Trump Orders Investigation into US Dependence on Imported Critical Minerals Amid Rising Trade Tensions You said:

America's Mineral Gambit: Trump's Bold Bid to Reshape Global Supply Chains

In the shadow of mounting global tensions, President Donald J. Trump signed an Executive Order on April 15, 2025, that may fundamentally alter America's industrial landscape. With the swift stroke of a pen, he launched a Section 232 investigation into processed critical minerals—a move that simultaneously escalates his "America First" agenda and acknowledges the fragility of supply chains that power everything from smartphones to missile guidance systems.

Under the Trade Expansion Act of 1962, a Section 232 investigation determines whether specific imports threaten national security—and empowers the President to impose remedies ranging from targeted tariffs to outright restrictions. For critical minerals, the stakes couldn't be higher.

The Invisible Backbone of American Power

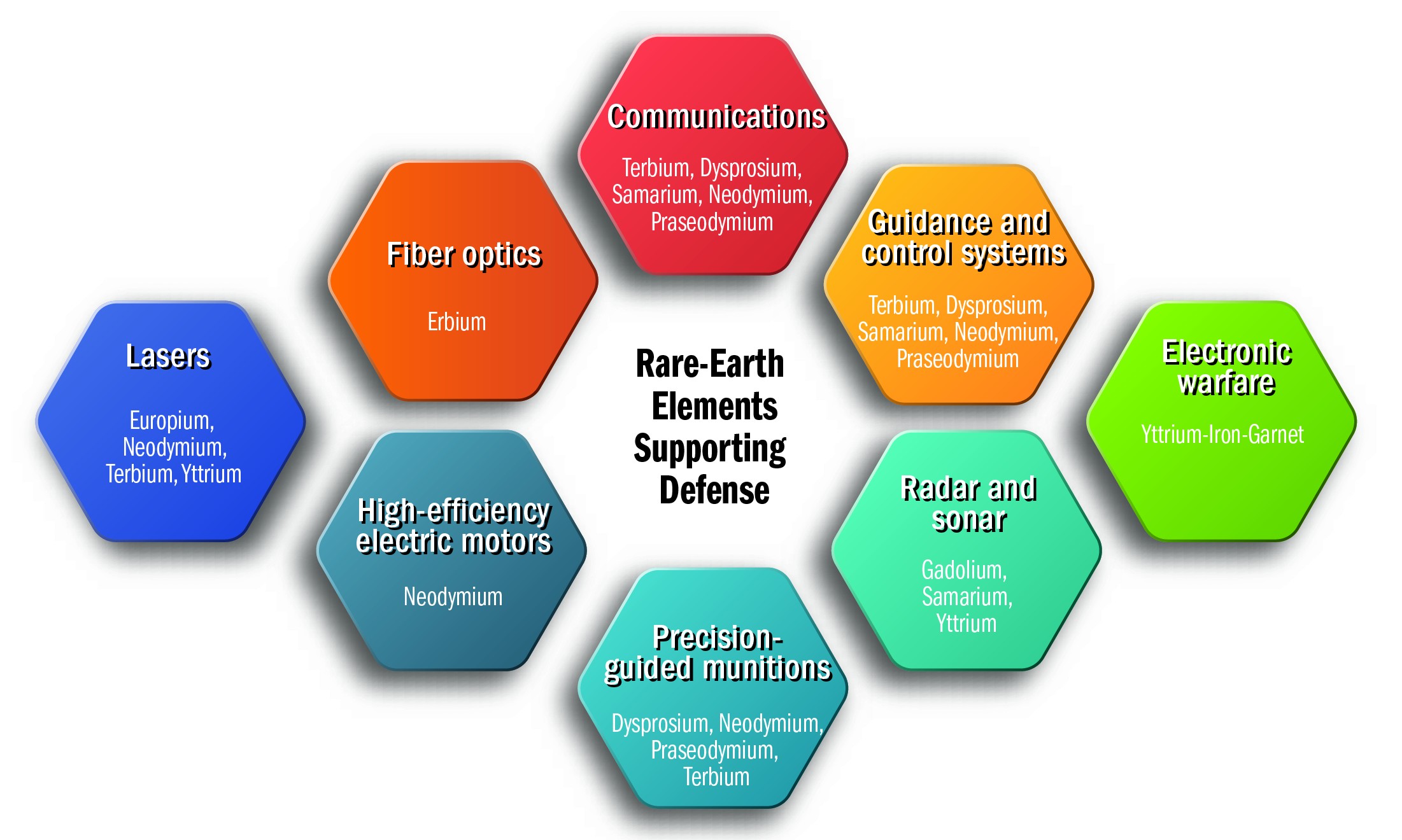

Beneath the surface of smartphones, electric vehicles, and advanced weapons systems lies an often-overlooked reality: America's technological superiority rests on minerals most Americans couldn't name.

Rare earth elements like neodymium and dysprosium, alongside critical minerals such as gallium and graphite, form the hidden architecture of modern technology. These elements enable the miniaturization of electronics, the efficiency of green energy, and the precision of military hardware. Yet the United States finds itself in a precarious position—dependent on potential adversaries for materials essential to both economic vitality and national defense.

The Executive Order directs Commerce Secretary to conduct a comprehensive assessment of this vulnerability, examining not just raw materials but the processed forms and derivative products that actually power American innovation.

"This investigation is fundamentally about mitigating risk and reinforcing the backbone of American industry," noted a source close to the administration, speaking on condition of anonymity due to the sensitivity of ongoing policy deliberations.

The inquiry will inevitably focus on China, which controls approximately 90% of global rare earth processing capacity and similar dominance in other critical minerals. This concentration of power was starkly demonstrated by recent Chinese export bans on gallium, germanium, antimony, and six heavy rare earth metals—moves that sent technological supply chains into disarray worldwide.

| Category | Definition | Examples | Key Applications | Challenges |

|---|---|---|---|---|

| Critical Minerals | Natural resources essential for economic, technological, and national security. | Lithium, Cobalt, Nickel, Copper, Graphite | Batteries, semiconductors, renewable energy systems (e.g., solar panels, wind turbines). | Limited geographic distribution, supply chain vulnerabilities, and environmental extraction issues. |

| Rare Earth Elements | A subset of critical minerals with unique magnetic, luminescent, and catalytic properties. | Neodymium, Dysprosium, Europium, Cerium | Electric vehicle motors, wind turbine magnets, lighting and displays (phosphors), catalysts. | Dispersed deposits make extraction challenging; production concentrated in a few countries. |

The Trump Trade Doctrine Evolves

The investigation marks the next chapter in Trump's distinctive approach to international commerce—one that views traditional free trade orthodoxy with deep skepticism.

From his first day back in office, Trump has reimagined American trade policy. Building on his previous administration's foundation, he immediately imposed a 10% tariff on general imports while reserving harsher measures for nations running significant trade surpluses against the United States. His administration has engaged more than 75 countries in trade discussions, while simultaneously threatening China with tariffs that could reach a punishing 245%.

The U.S.-China trade relationship remains particularly fraught, as illustrated by persistent deficits:

| Year | U.S. Goods Trade Deficit with China (Billions USD) | U.S. Goods and Services Trade Deficit with China (Billions USD) | Data Source |

|---|---|---|---|

| 2024 | $295.4 | $263.0 (approx., based on $295.4 goods deficit & estimated $32.4 services surplus) | U.S. Census Bureau / USTR / Trading Economics / PolitiFact |

| 2023 | $279.1 (approx., based on $295.4 in 2024 being 5.8% increase) | $252.0 | USTR / FactCheck.org / PolitiFact |

| 2022 | $382.9 (Implied, based on goods deficit changes) | $366.0 | FactCheck.org / US-China Business Council (Services data) |

| 2018 | $418.2 | $378.0 (approx.) | EL PAÍS English / FactCheck.org |

Now, with critical minerals in his crosshairs, Trump signals that economic security and national security have become inseparable considerations in the administration's calculus.

A Nation Divided on Mineral Strategy

The investigation has triggered fierce debate across industries and expert communities.

"Without secure access to these minerals, we're building our future on quicksand," argues a defense contractor executive, who requested anonymity to speak candidly about sensitive supply arrangements. "When China banned gallium exports last year, it exposed just how vulnerable our defense industrial base has become."

Indeed, America's dependence on foreign sources is nearly absolute for several crucial minerals:

| Mineral | US Mine Production (Metric Tons) | Net Import Reliance (%) | Year | Notes |

|---|---|---|---|---|

| Rare Earths (REO equivalent) | 43,000 | 74% (Compounds & Metals) | 2023 | Production from Mountain Pass, CA. Reliance primarily on China (~72% of imports 2019-22). |

| Gallium | 0 | 100% | 2023 | No primary domestic production since 1987. Relies on imports (metal & wafers). China implemented export controls in Aug 2023. |

| Antimony | 0 | 100% | 2024 | US is 100% import reliant. China announced export ban to US in late 2024. |

| Manganese | 0 | 100% | 2023 | US is 100% import reliant, primarily from Gabon (based on 2018-2021 data). |

| Graphite (Natural) | 0 | 100% | 2023 | US is 100% import reliant, primarily from China (based on 2018-2021 data). |

But skeptics question whether protectionist measures will achieve their intended outcome.

"Without a realistic plan to scale up domestic production quickly, the risk of supply chain disruption is far too high," cautions a veteran economist specializing in industrial policy. "You can't simply wish refineries and processing facilities into existence with tariffs."

Critics suggest a more nuanced approach combining targeted quotas with strategic exemptions might better serve American interests—preserving relationships with allies like Chile while still addressing the core vulnerability.

The reality is stark: China's processing dominance extends across the critical mineral landscape:

| Mineral | China's Global Processing Share (%) | Data Source/Year Notes |

|---|---|---|

| Rare Earth Elements (REEs) | ~90% | Mining Technology (Jan 2025), CSIS (Jan 2024), Zimtu Capital (Nov 2024), Visual Capitalist (Nov 2024), IEA via How China Came to Dominate (Apr 2022) report 85% |

| Heavy Rare Earths | 99.9% | Benchmark Minerals Intelligence via CSIS (Jan 2024), Visual Capitalist (Nov 2024) |

| Refined Cobalt | 70% | IEA via Mining Technology (Sep 2024) |

| Refined Lithium | >60% | IEA via Mining Technology (Sep 2024) |

| Battery-Grade Graphite | 99% | IEA via Mining Technology (Sep 2024) |

| Gallium (Products/Refining) | ~90% - 98% | University of Technology Sydney (Jul 2023), Tradium (Jan 2024), ING Bank (Jul 2023), Sourceability (Dec 2024), USGS via Quantifying potential effects (Oct 2024) notes >90% since 2014 |

| Germanium (Products/Refining) | ~68% - 80% | University of Technology Sydney (Jul 2023), Tradium (Jan 2024), ING Bank (Jul 2023) |

The Market Reacts: Pain Now, Resilience Later?

For industries dependent on these materials—from automotive manufacturers to semiconductor designers—the Section 232 investigation introduces unwelcome uncertainty.

"We're already exploring contingency sourcing options," confides a supply chain director at a major electronics manufacturer. "But realistically, there's no short-term substitute for Chinese processing capacity."

Yet for forward-thinking investors, the investigation represents potential opportunity amid disruption.

"This could be the catalyst American mining and processing has needed," suggests a market analyst specializing in strategic materials. "The move could unleash a wave of innovation, driving companies to pioneer new technologies and recycling methods that reshape critical mineral processing."

Indeed, several U.S. mining operations have already announced accelerated timelines for expansion projects, anticipating favorable policy changes following the investigation's conclusion.

Redefining Global Supply Chains

Beyond America's borders, the investigation has prompted diplomatic consternation. European allies worry about collateral damage from potential tariffs, while mineral-producing nations like Chile eye the potential for new bilateral agreements that might exempt them from broader restrictions.

The global market for these minerals exists in delicate balance. Rare earth magnets—powerful permanent magnets made from alloys like neodymium and samarium-cobalt—exemplify the complex interdependence of modern supply chains. Nearly every advanced economy depends on these components, yet their production remains overwhelmingly concentrated in China.

The Section 232 investigation thus represents more than a technical trade remedy; it signals America's intention to fundamentally reconfigure global material flows according to strategic rather than purely economic calculations.

The Road Ahead: Strategic Autonomy or Supply Chain Chaos?

As the Commerce Department begins its work, uncertainty reigns. Will the United States successfully decrease its dependence on potentially hostile sources, or will hasty measures trigger unintended consequences across interconnected industries?

The answer likely lies somewhere between revolution and evolution. Even the most ambitious domestic capacity expansion will require years to meaningfully shift the balance of processing power. In the interim, strategic stockpiling, recycling innovation, and carefully calibrated trade measures may offer the most practical path forward.

What remains clear is that America's technological future—from the smartphones in consumers' pockets to the weapons systems protecting its borders—depends on securing reliable access to materials most citizens have never encountered. In that sense, President Trump's mineral gambit represents a belated recognition of a vulnerability that has been building for decades.

As one mining executive put it: "Whether you're talking about the green transition or national defense, whoever controls these minerals controls the future. This investigation is about determining whether that control remains in American hands."

The Commerce Department investigation is expected to deliver its findings within 270 days, potentially reshaping global mineral flows for generations to come.