Redwire and ispace-US Partner to Launch Commercial Lunar Missions Under NASA’s $2.6 Billion CLPS Program

A Strategic Lunar Leap: Redwire and ispace-U.S. Join Forces to Rewire the Future of Moon Missions

In a striking announcement at the 40th Space Symposium, amid a flurry of deals and declarations shaping the next era of space commerce, two rising powerhouses in lunar exploration—Redwire Corporation and ispace technologies-U.S., inc.—unveiled a strategic memorandum of understanding (MOU) that could decisively tilt the scales in the race to commercialize the Moon.

Their objective: to jointly pursue commercial lunar science and delivery missions under NASA’s $2.6 billion Commercial Lunar Payload Services (CLPS) initiative and serve a rapidly maturing market hungry for cost-effective, repeatable access to the Moon’s surface.

Table summarizing NASA's Commercial Lunar Payload Services (CLPS) initiative, including objectives, features, achievements, and benefits.

| Category | Details |

|---|---|

| Objective | Deliver science and technology payloads to the Moon to support Artemis and future exploration. |

| Contracting Model | Fixed-price contracts with private companies to bid on lunar delivery missions. |

| Budget | $2.6 billion through 2028 under indefinite delivery/quantity contracts. |

| Payloads | Focus on small science instruments, technology demonstrations, and resource scouting. |

| Achievements | First commercial Moon landing with IM-1 mission in 2024; successful missions by Intuitive Machines and Firefly Aerospace. |

| Benefits | Fosters a commercial lunar economy, enables frequent access to the Moon, and advances science and technology. |

But beyond the headlines, what does this partnership actually mean for the future of lunar infrastructure, and how does it shift the competitive balance in a field already populated by aggressive incumbents and well-financed disruptors?

A Tactical Pairing Rooted in Execution, Not Hype

In an industry often driven by ambitious promises and dramatic renderings, the Redwire–ispace-U.S. partnership stands out for its emphasis on execution over speculation. This is no moonshot fever dream; rather, it’s a strategic alignment between two companies with complementary capabilities and a shared appetite for risk-managed advancement.

Redwire, a publicly traded company (NYSE: RDW), has carved a niche in the aerospace sector through its mastery of digital engineering, integration, and the delivery of lunar subsystems and mission-critical payloads. It is one of 14 prime contractors eligible under NASA’s CLPS IDIQ contract vehicle, which offers multiple awardees access to a cumulative ceiling of $2.6 billion through 2028.

ispace-U.S., meanwhile, brings its APEX lunar lander to the table—a next-generation platform evolved from the Hakuto-R program, which includes the Mission 1 Series 1 and the Mission 2 RESILIENCE landers. Building on flight heritage and technical lessons, APEX is engineered for greater mass-to-surface payload capabilities, modularity, and mission flexibility.

While neither firm is new to the industry, their joint venture marks a notable escalation in capability—an integration of Redwire’s spacecraft hardware and systems with a proven lunar delivery platform that, on paper, matches or exceeds what’s currently flying.

“We’re Not Reinventing the Rocket. We’re Reinventing the Process.”

At the heart of this collaboration lies a deliberate effort to sidestep the pitfalls that have plagued lunar landing missions in recent years. Though the CLPS program has already seen launches from companies like Astrobotic and Intuitive Machines, consistency, precision, and cost-efficiency remain elusive.

“The key question isn’t who can land, but who can land reliably and repeatedly,” said one aerospace analyst attending the Symposium. “This partnership is smart because it doesn’t chase novelty—it optimizes what works.”

The APEX lander is central to that equation. According to technical breakdowns, the platform supports flexible mission profiles—delivering cargo to either lunar orbit or the surface—with a significantly improved payload capacity over its predecessors. More importantly, it’s been refined based on actual mission telemetry and operations, reducing both cost and uncertainty.

Meanwhile, Redwire brings operational pedigree in integrating complex space systems. In an industry where a single misaligned bolt or corrupted line of code can result in multimillion-dollar failures, the importance of tested, integrated systems cannot be overstated.

A Measured Answer to an Urgent Problem: Reliable Moon Deliveries

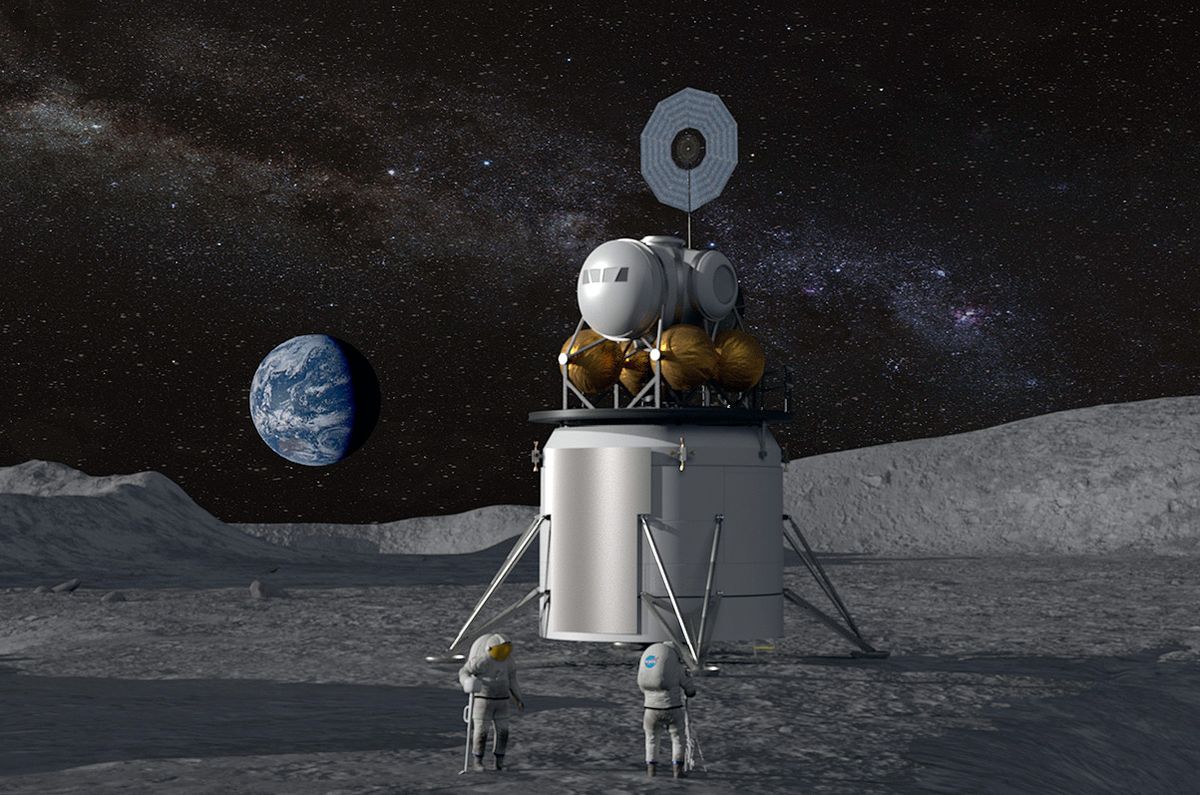

The broader context of this announcement is NASA’s high-stakes bet on commercial partners to spearhead payload deliveries in preparation for human return missions under Artemis. These deliveries are not symbolic—they’re essential. They carry science instruments, communication modules, power systems, and precursor technologies for sustainable lunar habitation.

And yet, as of early 2025, the success rate of commercial lunar landings remains mixed. “We’re not there yet. We need delivery systems that feel more like FedEx and less like the lottery,” remarked one former NASA program manager now advising private sector missions.

By combining Redwire’s mature engineering with ispace-U.S.’s flight-tested lander, the team seeks to shift the conversation from can we land? to how quickly and cost-effectively can we scale? That’s where this collaboration gets especially interesting: it isn’t a singular product launch; it’s a potential foundation for repeatable lunar commerce.

Mapping a Market with Gravity of Its Own

The Moon is fast becoming the hottest real estate in the solar system, and not just for national pride or scientific curiosity. As of this writing, NASA’s CLPS alone is a $2.6 billion opportunity. But that’s merely a wedge in a pie that includes:

- Lunar resource extraction (e.g., regolith mining and ice water harvesting),

Table summarizing key aspects of In-Situ Resource Utilization (ISRU) on the Moon, including goals, technologies, benefits, and current developments.

| Category | Description |

|---|---|

| Goals | - Extract oxygen from regolith for life support and rocket fuel. |

| - Harvest water ice for fuel production and human consumption. | |

| - Use regolith to create construction materials for habitats and infrastructure. | |

| - Enable energy production through solar power collection and storage. | |

| - Produce rocket propellant for deep-space missions. | |

| Technologies | - Excavation and processing of lunar regolith. |

| - Chemical methods like molten regolith electrolysis to extract oxygen. | |

| - Additive manufacturing using lunar materials for 3D printing structures. | |

| - Volatile extraction by heating regolith to release trapped water vapor. | |

| Benefits | - Reduces costs by minimizing resource transport from Earth. |

| - Supports sustainability through local resource utilization. | |

| - Enables extended exploration missions with fuel depots and supply stations. | |

| Current Developments | - ESA plans a demonstration mission by 2025 to produce oxygen on the Moon using ISRU technologies. |

| - NASA’s Artemis program focuses on utilizing lunar water ice at the South Pole for long-term missions. |

- Scientific missions funded by governments and institutions,

- Communication and navigation infrastructure for cislunar space, and

- Future human settlement—from habitats to in situ manufacturing.

According to industry estimates, the cislunar economy could grow into a $30–50 billion market over the next decade, driven by public-private partnerships, commercial payload rideshares, and lunar construction technologies.

Did you know that the global lunar economy is projected to experience significant growth over the next 10-15 years? By 2040, it's estimated to reach a cumulative value of approximately $170 billion, with transportation services contributing $100 billion and resource utilization adding $63 billion. Driven by government programs like NASA's Artemis and private sector innovations, the lunar market is expected to see a compound annual growth rate of around 10% in transportation alone. The U.S. is likely to lead this market, with China and Japan also playing major roles. As technology advances and infrastructure develops, the lunar economy could become a pivotal part of the broader space industry by the mid-2040s.

In this context, the Redwire–ispace-U.S. partnership is well-timed. By targeting both government and private-sector clients, it positions itself as a dual-use provider with scalable services and multiple monetization paths.

Rivalry Among the Stars: Competition Stiffens

Despite the promise, this new alliance enters a crowded arena. Current CLPS players like Intuitive Machines and Astrobotic have already flown—or attempted—NASA-backed missions. Blue Origin, though more focused on human-rated systems, is developing its own lunar delivery architectures via the Blue Moon program.

But unlike Blue Origin’s monolithic approach or the solo-flight mentality of smaller providers, the Redwire–ispace-U.S. tie-up benefits from systemic integration.

“They’re playing the game like enterprise software firms: modular, interoperable, and repeatable,” said a space sector investor who requested anonymity. “That’s how you win contracts and scale operations. Not with PowerPoint decks, but with pipelines and payloads.”

Still, execution remains the ultimate decider. Until the APEX lander logs multiple successful missions under the CLPS banner, this alliance—however promising—remains a strong contender, not yet a clear leader.

A Bet on Systems, Not Saviors

From an investment standpoint, the implications are nuanced but meaningful. The ispace-U.S.–Redwire partnership is less about dramatic technical innovation and more about systematic de-risking—a theme gaining traction among institutional investors who view the space economy as an infrastructure play, not a speculative moonshot.

Table: Key Reasons Why Systems Engineering is Critical for Complex Space Missions

| Aspect | Description |

|---|---|

| Integration of Subsystems | Ensures seamless functionality of diverse subsystems like propulsion, communication, and thermal control. |

| Requirements Management | Aligns spacecraft design with mission goals by capturing and prioritizing stakeholder requirements. |

| Risk Management | Identifies and mitigates potential hazards to reduce the likelihood of mission failure. |

| Testing and Validation | Conducts rigorous simulations and stress tests to ensure system reliability under harsh conditions. |

| Continuous Monitoring | Monitors spacecraft performance in real-time to optimize operations and address issues proactively. |

| Collaboration Across Disciplines | Coordinates diverse engineering teams to resolve conflicts and maintain project integrity. |

| Contingency Planning | Develops plans to handle unexpected challenges, ensuring safety and mission continuity. |

| Innovation in System Design | Designs robust architectures that balance functionality with constraints like weight and energy efficiency. |

If the team delivers, analysts forecast a potential re-rating of both companies' equity within 12–18 months, particularly if their missions demonstrate high precision, payload versatility, and rapid cadence.

What sets this partnership apart is not technological flash, but architectural maturity. It's an integrated stack—engineering, hardware, mission ops—all co-developed and co-validated. And in the high-consequence theater of lunar operations, maturity often beats novelty.

A New Dawn for Lunar Logistics

While many still view lunar exploration through the lens of science fiction, this partnership is a reminder that the Moon is swiftly becoming a logistics challenge—not unlike deploying a global shipping network, but on another celestial body.

And that, ultimately, may be the greatest value of this collaboration: it doesn't just promise lunar access; it promises lunar repeatability. If successful, it could accelerate the transition from episodic missions to a lunar supply chain, enabling everything from research stations to robotic mining and beyond.

The Moon, in other words, may no longer be a destination. Thanks to alliances like this, it’s beginning to look a lot more like a market.

Final Word

As the space economy pivots from proof-of-concept to infrastructure buildout, partnerships like that of Redwire and ispace-U.S. may serve as the scaffolding for a true off-Earth economy. It's not flashy, it's not cinematic—but it's real, and for investors and mission planners alike, that realism is worth its weight in lunar regolith.

“The future,” one analyst said, “won’t belong to those who get there first. It’ll belong to those who can deliver — and keep delivering.”

And in that race, this alliance just got into pole position.