Trump’s Tariff Gambit Has Hit a Wall. What Cards Does He Have Left — and What’s His Smartest Next Move?

Trump’s Tariff Gambit Has Hit a Wall. What Cards Does He Have Left — and What’s His Smartest Next Move?

As China Shows Strategic Patience, the U.S. Risks Playing a Losing Hand Without a Tactical Shift

WASHINGTON — After a week of aggressive moves, President Donald J. Trump’s trade war with China has reached a boiling point.

What Tools Does Trump Still Hold?

1. Negotiation Leverage Through De-escalation

The single most effective move remaining is not additive but subtractive: a tactical de-escalation that opens the door to structured negotiations. Trump could present this as a high-stakes game of brinkmanship that brought China to the table — allowing him to pivot while preserving the image of strength.

“He doesn’t have to back down,” said one policy analyst with knowledge of White House internal discussions. “He just needs to reframe the narrative: ‘We’ve applied pressure. They’ve blinked. Now let’s make a deal.’”

Offering conditional tariff rollbacks in exchange for specific Chinese policy adjustments — whether on intellectual property, market access, or state subsidies — could allow Trump to claim a win without further hurting U.S. consumers or markets.

2. Targeted Industrial Investment — Shifting from Defense to Offense

Rather than fighting on China’s terms through punitive tariffs, Trump could redirect focus toward industrial policy and technological investment at home. China has spent six years building import substitution frameworks, particularly across semiconductors, rare earths, and core manufacturing. The U.S., by contrast, remains exposed in strategic sectors.

Trump could unveil an “America Can Build” initiative, combining federal R&D funding, tax incentives, and supply chain reshoring credits — positioning the U.S. for long-term competitiveness.

“If the goal is independence from China, tariffs alone won’t do it,” said one Silicon Valley-based economist. “You need a 10-year industrial strategy. That’s the real answer to Beijing’s playbook.”

Industrial policy encompasses government strategies designed to shape the economy by promoting specific industries or sectors deemed crucial for growth and competitiveness. Historical examples, such as those in the US or strategies like import substitution industrialization, illustrate different approaches governments take to achieve these economic objectives.

4. Financial Market Calibration

The surge in Treasury yields above 5% should be a wake-up call. It implies investor anxiety about both inflation and liquidity — potentially tied to perceptions that China could unwind U.S. bond holdings. Trump cannot afford to ignore this.

Freezing further tariff hikes temporarily and coordinating with the Federal Reserve to maintain monetary stability would help avert a broader market shock. Maintaining investor confidence is as critical as messaging strength to voters.

China’s Position: Built for the Long Game

Unlike in 2018, this time China is not scrambling. It has prepared a comprehensive policy matrix — from reserve requirement and interest rate tools, to fiscal expansion, to local industrial subsidies.

Central banks utilize reserve requirements as a monetary policy tool, mandating the minimum percentage of deposits that banks must hold in reserve and cannot lend out. By adjusting this ratio, they can influence the amount of money banks have available to lend, thereby impacting credit availability and the overall money supply in the economy.

It has withheld monetary stimulus tools deliberately, suggesting that it is preserving ammunition for a prolonged economic standoff. A Chinese analyst compared the strategy to a Go board, where each move is reactive, patient, and surgical: “Defeating magic with magic.”

China’s message is clear: It will not blink first. And unlike the U.S., it has constructed regional economic alliances (ASEAN, Africa, Latin America) as part of a post-globalization framework. The tariff war is costly, but less existential for Beijing than Washington may hope.

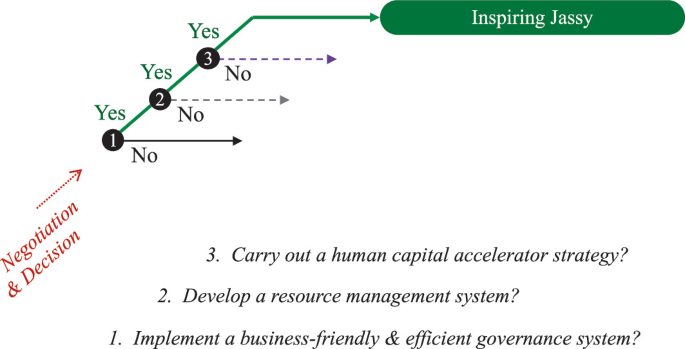

The Winning Move Now: A Dual-Track Strategy

1. Publicly Declare Readiness to Negotiate

Without lifting tariffs preemptively, Trump can signal a readiness to talk, creating an off-ramp. He can position it as a conditional offer: “China must meet us halfway — then we’ll ease pressure.”

This allows him to claim victory for bringing China to the negotiating table, even if the underlying conditions have not yet changed.

2. Quietly Freeze Further Escalation

By avoiding another round of increases, Trump buys time to gauge markets, stabilize investor sentiment, and engage diplomatic back channels. This “pause” becomes a tactical decision, not a retreat.

3. Launch a Strategic Supply Chain Initiative

Unveiling a domestic supply chain revitalization program — one that focuses on semiconductors, green energy, and pharmaceuticals — could create a positive policy narrative. It also answers one of the key vulnerabilities the Chinese side has already mitigated for themselves.

The Most Powerful Card: Acting Like Someone Worth Negotiating With

Above all these strategic cards — negotiations, alliances, industrial policy, and market calibration — perhaps the most critical move Trump can make is not policy, but posture. Portraying himself as a rational, negotiable counterpart — someone who, while firm, can be reasoned with — would dramatically alter the tone and trajectory of this conflict. Diplomacy is not weakness; it’s leverage in disguise. By stepping back from a purely combative stance, and engaging with respect rather than disdain, Trump could unlock doors currently shut by mutual mistrust. If he fails to evolve from firebrand to statesman, even the most sophisticated strategies may crumble under the weight of isolation. Without that shift, everything he set out to achieve for the United States — economic leverage, industrial renewal, global positioning — could ultimately go in vain.

From Tariffs to Tactics — Time for a Pivot

President Trump’s tariff surge has reached its tactical limits. With tariffs now over 100%, any further pressure risks severe economic fallout without delivering additional leverage.

China, meanwhile, is playing the long game — with internal tools still unused and global partnerships quietly expanding. In this setting, Trump’s smartest move is not more firepower, but better positioning.

By pivoting to negotiation, coordination, and strategic investment, the administration can reshape the trade conflict into a multi-dimensional economic strategy — one that not only confronts China but also strengthens the American foundation.

The game is far from over. But unless the U.S. changes tactics, it may find itself outmaneuvered — not by firepower, but by finesse.