Sipay Raises $78 Million Series B at $875 Million Valuation to Expand Fintech Platform Across Emerging Markets

Sipay’s Bold Ascent: The $875 Million Fintech Betting Big on Emerging Market Transformation

In a world where fintech unicorns often ride hype before proving sustainable value, Turkish startup Sipay has quietly but forcefully carved a different narrative. The company’s recent $78 million Series B funding round, which catapulted it to a striking $875 million valuation, is less a flash in the pan and more a calculated bet on the latent financial potential of emerging markets.

The round was led by U.S.-based Elephant VC, with participation from QuantumLight, a venture capital firm co-founded by Revolut’s Nik Storonsky. This isn’t just another check signed in Silicon Valley’s endless fintech sweepstakes. It’s a declaration: there’s a different model of digital finance brewing—one not born in New York or London, but in the complex, high-growth corridors of Turkey and beyond.

A Fintech Built for the Forgotten Half

Unlike many Western fintechs chasing saturated urban consumers with niche products, Sipay’s model is built for the underbanked, the overcharged, and the operationally underserved.

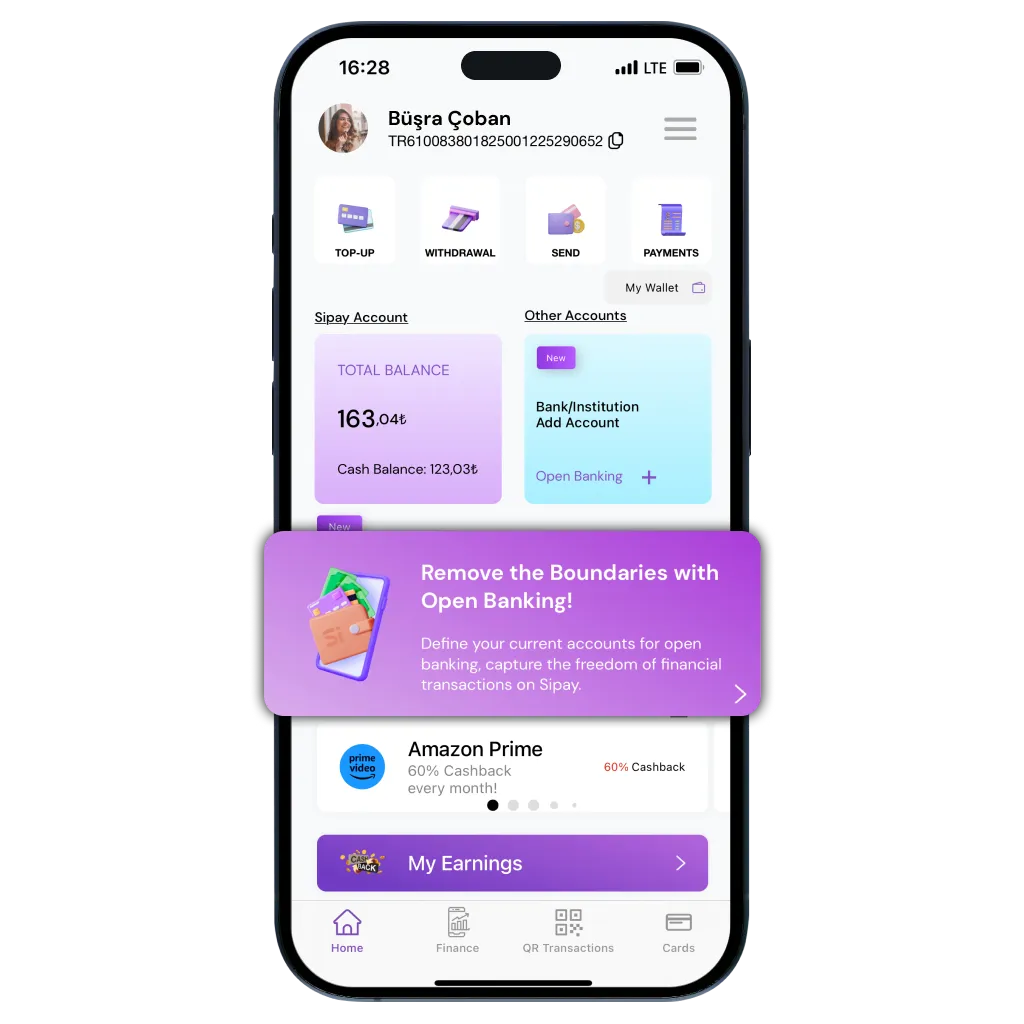

Founded in 2019, Sipay operates a multi-service fintech platform that combines digital wallets, embedded finance, FX transactions, investment services, loyalty programs, and more into a single integrated stack. It's not merely building an app. It’s building the financial nervous system for small businesses and consumers long neglected by traditional banking systems.

The results? 6.3 million wallet users, 25,000 registered merchants, and a fivefold year-on-year revenue surge, bringing Sipay to a $600 million run-rate by the end of 2024—all while turning a profit.

“This is beyond digital convenience,” said one fintech analyst familiar with the Turkish market. “It’s about rebuilding the infrastructure where nothing functional existed.”

Emerging Markets, Tailored Execution

The Global Model Falls Short

In markets where Stripe’s infrastructure doesn’t offer remittances and Revolut lacks local banking integration, Sipay has capitalized. Its platform is designed not for the glossy dashboards of high-income users but for merchants navigating currency volatility, consumers sending cross-border remittances, and SMEs looking for reliable, omnichannel payment systems.

Its business strategy is more than responsive—it’s deeply embedded in local market idiosyncrasies. Integration with domestic banks and payment networks like Visa and Mastercard gives Sipay credibility and liquidity. Strategic alignment with major e-commerce players like Trendyol turns it into a backend layer of the Turkish internet economy.

“Stripe, Adyen, Revolut—they were built for uniformity,” one venture partner noted. “Sipay’s betting on fragmentation. That’s where the real margin and moat are.”

From Wallets to Infrastructure: The “White-Label” Play

A cornerstone of Sipay’s scale strategy is its white-label offering, which enables other fintechs and corporates to issue cards or launch wallets using Sipay’s infrastructure. This move mimics models like Solaris Bank in the UK—but in a less banked, more fragmented geography where infrastructure itself is scarce.

By enabling local players to launch tailored financial services—while Sipay remains the underlying engine—it reinforces two core advantages:

- Scalability without heavy front-end marketing costs

- Compounding network effects, as every white-label partner indirectly expands Sipay’s platform reach

This approach not only scales distribution but also accelerates financial inclusion, enabling SMEs and consumers to onboard into digital finance via brands they already trust.

A Competitive Field, But Few with Comparable Depth

In Turkey, local players like Papara, Param, and United Payment command significant brand presence. But Sipay’s holistic integration, diversified service offering, and early profitability set it apart.

Globally, it competes indirectly with platforms like Stripe , Revolut , and Wise (FX and remittances). But each of these focuses on single-product excellence, while Sipay bets on product bundling and ecosystem depth.

With 600% revenue growth, the traction is not just vanity metrics. It's validation of a multi-layered monetization model: transaction fees, FX margins, value-added investment services, and B2B white-label deals.

Expansion Dreams Meet Real-World Friction

What’s Next?

Armed with new capital, Sipay plans aggressive international expansion, focusing on emerging economies with similar structural gaps. These include countries with high remittance volumes, fragmented banking infrastructures, and underserved digital finance markets.

It’s a compelling vision—but also one riddled with complexity.

Regulatory Wildcards

Expanding across borders means contending with inconsistent licensing regimes, data localization laws, and varying KYC requirements. Even with a strong compliance team, entering new markets like Nigeria, India, or Latin America will require deep local partnerships and long-term engagement with regulators.

“Execution isn’t about tech,” said one regional VC. “It’s about trust and patience.”

Operational Risk

The all-in-one nature of Sipay’s platform brings scale, but also exposes it to cascading risk. A technical glitch in FX could impair remittance flows. A compliance miss in one country could stall licensing in others. Running an integrated stack at this scale demands flawless engineering and robust risk management.

Broader Implications: Not Just a Fintech, A Signal

Sipay’s rise tells us more than just the story of one company—it reflects the next chapter in fintech globalization.

1. The Super App is Alive and Local

While Western markets have turned away from the “super app” dream, Sipay is proving its validity in regions where financial services are fragmented, costly, and inconsistent. A single, integrated app isn’t overkill—it’s salvation.

2. White-Label Infrastructure is the Trojan Horse

Rather than fight for consumer mindshare in new markets, Sipay empowers local players to carry its stack. This model reduces CAC and accelerates adoption—an especially potent strategy in trust-sensitive markets.

3. The Emerging Market Premium

Western investors, burned by overvalued neo-banks and high-burn fintechs, are recalibrating. Profitability, real user growth, and local adaptability are the new gold standard. Sipay offers all three, and its rise may signal a broader shift in where capital—and innovation—flows next.

High Potential, High Stakes

The future for Sipay is as promising as it is perilous. On the one hand, the company is perfectly positioned to become a de facto infrastructure layer for emerging market fintech. On the other, its ambition to offer a universal financial toolkit across geographies means compounding complexity at every level—technical, regulatory, cultural.

Still, early indications suggest this is not a startup betting on the next funding round, but a business model designed to sustain and scale profitably.

The next 12–18 months will be telling. If Sipay can maintain its execution discipline while entering new markets, it may not only become Turkey’s first true fintech unicorn, but also a template for the next generation of global financial platforms.

A Blueprint for the Next Fintech Frontier

Sipay’s success is no accident. It is the result of a calculated strategy tailored to fragmented, underserved markets, delivered through a deeply integrated tech stack, and validated by real revenue and profitability. Its decision to stay focused on solving complex problems in hard markets—rather than expanding prematurely into low-margin, crowded developed economies—may be its masterstroke.

For fintech investors, operators, and policymakers watching the evolution of digital finance, Sipay offers both inspiration and instruction. In a space dominated by Western voices, it is a reminder that the next era of innovation may well be scripted in Istanbul, not Palo Alto.