Embedded Lending Goes Mainstream: Inside PayPal’s $30 Billion Bet on Small Business Credit

In a financial ecosystem still wrestling with tightened bank credit and evolving digital infrastructure, one company has steadily redefined what it means to lend at scale in the digital age. PayPal, once synonymous with digital payments, has quietly emerged as a central pillar in small business financing. This week, the company announced it had surpassed $30 billion in merchant loan originations—through more than 1.4 million loans disbursed to over 420,000 business accounts globally.

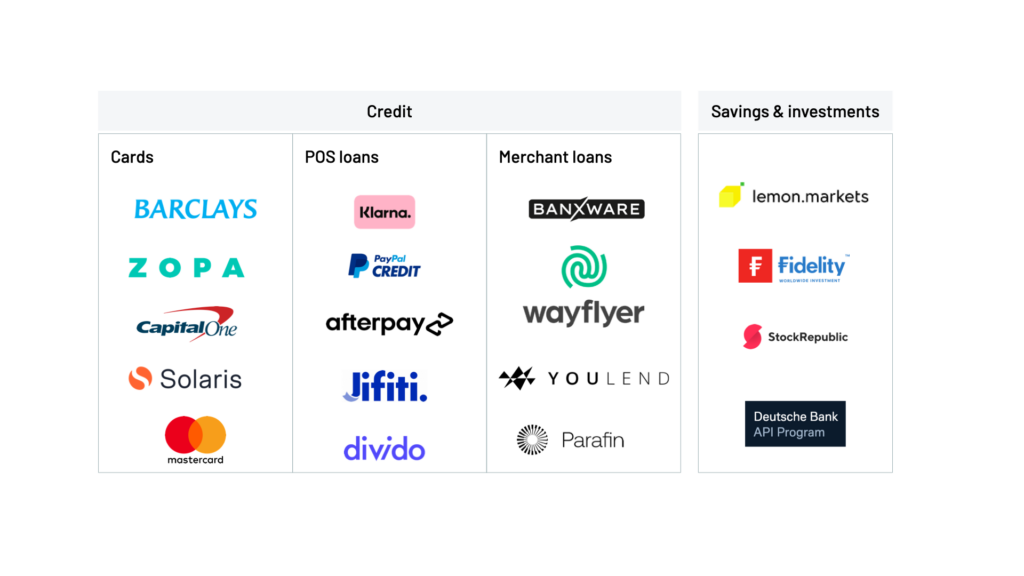

It’s a flashing signal that embedded finance—where lending is woven directly into the transaction layer—is no longer experimental. It’s a primary engine.

Did you know that embedded finance is revolutionizing how we interact with financial services? It involves integrating financial tools like payments, lending, and insurance directly into nonfinancial platforms, such as apps or websites, making transactions seamless and convenient. This trend allows consumers to access financial services without leaving their favorite apps, enhancing user experience and creating new revenue streams for businesses. Embedded finance is growing rapidly, projected to reach hundreds of billions of dollars by 2033, driven by technological advancements and changing consumer behaviors. It also expands financial inclusion by reaching underserved populations through everyday platforms.

A Radical Rewriting of Credit Access

At a glance, PayPal’s merchant lending model is deceptively simple. Instead of relying on traditional credit scores or slow bank processes, the company taps into its vast dataset of merchant transactions, approving loans in real-time based on actual sales history.

Two core products drive this engine:

- PayPal Working Capital, tailored to small merchants, offering capital without a credit check. Loan amounts range from £1,000 to £225,000 and repayments are deducted automatically as a percentage of daily sales.

- PayPal Business Loans (formerly LoanBuilder), designed for larger businesses, using more conventional underwriting but streamlined within PayPal’s digital ecosystem.

What differentiates PayPal is not just speed. It’s integration. “This model folds lending into the same rails as payments,” noted one fintech analyst who covers alternative credit markets. “That changes everything—from how risk is assessed to how capital is repaid.”

Comparison of traditional bank lending vs PayPal embedded lending process

| Aspect | Traditional Bank Lending | PayPal Embedded Lending |

|---|---|---|

| Application Process | - In-person visits required- Extensive paperwork- 1-3 months processing time | - Fully online- Minimal documentation- Minutes to process |

| Accessibility | - Limited to bank hours- Multiple in-person meetings | - 24/7 availability- Accessible at point of sale |

| Approval Criteria | - Strong credit scores- Collateral often required- Overall business financials | - Alternative data sources- PayPal sales history- Less emphasis on traditional metrics |

| Loan Types/Amounts | - Various loan types- Generally larger amounts | - Specific products (e.g., Working Capital)- Smaller, tailored amounts |

| Repayment | - Fixed schedules- Strict covenants | - Flexible options (e.g., % of sales)- Fewer restrictions |

| Approval Rates | - Lower (≈28% for small businesses) | - Higher (>90% customer retention) |

And the impact is measurable. Merchants that tapped Working Capital saw a 36% increase in PayPal volume, while Business Loan users saw a 16% lift, based on internal data disclosed with the milestone.

From Payment Processor to Credit Powerhouse

It’s easy to forget that PayPal’s merchant lending journey began as a pilot over a decade ago. But the numbers today tell a very different story:

- $3 billion in originations in 2024 alone.

- Active across six countries, including the U.S., U.K., Germany, France, Australia, and the Netherlands.

- High repeat usage rates, with many merchants returning for second or third rounds of funding.

PayPal's merchant loan origination volume over the past decade

| Year | Loan Origination Volume | Key Information |

|---|---|---|

| 2015 | >$1 billion (cumulative) | PayPal Working Capital program reached $1 billion milestone |

| 2016-2021 | Data not available | Period of growth, specific annual figures unavailable |

| 2022 | ~$4 billion | One of top 5 small business lenders in the US |

| 2023 | $1.3 billion (first 9 months) | Began scaling back lending activities |

| 2024 | $3 billion | Continued reduction in lending volume |

| 2025 | >$30 billion (cumulative) | Surpassed $30 billion in total global loan originations |

This is not a marginal business line. It’s a core strategic differentiator—one that ties merchants deeper into the PayPal ecosystem and fuels long-term payment volume growth.

According to an individual familiar with PayPal’s merchant strategy, “The goal is not just to lend. It’s to make PayPal indispensable.”

A New Lending Model Finds Its Moment

PayPal’s model is finding tailwinds in broader macro trends. The 2023 Small Business Credit Survey by the Federal Reserve found that alternative lending products now make up 32% of small business financing, up from 24% in 2021. That trajectory underscores a growing shift away from traditional banks, whose appetite for small-dollar, short-term lending has diminished amid tightening regulations and economic caution.

Did you know that the alternative lending market is experiencing rapid growth, projected to reach $1.03 trillion by 2028 with a CAGR of 8.6%? This expansion is driven by the increasing demand for flexible financing options among small businesses. Online alternative finance, including Peer-to-Peer lending, is expected to grow at a CAGR of 18.2%, reaching $65.74 billion by 2033. Technological advancements and accessibility are key drivers, offering faster approval processes and tailored options that traditional banks often cannot match. As a result, alternative lending platforms are becoming a vital source of funding for small enterprises, especially in regions like North America and Europe, where they are gaining significant traction.

“What we’re witnessing,” said one market strategist, “is a reallocation of lending authority. Fintech platforms like PayPal are stepping in where traditional institutions have pulled back.”

And it's not just convenience. The appeal lies in predictability. Merchants know how much they’re repaying, with no compounding interest. This fixed-fee structure, paired with PayPal’s data access, minimizes friction.

But Can It Scale Sustainably?

Even as PayPal cements its dominance, the risks are mounting. The alternative lending space is becoming crowded. Rivals like Block’s Square Loans and Enova are innovating rapidly, carving out their own loyal bases.

There are signs of deceleration too. While $3 billion in 2024 is significant, some experts note that PayPal’s lending volume hasn’t grown at the same breakneck pace as in previous years, raising questions about saturation or tightening credit standards.

There are also systemic pressures to consider:

- Macroeconomic volatility, including higher interest rates and inflation, could dampen merchant ability to repay.

- Regulatory tightening is on the horizon, especially around non-traditional lenders and embedded credit models.

- Loan quality metrics, like default rates and charge-offs, remain closely guarded by PayPal, prompting investor caution.

Risk factors in the alternative lending market

| Risk Category | Key Risk Factors |

|---|---|

| Credit Risk | - Higher default rates due to borrowers with limited credit history- Unsecured loans lacking collateral- Increased sensitivity to economic downturns |

| Operational Risk | - Lack of comprehensive regulation and universal standards- Liquidity and funding challenges for non-bank financial institutions- Heavy reliance on technology platforms |

| Market Risk | - Vulnerability to interest rate volatility- Strong competition from traditional banks- Refinancing difficulties for certain lending models |

| Reputational Risk | - Consumer protection concerns due to inconsistent regulation- Potential lack of transparency in complex lending products |

Did you know that scaling credit quality in fintech lending poses several significant challenges? As fintech lenders grow, they face difficulties in managing large volumes of data, ensuring regulatory compliance across multiple jurisdictions, and accurately assessing credit risk, especially for underserved populations. Additionally, they must mitigate technological risks such as algorithmic biases and cybersecurity threats, while navigating economic volatility and maintaining customer trust. The integration with traditional banking systems can also be complex, potentially limiting operational agility. Despite these challenges, fintech lenders continue to innovate, developing advanced credit scoring models and robust risk management strategies to ensure high credit quality standards as they expand.

Competitive Heat and the Fight for Loyalty

Unlike traditional lenders, PayPal doesn’t just compete on rates—it competes on experience. Its lending products are frictionless, deeply integrated, and fast. But competitors are catching up.

Block’s Square Loans, which leverages Square’s POS data in a similar fashion, is expanding rapidly. Other platforms like Shopify Capital and Amazon Lending also offer embedded credit solutions within their merchant ecosystems.

This arms race for embedded lending dominance may ultimately come down to retention. Whoever can offer the best blend of capital, user experience, and ecosystem utility will likely win the loyalty of merchants long-term.

And therein lies PayPal’s unique strength: lending not as a service, but as a strategy. Every loan issued deepens merchant dependence, increases payment volume, and enhances platform stickiness.

Investors, Banks, and Regulators: All Eyes on Embedded Credit

The $30 billion milestone doesn’t just matter to merchants—it’s being watched closely across capital markets and policy circles.

For institutional investors, the rise of embedded lending represents a new category of private credit exposure with attractive yields. The ability to underwrite short-duration, high-frequency loans backed by real-time data is reshaping how risk capital is allocated.

Investor allocation to private credit and embedded lending

| Aspect | Private Credit | Embedded Lending |

|---|---|---|

| Market Size | $1.8 trillion in 2024 | Rapidly growing, integrated into various sectors |

| Growth Projection | $2.3 trillion by 2028 | Mainstream adoption across industries |

| Key Segments | Direct lending (36% of market), specialty finance, asset-based lending | Working capital loans, invoice financing, BNPL |

| Investor Interest | 53% plan to increase allocation | Growing interest from VCs, banks, and institutions |

| Recent Trends | Shift towards niche strategies; specialty finance allocations up from 10% to 18% | B2B solutions gaining traction alongside B2C |

| Driving Factors | Higher yields, portfolio diversification | AI-powered credit decisioning, regulatory changes |

| Notable Activities | Launch of dedicated groups by major institutions | Partnerships between banks, fintechs, and platforms |

| Future Outlook | Continued growth in fundraising and market size | Deeper integration into non-financial platforms |

For traditional banks, it’s a wake-up call. As alternative lenders capture more market share, some are being forced to partner with fintechs or develop internal solutions. Those that don’t may be disintermediated entirely from SMB lending—a segment they once dominated.

Banks face disintermediation in the SMB lending market, partly due to the rise of fintech solutions like embedded lending. Concurrently, this evolving landscape is attracting increased regulatory attention and oversight.

For regulators, PayPal’s growth raises questions around consumer protection, transparency, and systemic risk. Expect new scrutiny over disclosure practices and potentially tighter guidelines governing embedded credit.

The Road Ahead: Will PayPal Redefine Merchant Finance?

With rising competition, economic uncertainty, and regulatory flux ahead, the road forward is anything but guaranteed. Yet if PayPal can maintain its underwriting discipline and continue to demonstrate clear value for merchants, its model could define the next decade of small business finance.

Three emerging dynamics may shape that path:

1. The Convergence of Payment and Credit

We’re moving toward an environment where every payment becomes a credit data point. In that world, PayPal’s dual role as processor and lender gives it a structural advantage few can match.

2. The Battle for Ecosystem Control

As more companies embed lending into their platforms, the fight is shifting from pricing to platform utility. Loyalty will belong to the ecosystem that delivers holistic financial tools—not just credit, but payments, analytics, and cash flow management.

3. The Rise of Real-Time, Risk-Based Capital Allocation

Gone are the days of slow underwriting cycles. The next frontier is dynamic credit—capital deployed and adjusted in real time based on merchant behavior. PayPal is already close to that future. Others are racing to catch up.

A Financial Revolution, One Merchant at a Time

PayPal’s $30 billion milestone is not a final chapter—it’s a midpoint in a larger transformation. By embedding credit into the heart of digital commerce, it is rewriting the rules of small business finance and forcing a rethink across banking, investing, and regulation.

The implications ripple far beyond PayPal. If its model proves both scalable and sustainable, it may represent a blueprint for how credit will be delivered in the 21st century: fast, data-driven, and deeply integrated into the flows of commerce itself.

For now, the message is clear. Lending is no longer a separate service. It is the spine of digital commerce. And PayPal, quietly but unmistakably, is building that backbone.