Trump Threatens Further Tariffs and Sanctions Over Mexico's Water Shortfall Under 1944 Treaty

“Water is the New Oil”: Trump’s Border Clash with Mexico Sparks Treaty Tensions, Investor Alarm, and Climate Reckonings

As Drought Deepens, a Presidential Warning Escalates a Quiet Crisis Into a Geopolitical Flashpoint

In a post that jolted traders, diplomats, and farmers alike, President Donald J. Trump reignited a long-simmering dispute over a World War II-era water treaty with Mexico—accusing the neighboring country of “stealing” water from Texas and vowing aggressive retaliation. His message, posted on Truth Social, pledged to impose tariffs, halt water exports to Mexico, and consider sanctions until the United States receives what he claims is “1.3 million acre-feet of water” owed under the 1944 Water Treaty.

The announcement has poured gasoline on a policy tinderbox that had, until now, remained largely relegated to agricultural and environmental circles. In reality, it’s about far more than crops—it’s about commodities, climate, and cross-border power.

A 1944 Treaty, a 2025 Drought, and a Fractured Water Future

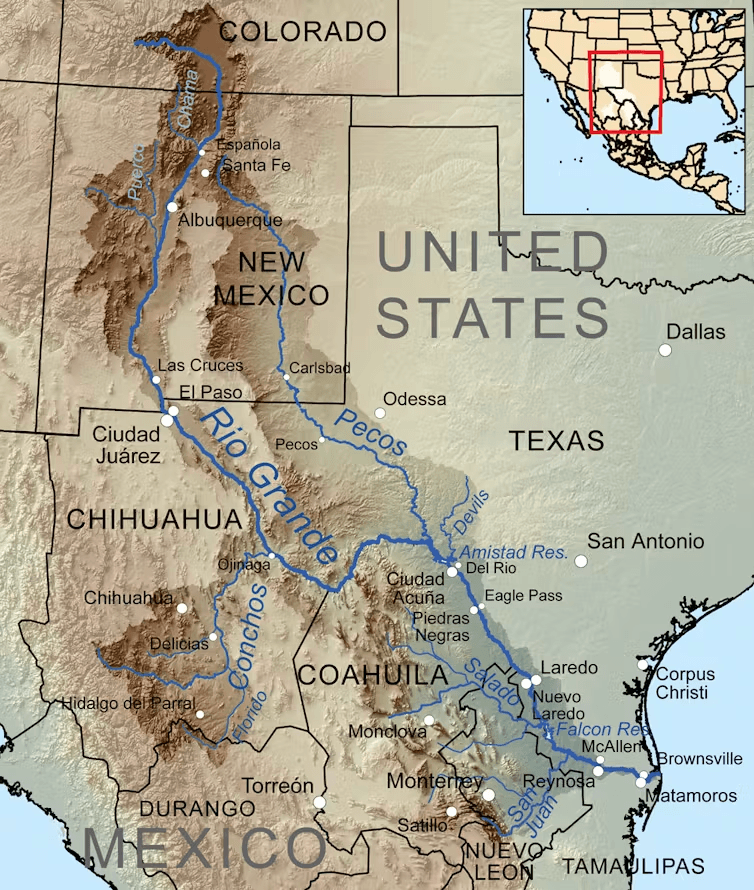

The dispute centers on the 1944 Water Treaty, an agreement that requires Mexico to deliver an average of 350,000 acre-feet of water annually to the U.S. from six tributaries that feed into the Rio Grande. The full cycle spans five years, totaling roughly 1.75 million acre-feet. Trump and his allies claim that Mexico is currently delinquent, having delivered less than 30% of that obligation.

Did you know that an acre-foot of water is a significant unit of measurement? It represents the amount of water needed to cover one acre of land to a depth of one foot, which is equivalent to about 325,851 gallons or 1,233 cubic meters. Historically, this volume was enough to supply two suburban households for a year, but with modern conservation practices, it can now support up to three households annually. Acre-feet are crucial for managing large water resources, such as reservoir capacities and irrigation allocations, making them a vital metric in water management and planning.

For South Texas—where agriculture hinges on water from the Rio Grande—the shortage is catastrophic. The closure of the state’s last sugar mill last year is frequently cited as a vivid marker of the crisis.

Farmers, ranchers, and regional water boards are sounding the alarm. “We’ve been warning about this for years,” said one irrigation district official who asked not to be named. “It’s not just about international law—it’s about losing entire growing seasons. You can't plant fields with promises.”

Yet the treaty itself isn’t as clear-cut as Trump’s tweet suggests. “The agreement allows Mexico to delay delivery in cases of extraordinary drought,” explained a senior hydrologist affiliated with an international water monitoring commission. “So yes, there’s a shortfall. But that doesn’t automatically mean there’s a violation.”

Summary of Mexico's Water Delivery Challenges Under the 1944 Treaty

| Aspect | Details |

|---|---|

| Obligation | Deliver 1.75 million acre-feet of Rio Grande water to the U.S. every five years. |

| Current Status | Less than 30% delivered; over 1.25 million acre-feet shortfall with deadline in October 2025. |

| Key Challenges | Severe drought, climate change, poor infrastructure, and rising local water demand. |

| Political Tensions | U.S. officials (especially Texas) accuse Mexico of recurring failures, impacting American farmers. |

| Treaty Flexibility | Allows deficit carryovers during droughts, but fails to ease U.S. concerns about repeated shortfalls. |

| Negotiation Efforts | Mexico is negotiating with the U.S., fearing economic retaliation (e.g., tariffs). |

| Domestic Opposition | Reallocation of water from northern Mexican states has sparked protests and resistance locally. |

| Broader Context | Both nations face prolonged droughts and increasing water demands, straining treaty commitments. |

Border Farmers Applaud the Rhetoric, but Critics Warn of Political Pyromania

Trump’s message resonated loudly in South Texas, where water scarcity has taken a personal and economic toll. Supporters, including Senator Ted Cruz and Rep. Monica De La Cruz, have long pushed for stronger enforcement of the treaty. Agricultural Secretary Brooke Rollins has gone even further, backing economic retaliation to ensure Mexico’s compliance.

Behind closed doors, some policy experts privately express support for Trump’s hardline approach, viewing it as a necessary pressure tactic. “Mexico has relied too long on last-minute rainstorms to fulfill its obligations,” said a senior policy strategist. “This sends a signal that waiting for rain isn’t a strategy anymore.”

But critics argue the post’s tone risks tipping delicate diplomacy into confrontation. “This isn’t just about Texas,” one former U.S. diplomat cautioned. “It’s about U.S.-Mexico cooperation in everything from trade to immigration to drug enforcement. A blow-up over water could derail years of coordinated progress.”

Moreover, several legal scholars challenge the political framing of the issue. Gabriel Eckstein, a leading water law expert, has long warned that the 1944 treaty is built on assumptions that no longer hold true in a climate-altered world. “We’re applying 20th-century metrics to a 21st-century climate,” one water analyst noted. “This isn’t about enforcement. It’s about modernization.”

Did you know that the U.S.-Mexico Water Treaty of 1944 includes a unique "Minute" system? This system allows for flexible adjustments to the treaty without needing formal legislative changes, enabling rapid responses to challenges like droughts and climate change. Through the International Boundary and Water Commission (IBWC), the U.S. and Mexico collaborate on these "Minutes," which have been instrumental in managing shared water resources, such as the Colorado River. For example, Minute 319 facilitated water storage flexibility and environmental restoration projects. This adaptive approach has made the treaty a "living document," capable of addressing evolving hydrological and governance challenges, making it a model for transboundary water management worldwide.

Tariffs, Sanctions, and Supply Chains: Markets React to a New Category of Geopolitical Risk

The policy ramifications are already sending ripples through markets—especially in sectors tethered to cross-border infrastructure, agriculture, and utilities. Investors have begun repricing risk in companies exposed to Texas agriculture and U.S.–Mexico trade routes.

“The idea of halting water exports to Tijuana may sound like leverage, but it risks unintended consequences,” said one Latin America-focused fund manager. “Water is connected to energy, sanitation, health. You pull one thread, the whole border economy could unravel.”

The Cross-Border Web at Risk

- Agribusiness: Companies dependent on Rio Grande-fed irrigation systems are bracing for further yield declines, which could stress inventories and impact processing firms downstream.

- Utilities: Regional water utilities are seeing a surge of interest from investors betting on emergency infrastructure spending—particularly in desalination, reclamation, and leak mitigation technologies.

- Logistics and Manufacturing: If tariffs or sanctions are enacted, supply chains connecting maquiladoras in Mexico to Texas assembly lines could face delays, added costs, or outright suspension.

- Currency Markets: Early trading signals suggest that market participants are hedging against volatility in the Mexican Peso, while analysts say U.S. municipal bonds tied to drought-prone regions could also experience pressure. Table: Summary of U.S.-Mexico Annual Trade Volume Trends and Key Insights, 2023-2025

| Category | 2023 | 2024 | 2025 (YTD) |

|---|---|---|---|

| Total Trade Volume | $699 billion | $1.5 trillion | $69.6 billion (Jan 2025) |

| U.S. Exports to Mexico | $243 billion | N/A | $27.9 billion (Jan 2025) |

| Mexico Exports to U.S. | $456 billion | N/A | $41.7 billion (Jan 2025) |

| Top U.S. Exports | Refined petroleum, vehicle parts, gas | Similar trends | Refined petroleum, vehicle parts |

| Top Mexico Exports | Cars, vehicle parts, delivery trucks | Similar trends | Cars, vehicle parts |

| Trade Growth Rates (2018-2023) | U.S. exports: +2.26% annually | Mexico exports: +5.22% annually | N/A |

| Key Trade Hubs | Texas: $9.55B exports, $12B imports | Texas remains a key trade hub | Texas leads trade activity |

Water Becomes a Political Weapon, but Experts Urge Structural Reform, Not Retaliation

While Trump’s call for “tariffs and maybe even sanctions” dominates headlines, a chorus of water and trade experts warns that confrontational tactics may worsen, not solve, the issue.

Instead, they advocate revisiting the treaty’s “minute” system—an existing framework allowing for modern amendments to the treaty without rewriting it entirely. Past “minutes” have added flexibility to dam management and emergency delivery protocols. A new minute, some argue, could incorporate climate contingencies and updated data modeling.

“Why are we punishing Mexico for something we haven’t prepared for ourselves?” asked one water equity researcher. “Texas doesn’t even have a unified groundwater policy. Our domestic water mismanagement makes retaliation look hypocritical.”

From a structural standpoint, the most enduring takeaway may be the new lens through which water is viewed. No longer a public utility relegated to the sidelines of geopolitical analysis, water is increasingly seen as a tradable asset, a national security concern, and an investor risk vector.

The Price of Water in a Climate-Driven Future

Trump’s post may have crystallized the issue in blunt political terms, but the underlying tensions span law, climate science, economics, and geopolitics. Whether his warnings translate into actual policy or remain political theater, they have already achieved one effect: forcing water to the top of America’s foreign policy and investment agenda.

For now, the next moves will likely unfold in diplomatic backchannels, treaty oversight meetings, and investment portfolios recalibrating for a world where natural resources are no longer cheap, plentiful, or predictable.

What comes next isn’t just about the Rio Grande. It’s about how we price scarcity, govern shared assets, and build resilience across borders—in water, and beyond.