Trump Family Expands Business Empire Through Crypto Deals Legal Settlements and Foreign Ventures During Second Term

“Profits of Power”: Trump’s Second-Term Business Empire Blurs the Line Between Governance and Self-Enrichment

In an era where the line between public service and private profit has often seemed blurred, the Trump family’s second-term business ventures have effectively erased it. What began as vague promises to “drain the swamp” has transformed into what critics call a sprawling apparatus of political influence, commercial gain, and familial entrenchment, orchestrated from the highest office in the United States.

Through crypto acquisitions, global real estate expansions, and monetization of lawsuits and media partnerships, Donald J. Trump and his inner circle are reshaping the presidency—not as a stewardship of democratic ideals, but as a platform for elite financial extraction. With mounting concerns from ethics experts and international watchdogs, what’s unfolding is more than just controversial; it’s a test of the integrity of American institutions under sustained pressure from private ambition.

A New Chapter in Crypto Influence: Pardons, Platforms, and Power Plays

In what is perhaps the most audacious development, the Trump family has entered the cryptocurrency world with a vengeance, leveraging both influence and political capital. A partial equity stake in a U.S.-based arm of a major cryptocurrency exchange—linked to Binance founder Changpeng Zhao—is being quietly transferred to World Freedom Wealth, an investment vehicle reportedly controlled by Trump’s inner circle.

According to sources close to the negotiations, Zhao is hoping to parlay this deal into a presidential pardon amid ongoing legal scrutiny. “No felon would refuse a pardon,” Zhao stated publicly, a cryptic remark interpreted by analysts as a veiled confirmation of the deal’s underlying motives.

Did you know that the President of the United States has the constitutional power to grant pardons to individuals convicted of federal crimes? This power, derived from Article II of the U.S. Constitution, allows the President to exempt a person from serving their sentence and restore their civil liberties. Pardons can be issued at any time after an offense is committed and provide legal forgiveness, though they do not erase the conviction from the record. The President can also grant other forms of clemency, such as commutations and reprieves, but cannot pardon for state crimes or impeachment offenses. This powerful tool is meant to serve justice and mercy, and its use is typically reviewed by the Department of Justice before a decision is made.

The Trump network’s eyes, however, extend beyond Binance. Insiders claim the family is strategically targeting Coinbase as a long-term play, aiming to consolidate influence over multiple U.S. crypto exchanges.

“This isn’t just a portfolio expansion—it’s a power consolidation across platforms that influence both capital and narrative,” said one financial analyst specializing in crypto policy. “And the implications for U.S. financial regulation are enormous.”

Adding complexity to the web, Justin Sun—founder of the TRON blockchain—invested $30 million in World Freedom Wealth before the SEC paused fraud litigation against him. That the courts responded so quickly after Sun’s investment raises critical questions about the transactional nature of legal outcomes under Trump’s administration.

Legal Settlements as Revenue Streams: A Presidency Monetized

In an unprecedented twist, Trump’s legal entanglements have become a source of income. Lawsuits filed against major tech companies for deplatforming his accounts have resulted in staggering settlements: $10 million from Elon Musk’s X (formerly Twitter) and $25 million from Facebook’s parent company, Meta.

Did you know that deplatforming is the practice of removing or denying access to platforms used for sharing information or ideas? This can occur on social media and other digital platforms, often due to violations of community guidelines, such as spreading misinformation or hate speech. Originating from the concept of no-platforming in the 1970s and 1980s, deplatforming has evolved with the rise of digital media. It aims to reduce public visibility and maintain a safe online environment, but it also sparks debates about freedom of speech. Notable examples include the deplatforming of prominent figures like former US President Donald Trump from Twitter following the January 6, 2021, Capitol attack.

Only YouTube remains in litigation, with Trump’s legal team predicting another eight-figure settlement. While the exact terms remain confidential, the pattern is unmistakable: political power wielded as leverage against private enterprise, with substantial payouts flowing back to the president’s allies.

“I’ve never seen litigation used this overtly as a cash-flow mechanism by a sitting president,” noted one legal scholar. “It’s a modern form of institutional shakedown, cloaked in the language of grievance.”

Melania’s Media Deal: $40 Million for a First Lady’s Story

Adding another layer to the Trump family’s monetization matrix, Amazon Studios has signed a $40 million contract with Melania Trump for a docuseries exploring her personal and political life. The agreement, which includes both production costs and profit-sharing provisions, has stunned observers given Jeff Bezos’ past opposition to Trump.

“This is less about content and more about quiet reconciliation,” one media insider said. “It’s transactional diplomacy through media.”

While defenders argue that public figures are entitled to commercial ventures, ethics watchdogs contend that such deals—especially while her husband remains in office—violate the spirit, if not the letter, of federal ethics norms.

Key ethics rules and considerations for Presidential families

| Category | Description |

|---|---|

| Anti-Nepotism Statute | Prohibits appointing relatives to civilian positions, but exempts White House Office appointments |

| Financial Disclosures | Proposed legislation requires disclosure of foreign payments, gifts, loans, and tax returns |

| Ethics Principles | 14 principles of ethical conduct apply to federal employees, including avoiding conflicts of interest |

| Historical Practices | Presidents have involved family members as advisers, raising ethical concerns |

| Proposed Reforms | Recommendations include stricter disclosure requirements and enhanced conflict-of-interest rules |

The Balkan Real Estate Push: Kushner’s Serbia Play and a Long Game in Gaza

In Serbia, Trump's eldest son recently met with President Aleksandar Vučić under the guise of “strategic cooperation.” But beneath the diplomatic optics lies a real estate goldmine: a 99-year development contract for luxury hotels and 1,500+ apartments, granted to Kushner’s firm.

This project, occurring in a region still recovering from decades of political instability, has triggered fears of backdoor profiteering. Kushner’s reported comments at Harvard—advocating for Gaza redevelopment through “forcible demolition”—have only intensified scrutiny of the ethical foundation underlying these ventures.

“What we’re seeing,” said one international urban development expert, “is a global expansion of the Trump brand under the protective umbrella of U.S. power. It’s soft influence monetized.”

The Family Trust Mirage: Conflicts Cloaked in Transparency Theater

Traditionally, presidents place assets in blind trusts to avoid conflicts of interest. Trump, by contrast, has transferred control to his children, who continue to conduct international business dealings—arguably with more vigor than during his first term.

Publicly, the family insists on avoiding direct partnerships with foreign governments. Privately, they court foreign private companies whose shareholders often include sovereign wealth funds or government-linked investors.

“It’s plausible deniability by design,” said one government ethics advisor. “Foreign capital is still influencing domestic decisions—just through a more oblique channel.”

Did you know that Sovereign Wealth Funds (SWFs) are powerful state-owned investment vehicles that manage a country's excess financial resources? These funds, often fueled by natural resource revenues or trade surpluses, invest globally in assets like stocks, bonds, and real estate. SWFs serve multiple purposes, including saving for future generations, stabilizing government budgets, and supporting strategic economic development. Some of the largest SWFs are managed by countries like China, the UAE, Singapore, Norway, and Saudi Arabia, collectively holding trillions of dollars in assets. As significant players in the global financial market, SWFs play a crucial role in shaping economies and securing long-term financial stability for their respective nations.

Capitalism in the Age of Trump: Market Risks Beyond the Fed

Investor Uncertainty in the Shadow of Presidential Profit

For professional traders and institutional investors, Trump’s merging of business and politics introduces a unique set of risks. Markets are now exposed to sudden, politically driven fluctuations untethered from traditional macroeconomic indicators.

“The usual tools—earnings reports, interest rates, Fed policy—still matter,” said one Wall Street risk strategist, “but now you also have to model presidential tweets, pardons-for-partnerships, and media-brokered settlements. It’s a different beast.”

Foreign Capital and Policy Capture: Gulf States and Hidden Strings

With over $2 billion from the UAE invested in entities tied to Binance, and Middle Eastern governments tangentially linked to Trump-affiliated projects, the U.S. risks ceding policy sovereignty to foreign actors whose investments now blur the lines between diplomacy and business.

“The backdoor influence is real,” warned a former intelligence official. “Every dollar invested could be a lever pulled in a future policy decision.”

Did you know that policy capture is a significant issue affecting public decision-making? It occurs when powerful groups or individuals manipulate policies to serve their own interests rather than the public good. This phenomenon can undermine democratic values and legitimacy by influencing regulations, laws, and resource allocation through both legal and illegal means. Policy capture is closely related to regulatory capture, where industries dominate the agencies meant to oversee them. Addressing this issue requires increased transparency, stakeholder engagement, and accountability measures to ensure that policies truly serve the broader public interest.

Toward a Post-Ethics Presidency: Implications for Governance

The Trump model—where executive decisions, legal maneuverings, and private enterprise are fused into a single operating strategy—may not remain unique for long.

If left unchecked, critics warn, this framework could redefine not just the presidency but governance itself.

“A president who governs with one hand and signs business contracts with the other sets a precedent that’s dangerously hard to reverse,” said a political historian. “It’s no longer about ethics—it’s about incentives. And they’re all pointing the wrong way.”

A Warning Sign, Not an Aberration

The Trump family’s business undertakings during his second term offer more than political drama—they are a case study in the monetization of American power. What once might have been whispered concerns about conflicts of interest have now crystallized into a systemic playbook: one where influence, money, and governance are fungible assets in a global marketplace.

For institutional investors, regulators, and citizens alike, this evolution demands urgent attention. The real question is no longer whether Trump is violating norms—but whether the system is capable of stopping the next president from doing the same, or worse.

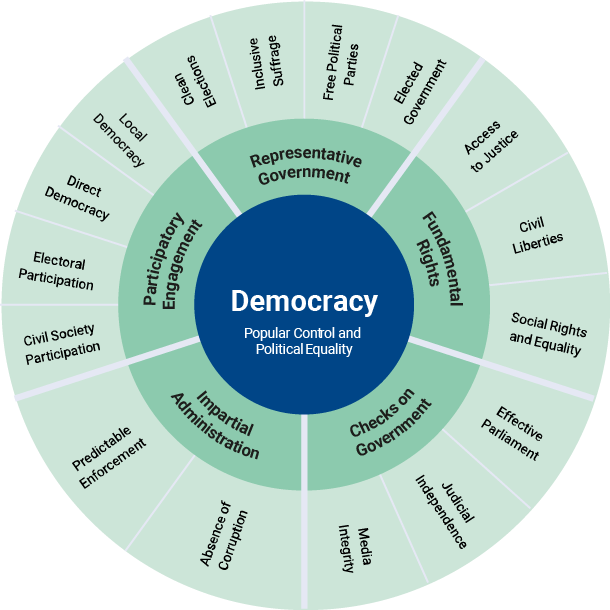

In this emerging paradigm, democracy risks becoming not the guardian of public trust, but a premium asset—available to those who know how to buy it.