Texas’ $1 Billion School Choice Pivot Sparks Financial Shockwaves — and a National Education Repricing

A High-Stakes Win for Trump, Abbott, and a New Generation of Education Investors

AUSTIN — Beneath the searing Texas sun, a quiet but seismic shift is reshaping American education policy—and the capital markets that orbit it. The state’s recent passage of a $1 billion private school voucher bill marks not only a crowning ideological win for conservatives but a structural disruption of public school financing and the broader $800 billion K-12 education economy.

Praised effusively by Donald J. Trump as a “gigantic Victory” in a Truth Social post today, the new Texas law enables families to divert up to $10,000 in taxpayer funds per student annually to private schools or homeschooling. It is the largest voucher program in U.S. history to date and the culmination of years of political engineering by Texas Governor Greg Abbott, who aggressively campaigned to replace anti-voucher incumbents with school-choice loyalists.

US School Choice Program Growth (2011-2024)

| Year | Total Programs | Total Participation | Key Developments |

|---|---|---|---|

| 2011 | ~20 | ~200,000 | Primarily vouchers & tax-credit scholarships; First ESA introduced in Arizona |

| 2019 | ~65 | ~540,545 | ESAs still limited (~19,211 students); No universal programs existed |

| 2022-23 | 70+ | ~770,000 | ESA participation nearly tripled from prior year; Arizona launches first universal ESA |

| Mid-2024 | 75 | > 1,000,000 | 10 states with universal programs; ESAs (~470,801 students) driving growth; 40% of US K-12 students eligible for some form of private choice |

| 2024-25 | 80+ | > 1,000,000 | 13 states with universal/near-universal eligibility laws passed; Continued growth in ESAs |

But beyond the partisan rhetoric, a more profound question looms: is this the beginning of a decade-long repricing of American education, or a high-risk gamble that could fracture public schooling beyond repair?

The “Uber Moment” of U.S. Education: Market Disruption in Real Time

Investors are already treating the Texas voucher program as a structural inflection point, not a policy sideshow. Some hedge fund analysts have compared the initiative to the early days of Uber—small-scale at first, but with the potential to destabilize entrenched incumbents and redistribute capital flows across multiple asset classes.

Market disruption occurs when a smaller company, often using what Clayton Christensen termed "disruptive innovation," successfully challenges established incumbent businesses. Typically, this involves introducing simpler, cheaper, or more convenient offerings that initially target overlooked customer segments, eventually moving upmarket to displace the established competitors, as demonstrated by numerous examples.

“This is the ride-hailing moment for U.S. education,” one education-focused fund manager noted. “The scale isn’t national yet, but the pricing shock in places like Collin and Williamson Counties is very real. And it’s only just started.”

The bill’s initial $1 billion allocation covers roughly 90,000 seats in its first year—equivalent to just 0.6% of national K-12 spend. But Texas budget models project that by 2030, this could expand to $4.5 billion annually. In concentrated metro areas across the Sun Belt, the localized financial impact is already rippling outward.

Projected annual spending growth for the Texas school voucher program.

| Fiscal Year | Projected Annual Cost (General Revenue Funds) | Source/Notes |

|---|---|---|

| 2026 | $6.9 million - $10.8 million | Initial administrative/setup costs estimated by the Legislative Budget Board (LBB) depending on the specific bill version (SB 1/SB 2). |

| 2027 | $1.0 billion | Proposed initial funding cap for the first year (or biennium depending on the bill version) as outlined in the state budget proposals (SB 1) and passed House version of SB 2. This amount is contingent on enacting legislation and would fund an estimated 60,000-100,000 students depending on the bill details. |

| 2028 | $3.0 billion - $3.3 billion | LBB projection based on estimated demand growth, assuming program expansion beyond the initial cap. Actual spending depends on future legislative appropriations. |

| 2029 | $3.3 billion - $3.8 billion | LBB projection based on estimated demand growth, assuming program expansion beyond the initial cap. Actual spending depends on future legislative appropriations. |

| 2030 | $3.7 billion - $4.8 billion | LBB projection based on estimated demand growth, assuming program expansion beyond the initial cap. Actual spending depends on future legislative appropriations. Some analyses based on earlier bill versions projected costs exceeding $10 billion by 2030 without strict caps. |

Winners Emerge: Digital Schools, Hybrid Learning, and Texas Land Plays

Texas’ new education savings accounts (ESAs) have uncorked a fresh channel of state-backed spending—one that’s portable, fast-moving, and largely unencumbered by the regulatory frameworks that define public schooling.

Education Savings Accounts (ESAs) are typically government-funded accounts that give parents funds to cover approved educational expenses, thereby facilitating school choice. Unlike traditional school vouchers, ESAs often provide more flexibility, allowing money to be spent on a wider range of costs beyond tuition, such as tutoring, supplies, or therapy services.

Among the most direct beneficiaries are hybrid and digital private school operators, especially those positioned to scale rapidly without traditional brick-and-mortar delays. “We’re seeing managed services firms offering plug-and-play school models at sub-$8K per pupil,” one industry analyst said. “Their unit economics make them a natural fit for voucher dollars.”

Listed companies such as Grand Canyon Education, which is pivoting into K-12 services, and Nerdy, an AI tutoring firm, are becoming speculative vehicles for investors betting on the acceleration of home-based and modular education. Some funds are also buying land in fast-growing suburban corridors—expecting micro-school campuses to sprout in districts like Montgomery and Williamson as parents exit traditional public schools en masse.

Cracks in the Foundation: Texas School Bonds and the Public Education Status Quo

While some portfolios are positioning for upside, others are bracing for turbulence. Chief among the potential losers: Texas Independent School District (ISD) general-obligation and maintenance-and-operations (M&O) bonds. These tax-backed instruments depend on stable enrollment and property tax bases—both now under threat.

Municipal Bond Yield Spreads and School District Credit Factors

| Aspect | Key Trends |

|---|---|

| Municipal Bond Yield Spreads | • Lower-rated bond spreads were tight in late 2024 • Recent volatility (April 2025) caused muni yields to rise • High-yield muni spreads narrower than 5-year average but wider than tightest levels • Widening spreads indicate increased market concern |

| Texas ISD Bond Ratings | • Most Texas ISDs rated 'A' or 'AA' • Highland Park ISD among only three districts with Aaa/AAA ratings • Key factors: property tax base, state funding, reserves, debt management • Challenges: recapture system, legislative changes |

| Impact of Enrollment Decline | • Directly impacts state funding • Can lead to revenue shortfalls and budget pressure • May negatively affect bond ratings and borrowing costs • Often requires staff cuts or school closures • Can reduce voter support for future bonds |

| “If you’re holding BBB-rated muni bonds backed by ISD cash flows, you could be looking at a 25-50 basis point spread widening in the next 24 months,” warned one municipal bond strategist. “This isn’t just theoretical. It’s already being priced in.” |

The textbook industry is also under fire. The decentralization of curriculum decisions—especially with more families crafting bespoke learning experiences—has accelerated the shift away from standardized print materials and toward open educational resources (OER) and modular digital content.

And while the program’s backers tout “empowerment” and “choice,” its political cost is becoming clear. Teachers’ unions, already weakened by membership losses, now face an existential threat in states where headcount elasticity and voucher eligibility intersect. Their diminishing leverage was starkly evident during the 2024 Republican primaries, where union-aligned candidates struggled to survive.

A Fractured Future: Equity, Access, and the Uneven Geography of School Choice

Despite the fanfare, the path forward is fraught with risk—legal, political, and human.

Critics argue the program undermines public education’s foundational equity by draining resources from the schools that serve the most vulnerable. “You can’t bleed public schools of funding and still expect them to serve every child,” one education policy expert said. “Especially in rural districts, where there simply aren’t private alternatives.”

Data backs up the concern: rural areas often lack the density to support viable private schooling ecosystems, yet will still see local budgets shrink if students exit. And while voucher advocates promise academic gains through competition, recent research offers a more mixed picture—particularly for low-income students, who often perform worse in voucher-funded private schools.

Table: Summary of Academic Performance Outcomes for Students in Voucher Programs vs. Public Schools.

| Outcome Area | Voucher Program Effect | Examples/Notes |

|---|---|---|

| Test Scores (Math) | Declines (up to 14 percentile points) | Louisiana, Indiana, Ohio (statewide programs) |

| Test Scores (Reading) | Mixed/Neutral | Milwaukee, D.C., New York (city-level programs) |

| Norm-Referenced Tests | Neutral or small positive effects | Florida, India, Colombia |

| Criterion-Referenced Tests | Significant declines | Louisiana, Ohio |

| Educational Attainment | Increased graduation and college enrollment rates | D.C. (+21% grad), Milwaukee (+2–12% grad, higher college entry) |

| Public School Impacts | Slight improvements in test scores and attendance | Florida, Louisiana (due to competition effects) |

| Geographic Disparities | Urban programs show stronger positive effects | Delhi, Bogotá, U.S. cities |

| Program Design Impact | Targeted programs outperform universal ones | Florida (targeted), Indiana (universal) |

| Long-Term vs. Short-Term | Attainment gains may not align with test score trends | Graduation/college gains despite test score stagnation/declines |

There’s also the risk of fraud. In Arizona, a state with a similar ESA model, 12% of vendors in 2023 were flagged for misuse of funds. The Texas bill includes oversight mechanisms, but analysts warn that without escrow-style disbursement and platform-level accountability, misuse could quickly become systemic.

Litigation looms large, too. Equal-protection lawsuits and challenges based on “Blaine Amendments” in state constitutions could slow or halt expansion. Some legal observers put the odds of a federal Supreme Court showdown at 25% within three years.

Blaine Amendments are provisions found in many state constitutions that restrict the use of public funds for religious schools. These amendments are frequently at the center of legal challenges, particularly concerning school voucher programs and other forms of school choice.

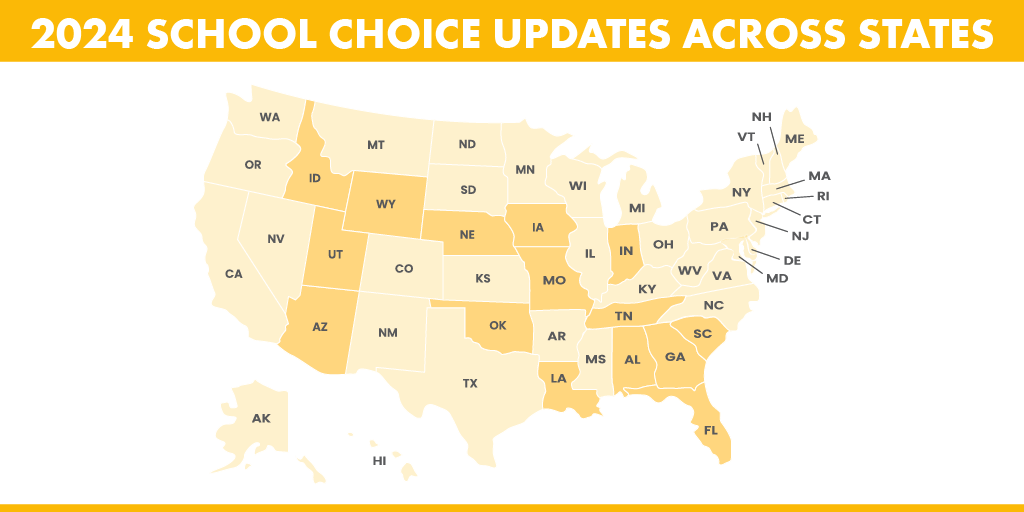

The National Contagion: Four States Poised to Copy Texas Blueprint

What happens in Texas doesn’t stay in Texas. Conservative lawmakers in at least four deep-red states are already drafting similar ESA bills, citing the Lone Star State’s success as proof of concept. Based on prior adoption curves in Arizona and Florida, analysts expect the combined ESA total addressable market (TAM) to grow by $10-12 billion by 2028.

That expansion, if realized, will accelerate the bifurcation between urban magnet ISDs—which may retain share through branding and selectivity—and rural districts, which face a no-win scenario of declining enrollment and fixed-cost inflexibility.

Meanwhile, the growth of AI-enabled curricula and adaptive learning platforms is pushing tuition costs below $6,000 per pupil, pressuring high-end private schools to justify their premium sticker prices. This margin compression could further disrupt the education landscape, especially as parents begin comparing outcomes—and costs—more critically.

For Investors, A Volatile but Tradable Theme

In the capital markets, the Texas education pivot has become a thematic trade with legs. Investors are executing multi-pronged strategies:

- Build-to-core positions in digital-first education names like LRN (scaling positions during legislative sell-offs).

- Pair-trade long Grand Canyon Education (LOPE) vs. short Texas ISD GO bonds, for a policy-levered exposure.

- Buy deep OTM call options on AI tutoring plays like NRDY, for high-upside, defined-risk exposure.

- Take illiquid stakes in land LPs across Texas growth corridors, anticipating a micro-school buildout akin to the 2000s charter boom.

Still, risk remains. Academic underperformance headlines could trigger backlash. Fraud scandals could freeze program expansion. And political turnover—even a modest swing in the Texas House—could pause the voucher rollout.

Smart money is hedging with puts and coupon-neutral municipal spread trades, aware that policy conviction may be strong, but execution drag is volatile.

Education Becomes an Asset Class

What began as a cultural rallying cry for “parental rights” has morphed into a tangible, tradable shift in state-guaranteed revenue flows. Texas didn’t just pass a bill—it cracked open the capital structure of American public education.

The question now is not whether school choice is here to stay. It is how far, how fast, and with what collateral damage.

As one investor put it succinctly:

“Go long the picks and shovels of optional education. Short the inertia-priced cash flows of compulsory schooling. The future is modular—and it’s already being priced in.”