Roche's $50 Billion US Gambit: When Swiss Precision Meets American Innovation

In a sprawling industrial complex outside New Jersey's pharmaceutical corridor, engineers huddle over blueprints for what will become one of the most ambitious pharmaceutical manufacturing projects of the decade. The stakes couldn't be higher: Roche, the Swiss pharma titan, is betting $50 billion—equivalent to Ecuador's annual GDP—on a future where America becomes not just a consumer of life-saving medicines, but the world's next pharmaceutical powerhouse.

The announcement, unveiled on Tuesday, April 22, 2025, sends seismic waves through the global pharmaceutical landscape. The five-year investment plan dwarfs anything seen in recent industry history, eclipsing even Johnson & Johnson's $55 billion pledge and outpacing Eli Lilly's $27 billion commitment. But this is more than just corporate one-upmanship—it's a calculated maneuver in an increasingly unpredictable geopolitical chess game.

The Tariff Specter and the Great Pharma Pivot

Behind the boardroom doors of Roche's Basel headquarters, CEO Thomas Schinecker faced a stark reality when trade winds shifted in Washington.

The Trade Expansion Act of 1962 granted the U.S. President broad authority to negotiate tariff reductions and stimulate economic growth through increased international trade. Notably, its Section 232 allows the President to adjust imports if they are determined to threaten national security.

"The landscape has fundamentally changed," explains a senior industry analyst in Switzerland. "What started as saber-rattling has morphed into actionable policy considerations that could reshape global supply chains overnight."

The numbers tell a compelling story. The United States accounts for nearly half of Roche's pharmaceutical sales—approximately $25 billion in 2024 alone.

Table: Roche Pharmaceuticals Sales Breakdown by Geographic Region, 2024

| Region | Sales (CHF million) | % of Division Sales | Year-on-Year Change (CER) |

|---|---|---|---|

| United States | 24,774 | 53.7% | +9% |

| Europe | 8,832 | 19.1% | +8% |

| Japan | 2,874 | 6.2% | –16% |

| International | 9,691 | 21.0% | +17% |

| Total | 46,171 | 100% | +8% |

A proposed 25% tariff on imported pharmaceuticals could potentially erase billions in profits, making the $50 billion investment seem almost conservative by comparison.

Beyond Defensive Posturing: The Three-Pronged Strategy

But Roche's leadership sees opportunity where others see threat. The investment encompasses three strategic flywheels that could catapult the company from a Europe-anchored oncology leader to a US-centric innovative powerhouse.

1. The Metabolic Gold Rush

At the heart of Roche's American push lies a massive 900,000-square-foot manufacturing facility dedicated to next-generation weight loss medications. The location remains under wraps as states engage in fierce bidding wars with tax incentives and infrastructure promises.

Table: Overview of Roche’s Latest Weight Loss Drug Pipeline

| Drug | Mechanism | Administration | Clinical Phase | Key Recent Data/Status |

|---|---|---|---|---|

| Petrelintide | Amylin analog | Weekly injection | Phase 2 | Roche-Zealand Pharma partnership; promising tolerability; potential best-in-class amylin monotherapy |

| CT-388 | Dual GLP-1/GIP agonist | Weekly injection | Phase 2 | 18.8% weight loss over 24 weeks; favorable safety profile; no discontinuations due to side effects |

| CT-996 | Oral GLP-1 agonist | Daily tablet | Entering Phase 2 | 7.3% weight loss over 4 weeks in phase 1; flexible dosing; phase 2 trials starting in 2025 |

"This isn't just about capturing market share," notes a metabolic disease researcher at a leading Boston institute. "It's about positioning Roche at the epicenter of what could be the most lucrative therapeutic area of the next decade."

The obesity epidemic, affecting over 100 million American adults, represents a potential market worth hundreds of billions.

US Adult Obesity Prevalence Trends over recent decades. Period | Obesity Prevalence (%) | Severe Obesity Prevalence (%) | Notes 1960–1962 | 13.0 | — | Baseline data from early national health surveys. 1999–2000 | 30.5 | 4.7 | Marked increase from previous decades. 2017–2018 | 42.4 | 9.2 | Continued upward trend in both obesity and severe obesity rates. 2021–2023 | 40.3 | 9.4 | Slight decrease in obesity prevalence; severe obesity remains high.

With demand already outstripping supply for existing GLP-1 drugs from Novo Nordisk and Eli Lilly, Roche's timely capacity expansion could prove transformative.

GLP-1 receptor agonist drugs mimic the body's natural GLP-1 hormone. This action helps promote weight loss primarily by reducing appetite, slowing stomach emptying, and increasing feelings of fullness, leading to reduced calorie intake.

2. Gene Therapy's New Frontier

In Pennsylvania's life sciences corridor, ground will soon break on a state-of-the-art gene therapy manufacturing plant.

"Tech transfer complexity for gene therapy vectors is astronomical," explains a veteran bioprocessing engineer who has designed similar facilities.

Table: Key Factors Contributing to the Complexity of Gene Therapy Technology Transfer

| Factor | Description |

|---|---|

| Process Complexity | Manual, non-standardized steps dependent on operator skill; difficult to document and reproduce. |

| Material Variability | Patient-specific cells and unique raw materials introduce inconsistency and sourcing challenges. |

| Scalability Issues | Scaling up alters critical parameters; equipment differences may require process redesign. |

| Analytical & Regulatory | Potency assays and method validation are complex; GMP compliance may be lacking. |

| Timeline & Risk | Tight deadlines and comparability risks can delay or complicate transfer. |

| Collaboration & Training | Requires alignment and training across organizations and sites. |

"Moving these capabilities from Basel to Pennsylvania involves navigating an FDA validation backlog that stretches 18 months. It's a high-risk, high-reward proposition."

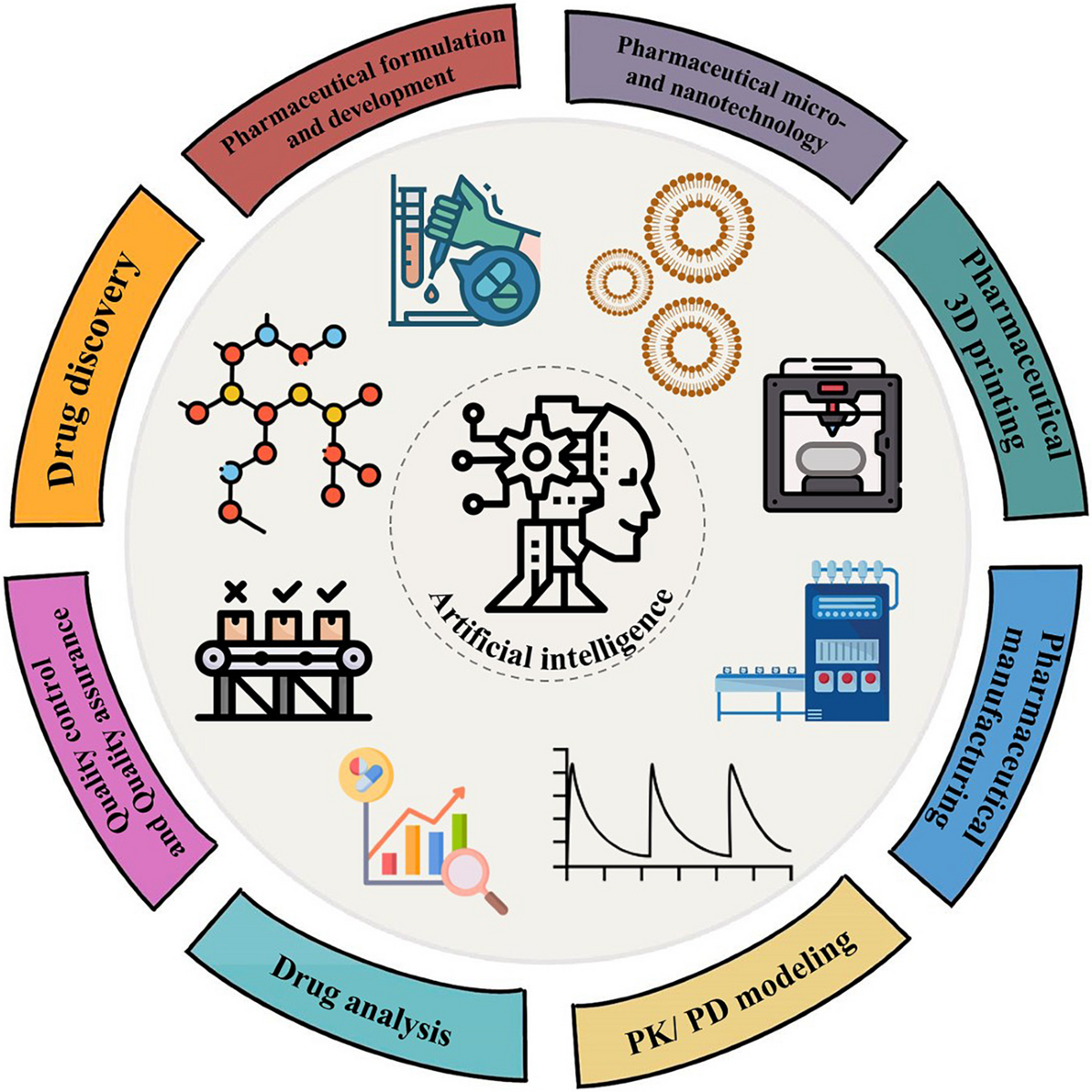

3. The AI-Enabled Discovery Revolution

Perhaps most intriguing is Roche's planned AI research hub in Massachusetts, strategically positioned to leverage what insiders call the "Boston data flywheel"—a dense ecosystem of real-world patient data, algorithm talent, and cloud infrastructure.

"They're not just building a research center," observes a pharmaceutical AI specialist. "They're attempting to embed themselves in the neural network of American biomedical innovation."

The Ripple Effect: Winners and Losers

The investment's impact extends far beyond Roche's balance sheet. Construction firms like Jacobs and Fluor are already mobilizing resources, while bioprocessing equipment suppliers such as GE Healthcare and Sartorius anticipate years-long order backlogs.

However, the euphoria isn't universal. Smaller biotechs in Cambridge face an unprecedented talent war, with hiring managers reporting 30% wage inflation for experienced biologics operations personnel. European pharmaceutical regions, once considered secure in their industrial dominance, confront the reality of potentially losing major projects to US counterparts.

The Financial Anatomy of a $50 Billion Bet

For investors scrutinizing Roche's bold move, the mathematics appear compelling yet complex. The $50 billion investment represents approximately 11% of projected sales for 2025-2029. At a conservative 15% internal rate of return, analysts project an additional CHF 1.3 billion in annual EBIT by 2030—sufficient to offset two patent cliffs of Humira's magnitude.

A pharmaceutical patent cliff refers to the sharp decline in revenue experienced by a drug company when patents for its highly profitable blockbuster drugs expire. This expiration allows lower-cost generic or biosimilar competitors to enter the market, drastically reducing sales and market share for the original branded medication.

"The company maintains formidable financial flexibility," notes a credit analyst at a major rating agency. "Net debt-to-EBITDA remains below 2x even after this massive capital deployment, thanks to robust cash flows and margin expansion."

Did you know? A healthy Net Debt-to-EBITDA ratio is a key indicator of a company’s financial strength, showing how easily it can pay off its debt using operational earnings. For large corporations like Enel, a leading utility company, this ratio has improved significantly—from 3.1 to 2.7 in 2023—as they reduce debt and boost profits. Typically, a ratio below 3 is considered strong, especially in capital-heavy industries. A downward trend over time signals smart financial management and increased resilience.

The real prize, however, lies in the obesity market. If Roche's weight-loss therapies achieve even mid-single-digit penetration of the US obese adult population—roughly 11 million patients—factory throughput could generate $10-15 billion in incremental revenue, dramatically elevating return on invested capital.

Navigating the Execution Minefield

Yet success remains far from guaranteed. The specter of the Inflation Reduction Act's price negotiation provisions looms large, potentially squeezing margins on high-volume products.

Table: Key Provisions of the Inflation Reduction Act and Their Effects on Drug Prices and Patients

| Provision | Description | Expected Effect |

|---|---|---|

| Medicare Price Negotiation | Allows Medicare to negotiate prices for select high-cost drugs | Direct price reductions for targeted drugs |

| Inflation Rebates | Requires manufacturers to pay rebates if prices rise above inflation | Discourages excessive annual price increases |

| $2,000 Out-of-Pocket Cap | Limits annual drug spending for Medicare beneficiaries (from 2025) | Reduces financial burden for patients |

| Insulin and Vaccine Caps | Caps insulin at $35/month; no cost-sharing for adult vaccines | Lowers out-of-pocket costs for insulin and vaccines |

| Broader Market Impact | May influence pricing beyond Medicare | Slower price growth industry-wide; possible higher launch prices for new drugs |

Construction inflation threatens to erode returns, with a 10% cost overrun capable of shaving 140 basis points off projected IRR.

Union leaders in Kentucky and New Jersey already flag critical craft-worker shortages, while industry veterans warn of potential permitting delays in traditionally slower regulatory environments. The complexity of technology transfer, particularly for gene therapy manufacturing, adds another layer of execution risk.

The Next 24 Months: Watching the Dominoes Fall

As Roche's ambitious blueprint unfolds, several key milestones warrant close attention:

The final site selection for the weight-loss facility, expected by Q3 2025, will trigger an intense competition among governors eager to claim victory in the incentive derby. Pennsylvania's gene therapy groundbreaking in Q4 2025 serves as a litmus test for execution capability across the broader program.

Perhaps most intriguing is the anticipated emergence of the first AI-generated cardiovascular IND from the Boston hub by 2026—a proof point that could validate the entire data flywheel concept.

The Geopolitical Endgame

As other pharmaceutical giants rush to emulate Roche's strategy—Novartis with $23 billion and Johnson & Johnson with $55 billion—the industry witnesses a tectonic shift in global pharmaceutical manufacturing. Comparison of Recent Major Pharmaceutical Manufacturing Investments Announced in the US. Company | Investment | Location(s) & Site Notes | Year | Focus Areas Novartis | $23B (5 yrs) | San Diego, CA (R&D); FL, TX, IN, NJ, CA (RLT); 4 new sites (TBD) | Apr 2025 | R&D, Biologics, Chemical Substances, Radioligand Therapy (RLT) Johnson & Johnson | $55B (4 yrs) | Wilson, NC; 3 new sites (TBD); expansions at existing sites | Mar 2025 | Biologics (Oncology, Immunology, Neuro), R&D, MedTech Eli Lilly | $27B | 4 new sites (TBD) | Feb 2025 | APIs, Injectables | $9B | Lebanon, IN (LEAP) | Updated May 2024 | API for Tirzepatide, Pipeline Medicines Merck (MSD) | $1B | Durham, NC | Mar 2025 | Vaccine Manufacturing

"We're seeing the emergence of what might be called 'pharmaceutical nationalism'," suggests a former trade official familiar with the administration's thinking.

Pharmaceutical nationalism refers to government policies prioritizing a nation's own population for access to medicines and vaccines, often driven by national security concerns about supply chain reliability. This trend involves strategies like onshoring drug manufacturing to reduce dependence on foreign sources and mitigate geopolitical risks affecting the availability of essential pharmaceuticals. "The pandemic exposed supply chain vulnerabilities that politicians of all stripes are now determined to address."

For Roche, the audacious investment represents more than defensive positioning against potential tariffs. It's a high-conviction bet that the next wave of value creation in biopharma will be captured in America's policy-favored, data-rich, obesity-driven market.

As construction crews prepare to break ground across multiple states, one thing becomes clear: the Swiss precision that built Roche into a pharmaceutical powerhouse now combines with American scale and innovation. The result could reshape not just one company's future, but the entire landscape of global drug development and manufacturing for decades to come.

Whether this $50 billion gamble transforms into triumph or cautionary tale remains to be seen. But in the high-stakes world of pharmaceutical manufacturing, Roche has just pushed all its chips to the center of the table—and the industry watches with bated breath.