff sword looms over global tech and AI reshapes industry orthodoxy, NVIDIA brings the engine room of the digital future home to America—ushering in a trillion-dollar industrial pivot with profound stakes for investors, the global supply chain, and geopolitical power.

The New Frontier of American Industrial Policy Starts in the Desert

The searing sun above the Arizona desert now casts shadows over something rarely seen in modern American manufacturing: the domestic birth of cutting-edge semiconductor technology. In a stunning pivot, NVIDIA, long synonymous with offshore production and Asia-centric chip supply chains, has launched its first U.S.-based manufacturing initiative. The centerpiece? Its next-generation Blackwell AI chips and supercomputers, to be built entirely on U.S. soil.

More than one million square feet of manufacturing space has already been commissioned in Phoenix, Dallas, and Houston. The company has tapped stalwarts like TSMC, Foxconn, Wistron, Amkor, and SPIL in an effort that amounts to an industrial reshoring at a scale the chip industry has not witnessed since the 1980s.

For NVIDIA, this isn’t just patriotic optics. It’s a strategic recalibration in response to new political and economic tectonics—chief among them, President Trump’s recent tariff exemptions for semiconductor components, smartphones, and computers, which spared key industries from levies of up to 125% on Chinese imports. The move, insiders say, offers an accelerated window to harden U.S. tech infrastructure while protecting margins in a volatile tariff environment.

From Taiwan to Texas: A Semiconductor Megapivot

Manufacturing Ground Game: Blackwell Chips Born in the U.S.A.

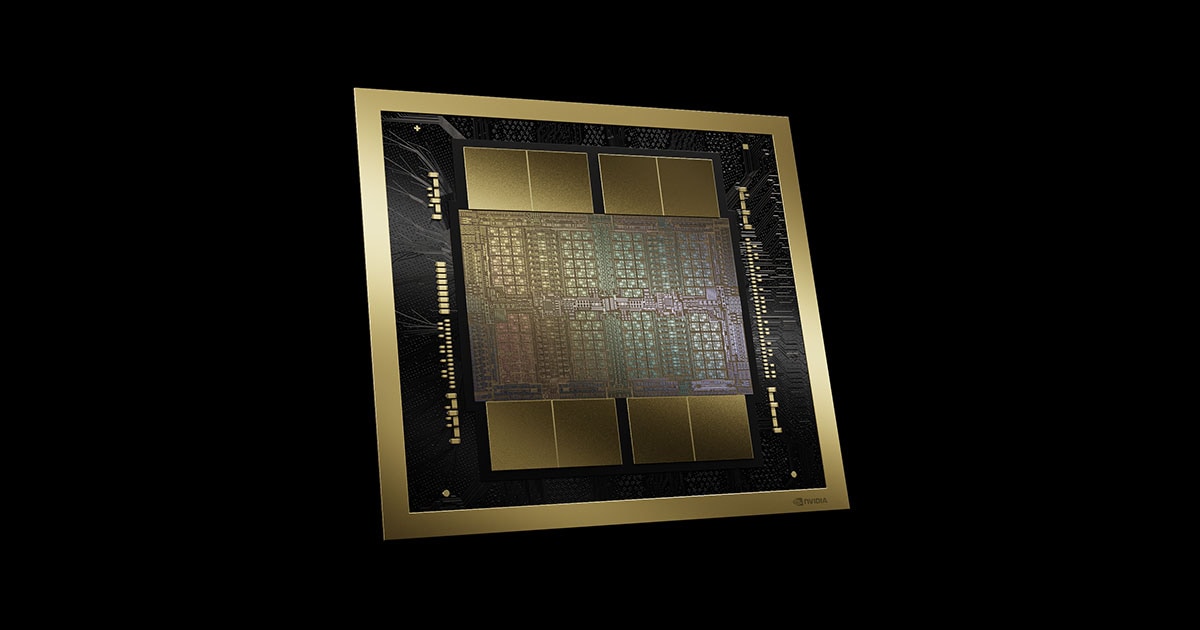

The production of NVIDIA’s Blackwell chips—its most advanced AI processors to date—has commenced at TSMC’s newly operational fab in Phoenix, Arizona. These chips, which underpin everything from massive language models to edge computing clusters, are being packaged and tested in partnership with Amkor and SPIL, also in Arizona.

Meanwhile, full AI supercomputers are set to roll off production lines in Texas, with Foxconn establishing operations in Houston and Wistron in Dallas. Mass production is expected to ramp within 12 to 15 months.

Unlike consumer-grade GPUs, NVIDIA’s AI supercomputers are the backbone of what it calls “AI factories”—gargantuan data centers purpose-built for machine learning at industrial scale. These aren’t merely tools; they are infrastructure—the digital equivalents of railroads and highways in the 21st century.

A senior semiconductor analyst noted, “This is a supply chain masterstroke. It’s not just about chips—it’s about building sovereignty into AI infrastructure. What we’re watching is industrial policy disguised as corporate strategy.”

De-Risking Supply in a Post-Globalization Era

A Hedge Against Tariffs and Geopolitical Disruption

For investors, the logic behind NVIDIA’s move is as economic as it is strategic. As the U.S.–China relationship teeters on a knife-edge and Taiwan remains a geopolitical flashpoint, offshoring chip production—especially to Asia—has become a critical vulnerability.

NVIDIA’s Arizona-Texas axis directly addresses this. By localizing production of its highest-value components, the company reduces exposure to long-haul supply chain disruptions, maritime bottlenecks, and volatile export policies.

According to confidential investor briefings, NVIDIA’s executives anticipate that “up to half a trillion dollars” in AI infrastructure may be produced domestically through these new facilities over the next four years. This reallocation isn’t just about mitigating risk—it’s about capturing the upside of vertical control in a market expected to balloon past $3 trillion by 2030.

“The supply chain shift is tectonic,” said one hedge fund portfolio manager focused on semiconductors. “It’s a margin stabilizer, a geopolitical hedge, and potentially a valuation catalyst—if execution holds.”

Economic Engine or Expensive Experiment?

Jobs, GDP Growth, and the Promise of Regional Revitalization

The scale of economic transformation in play is substantial. Analysts estimate that the Arizona and Texas sites could generate hundreds of thousands of jobs across technical, manufacturing, and support roles—creating ripple effects for housing markets, local tax bases, and regional GDP.

But these aren’t legacy assembly-line jobs. These are advanced manufacturing roles that demand precision engineering and expertise in everything from cleanroom operations to AI-augmented robotics. To bridge the skills gap, NVIDIA is investing heavily in workforce training, while lobbying for federal subsidies under the CHIPS and Science Act.

Yet there are hurdles. One technology sector analyst put it bluntly: “The biggest bottleneck isn’t capital—it’s people. We don’t have the labor force trained for this. And if power infrastructure doesn’t scale alongside capacity, the whole plan risks energy constraints.”

Energy concerns are real. AI factories are notoriously power-hungry. Gigawatt-scale data centers will require stable, abundant electricity—a challenge in water-scarce Arizona and grid-fragile Texas.

The Cost of Ambition: Margin Compression and Execution Risk

Despite the promise, the cost of domestic chip production is 25%–40% higher than in East Asia, according to estimates from private equity consultants tracking the transition. And while Trump’s tariff exemptions ease the import cost of certain upstream modules, downstream logistics—especially for specialized packaging and testing—remain partly offshore and vulnerable to future levies.

“Partial onshoring is still a risk architecture,” warned one former semiconductor executive. “If the final mile gets blocked—whether by politics, pandemics, or port issues—the whole line freezes. Redundancy is not resilience if it’s incomplete.”

Moreover, analysts caution that NVIDIA’s ambitious 12–15 month production timeline leaves little room for error. Yield issues, labor shortages, or regulatory hurdles could delay rollout, inflating costs and jeopardizing initial ROI.

Investors Eye Long-Term Alpha—But Brace for Volatility

Valuation Implications and Strategic Re-Rating

From an investor’s perspective, the strategy holds promise for long-term multiple expansion—especially if NVIDIA can demonstrate operational excellence and domestic scale without cannibalizing its gross margins.

“This is classic convexity,” said one venture capital partner focused on AI. “High upfront CapEx and execution risk, but if they pull it off, NVIDIA will control the most secure and efficient AI supply chain in the world. That’s a structural moat.”

Still, markets may need to stomach short-term volatility. As with any industrial buildout, initial costs may compress EBITDA margins before supply efficiencies and automation gains kick in.

An investment strategist summed it up: “You’re betting on NVIDIA to build not just factories—but a sovereign digital backbone. If they succeed, they could become the Intel and AWS of the AI age.”

The Bigger Picture: Strategic Autonomy and the Semiconductor Arms Race

Beyond margins and multiples lies a larger truth: NVIDIA’s move is part of a global reshuffling of technological sovereignty. As AI becomes the battlefield for economic dominance, nations are racing not just to own the algorithms—but to own the fabs that make them possible.

With its new American footprint, NVIDIA sends a clear signal: control the tools, control the future.

In a world where latency kills and supply chains can be weaponized, speed, security, and proximity matter more than ever. And for investors who understand the language of compounding, few assets compound like infrastructure that defines an epoch.

An Industrial Bet with Epochal Stakes

In the final analysis, NVIDIA’s decision to domesticate AI supercomputer manufacturing marks a seismic inflection in tech industrial strategy. It's a bet on sovereignty over scale, on proximity over cost arbitrage, on resilience over optimization.

For long-term investors, this is a rare moment: not just a shift in how chips are made, but a glimpse into who will shape the scaffolding of the digital world.

Whether this bold pivot delivers durable alpha or temporary friction will depend on execution. But make no mistake—the age of offshore AI supremacy is ending. And in its place, a new silicon spine is forming, buried deep in the American heartland.

One wafer at a time.