A 25% Shockwave: The Fallout of Trump’s Automobile Tariff Tsunami

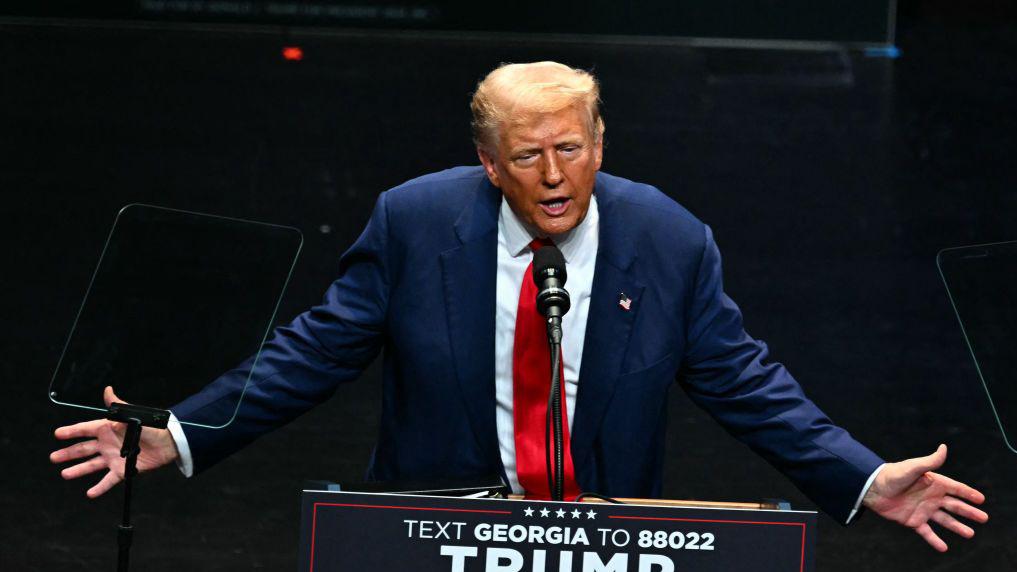

In a declaration that would reshape global trade overnight, U.S. President Donald Trump announced a sweeping 25% tariff on all imported automobiles—permanent, all-encompassing, and effective in just days.

A Tariff Blitz with No Warning: “Reciprocity” by Force

The announcement—set for April 2 implementation—envisions a sharp and immediate hike on all non-U.S.-made vehicles, layering a 25% tariff atop the already existing 2.5% levy. It’s not just autos: lumber and pharmaceuticals are also caught in the crosshairs, with the administration promising an unprecedented application of what Trump described as “reciprocal tariffs” against all countries.

Did you know that tariffs can have significant negative impacts on international trade? They increase the cost of imported goods, making domestic products less competitive globally. Tariffs often lead to retaliatory measures, sparking trade wars that disrupt industries and economies. They can also disrupt global supply chains, forcing businesses to adjust logistics or relocate production, which can be costly and inefficient. Additionally, tariffs can reduce economic growth, lead to currency appreciation, and cause inefficient resource allocation. By protecting domestic industries from competition, tariffs can even stifle innovation and decrease global trade overall. Historically, significant tariff increases have led to substantial declines in global trade, as seen during the Great Depression.

Unlike the precision of traditional trade policy, this is a blunt instrument aimed at systemic overhaul.

Trump suggested that the tariff structure would catch many off guard, but emphasized his view that the measures would be advantageous for American companies.

Markets React: Volatility Surges, Peso and GM Plunge

Within hours of the announcement, the Mexican peso slid 0.4%, signaling investor concern over the deep integration between U.S. and Mexican auto industries. General Motors stock dropped over 4% in after-hours trading, reflecting widespread unease about the fate of global supply chains.

One analyst noted, “This isn’t protectionism—it’s protectionism on steroids. It’s a scorched-earth policy against global integration.”

The immediate market reaction wasn’t panic—it was calculation. Traders began unwinding positions across import-reliant sectors and pivoting toward domestic defensive assets. Volatility indexes spiked.

Winners Without Victory: Domestic Producers May Still Lose

At first glance, American automakers appear to benefit. Foreign competition is suddenly 25% more expensive. But the structure of modern auto production complicates this narrative.

Many U.S. carmakers rely on globally sourced parts—engines from Germany, electronics from Japan, chassis components from Mexico. Although the announcement promised an exemption for “U.S.-manufactured parts used in foreign cars,” experts warn that such carve-outs are bureaucratic minefields.

“There’s no clean separation between ‘foreign’ and ‘domestic’ in the modern car,” said one industry insider. “That exemption may be administratively impossible to enforce.”

Instead of a manufacturing renaissance, automakers may face cost surges, export retaliation, and supply chain gridlock.

Tesla in the Spotlight: The Accidental Beneficiary?

Though the company was "not consulted", and no favors were requested (as Trump himself emphasized), Tesla may find itself an unintended beneficiary. With competitors facing sudden 25% headwinds, Tesla’s U.S. production base becomes an asymmetric advantage—if it can navigate its own globally interconnected supply lines.

One observer noted, “Tesla could gain U.S. market share, but margins will be squeezed hard by component inflation. It’s not a free lunch.”

The irony is that in a world built on cost efficiency, advantage now lies with resilience and localization.

Retaliation is Not a Threat—It’s a Certainty

Perhaps the most predictable element of this shock policy is retaliation.

European Commission President Ursula von der Leyen issued a statement of “deep regret,” echoing prior diplomatic clashes over trade. EU tariffs on American goods—likely targeting agriculture, aviation, and tech—are virtually guaranteed.

“When you tax our cars, we will tax your soybeans,” an unnamed EU diplomat remarked off the record.

Expect Canada and Mexico, two of the U.S.'s largest trading partners, to respond in kind. These nations have deep auto integration through USMCA, and this move strikes at the heart of that pact’s logic.

Trade retaliation occurs when a country responds to another nation's imposed trade restrictions (like tariffs) by implementing its own barriers against that country. These responsive actions, often in the form of retaliatory tariffs or quotas, aim to pressure the original country to remove its initial restrictions.

Trade experts warn of a cascade: “Tit-for-tat responses aren’t linear—they’re exponential. One tariff breeds ten.”

Housing, Healthcare, and the Middle Class Get Squeezed

Beyond autos, the inclusion of lumber and pharmaceuticals widens the economic blast radius.

Lumber Tariffs

Roughly 30% of U.S. softwood lumber is imported from Canada. Tariffs here drive up homebuilding costs, exacerbating an already chronic affordable housing crisis. Builders will pass on these costs. Consumers will foot the bill.

Did you know that U.S. softwood lumber imports from Canada have experienced significant fluctuations over the years? In 2023, these imports reached 28.1 million cubic meters, marking the smallest volume since 2015 and a 7% decrease from 2022. Historically, Canadian imports peaked in the early 2000s, accounting for a substantial portion of U.S. consumption. The trade has been influenced by agreements like the Softwood Lumber Agreement, which affected market shares. Recently, tariffs on Canadian softwood lumber products were increased to 14.54%, impacting the trade dynamics further. Despite these changes, Canada remains a crucial supplier of softwood lumber to the U.S. market.

Pharmaceutical Tariffs

The global nature of drug production makes pharma tariffs a strategic blunder. U.S. companies rely on active pharmaceutical ingredients (APIs) from China and India. Generics—already operating on razor-thin margins—may become economically unviable.

“Drug prices will rise. Drug availability may drop. Tariffs on medicine are a recipe for shortages,” said a healthcare supply chain expert.

The sector has historically operated under global agreements discouraging pharma tariffs. Violating this norm could shatter cross-border medical cooperation.

Supply Chains Under Siege: End of the “Just-in-Time” Era?

This is more than a tariff. It’s a declaration of economic independence—and it risks isolating the U.S. in a deeply interconnected world.

Just-in-Time (JIT) manufacturing is a production strategy focused on making goods only as needed, thereby minimizing inventory and waste to enhance efficiency. While it offers benefits like reduced holding costs, JIT systems are highly susceptible to supply chain disruptions and demand fluctuations.

The auto industry, in particular, is built on parts that cross borders multiple times. These new tariffs will force companies to rebuild supply chains at immense cost. Regionalization—already a trend—may accelerate, but not without chaos.

“This isn't policy—it’s shock therapy with a sledgehammer,” said one market strategist.

In the medium term, inflation will spike. The Federal Reserve could be pressured to maintain high interest rates. Growth may slow, even stall. Debt reduction from tariffs—while advertised—is negligible compared to the economic drag they introduce.

Strategic Pivot or Structural Misfire?

Trump’s message is framed in economic nationalism, but the structure mirrors a kind of trade-era accelerationism: break things fast, force adaptation, profit later.

The auto loan tax deduction floated in the same announcement was quickly dismissed by economists as window dressing—politically attractive but economically negligible in the face of thousands of dollars in added costs per vehicle.

Consumers, meanwhile, are the unequivocal losers. Car prices may surge by $3,000–$10,000. Home prices will climb. Drug costs will spike. Discretionary income will contract.

Did you know that a 25% import tariff on automobiles could significantly impact the U.S. car market? The average price of new vehicles could rise by approximately from $3,000, with some models experiencing increases of up to $12,200. This is due to higher production costs from tariffs on imported parts, such as those from Canada and Mexico for North American-assembled vehicles. Electric vehicles might see particularly large price hikes due to their reliance on imported batteries and electronics. As a result, consumers may face increased costs for both new and used vehicles, as demand shifts in response to these changes.

One former trade official summarized, “This policy doesn’t just shift the cost—it multiplies it, then localizes the pain.”

Breaking the System to Save It?

As Trump signals permanence, markets are betting on impermanence. But uncertainty is already the new norm.

This hypothetical policy is more than a trade dispute. It is a referendum on globalization, efficiency, and cooperation. It dares to ask whether economic systems must be broken to be rebuilt.

Some believe a regionalized future—where nations trade mostly with allies—was inevitable. If so, this accelerates it. But acceleration without insulation is volatility incarnate.

For now, all eyes are on April 2nd.

And the only guaranteed winner?

Volatility.