U.S. Consumer Confidence Plunges to 12-Year Low in March 2025, Stirring Fears of Recession and Policy Missteps

U.S. Consumer Confidence Plunges to 12-Year Low, Stirring Fears of Recession and Policy Missteps

March's Collapse in Expectations Index Reveals Deepening Economic Anxiety Across Age and Income Groups

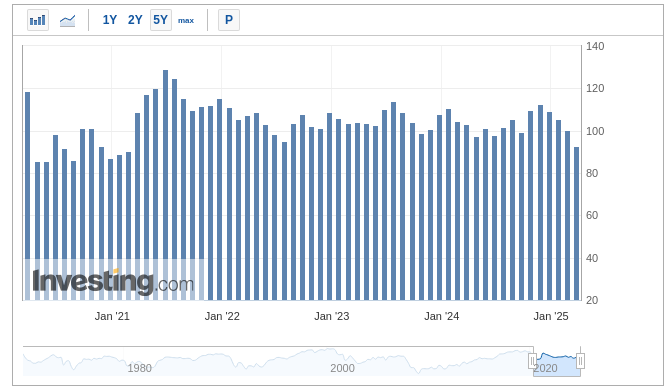

In a stark warning for the U.S. economy, consumer confidence tumbled for a fourth consecutive month in March, with The Conference Board’s Expectations Index plunging to its lowest level since 2013. The sharp decline reflects not only a souring outlook on jobs and income but also a deepening skepticism about the broader economic trajectory, as rising inflation and tariff concerns begin to corrode consumer sentiment in earnest.

The Consumer Confidence Index®, which surveys Americans’ perceptions of present and future economic conditions, fell to 92.9 in March—a drop of 7.2 points from February and well below economists’ expectations. But it was the Expectations Index, a forward-looking gauge based on income, labor, and business prospects, that sent a resounding alarm: down 9.6 points to 65.2, signaling recession territory.

| Metric | March 2025 Value | Change vs. Feb 2025 | Key Takeaway |

|---|---|---|---|

| Consumer Confidence Index | 92.9 | -7.2 | Down for 4th month |

| Present Situation Index | 134.5 | -3.6 | Weakening business assessment |

| Expectations Index | 65.2 | -9.6 | 12-year low, below recession signal threshold |

| Inflation Expectations | 6.2% | +0.4% | Rising, concern over staple prices & tariffs |

| Stock Market - Expect Prices to Rise | 37.4% | -10.0% | Negative Market Views |

“We are now below the threshold that typically precedes economic contractions,” said one senior macro analyst at a major hedge fund. “It’s a psychological inflection point.”

Gloom Deepens, Especially Among Older Americans

The data reveal a generational and socioeconomic cleavage in confidence levels. Consumers aged 55 and older—who typically account for a substantial portion of total wealth and stable spending—saw the steepest decline in optimism. Confidence also dropped significantly among middle-aged households, while those under 35 registered a modest increase, likely tied to stronger perceptions of the present job market.

This divergence is critical, as younger consumers often drive discretionary spending in categories such as tech, travel, and lifestyle goods. However, their optimism may be fragile.

“Younger people might feel upbeat today, but the broader economic storm clouds could quickly darken their outlook,” noted a consumer behavior specialist with a New York.

By income, the decline was broadly distributed. Confidence eroded across most brackets, with only households earning more than $125,000 per year bucking the trend—perhaps a reflection of equity market exposure and wealth buffers. But even there, optimism was tepid.

Cracks in the Foundation: Business and Labor Sentiment Falter

Consumers’ appraisal of present-day conditions weakened overall. Only 17.7% said current business conditions are “good,” a drop from 19.1% in February, while those saying conditions are “bad” rose to 16.6%. Meanwhile, views of the labor market were mixed: 33.6% said jobs were plentiful—unchanged—but the percentage who said jobs were “hard to get” fell slightly to 15.7%.

While those figures might appear stable, they mask a much sharper deterioration in expectations.

- Only 17.1% of respondents believe business conditions will improve in the next six months, down from 20.8%.

- Just 16.7% expect more jobs to be available, a 2-point drop.

- And crucially, just 16.3% anticipate their income will rise—down from 18.8%—while 15.5% now expect it to decline.

The collapse in income optimism, which had been resilient in previous months, is particularly telling.

“We’re seeing the first signs that worries about inflation, employment, and tariffs are seeping into how people view their own financial futures,” said a senior economist familiar with the Conference Board’s survey methodology.

Inflation: Still the Phantom in the Room

Adding to the anxiety is inflation. Expectations for 12-month inflation climbed again in March—from 5.8% to 6.2%—driven by persistent price pressures on essentials such as food, utilities, and imported goods. Eggs, in particular, were cited in multiple write-in responses as emblematic of surging everyday costs.

The Philips curve illustrates the inverse relationship between unemployment and inflation. Generally, lower unemployment is associated with higher inflation, and vice versa. This concept is a fundamental principle in macroeconomics.

Consumers are increasingly associating these cost increases with tariffs, according to the survey’s qualitative data. With trade policies remaining volatile and politically charged, expectations of further price hikes are rising. Nearly 39% of respondents reported difficulty predicting future inflation, highlighting the confusion and uncertainty permeating household budgets.

The inflation outlook is compounding fears about interest rates: 54.6% of consumers now expect rates to rise in the next 12 months (up from 52.6% in February), while just 22.4% expect lower rates.

Stock Market Sentiment Turns Sour

In a notable reversal, consumer expectations about stock prices also shifted into negative territory for the first time since late 2023. Just 37.4% of respondents expect stock prices to rise over the next year—down almost 10 points from February and 20 points from November 2024. Meanwhile, 44.5% expect markets to decline.

This erosion in equity sentiment is no small matter. Given the importance of 401(k)s and brokerage accounts in household wealth, consumer negativity on the markets could amplify the pullback in discretionary spending, particularly among higher-income groups.

Tariff Fears Fuel Durable Goods Purchases, Shift Priorities

Ironically, even as confidence plunges, some purchasing intentions are ticking up—but for potentially troubling reasons. On a six-month moving average, plans to buy homes and cars declined. Yet intentions to buy big-ticket items—such as appliances and electronics—rose slightly.

“This may reflect an acceleration in purchases ahead of expected price increases tied to new tariffs,” noted a retail analyst. “It’s a defensive behavior, not a confident one.”

Meanwhile, vacation plans increased, but entertainment spending (such as on movies and sports) fell. Consumers appear to be reallocating budgets toward outdoor and travel experiences—potentially viewing them as better value or more essential amid tightening wallets.

Consumer Voices: Inflation, Politics, and Uncertainty

Write-in responses collected as part of the survey overwhelmingly focused on inflation, administration policies, and economic uncertainty. Some consumers cited specific trade decisions and tariff increases, while others expressed frustration at a perceived lack of policy clarity.

One particularly striking trend: more than a third of respondents said they found it difficult to predict broader economic trends such as inflation and employment—highlighting a widespread sense of disorientation.

“When people can’t form expectations, they don’t spend,” said an economist at a Washington, D.C. think tank. “That’s when risk aversion sets in.”

What It Means for Markets and the Economy

The consumer sentiment downturn could ripple across financial markets and economic policy alike. Given that consumer spending accounts for roughly 68% of U.S. GDP, a contraction in sentiment may foreshadow slower growth, weaker earnings in discretionary sectors, and a harder landing than previously anticipated.

Investment strategists are already pivoting.

“You’re going to see a rotation out of cyclicals and into defensive sectors,” one institutional investor explained. “Think consumer staples, healthcare, utilities—anything with reliable cash flow and pricing power.”

Meanwhile, if inflation expectations remain high, the Federal Reserve may find itself boxed in—unable to cut rates to support growth without risking further price instability. That could result in a prolonged period of tight monetary conditions, increasing the odds of a stagflation scenario.

| Period | Duration | Peak Inflation | Peak Unemployment | Key Policy Response / Resolution | Primary Causes |

|---|---|---|---|---|---|

| 1964 Baseline | 1964 (pre‑stagnation) | ~1% | ~5% | – | Stable post‑war economic expansion |

| 1970s Stagflation (Overall) | 1965–1982 | Gradually rising to ~14.5% by 1980 | Rising; ~9% in 1973–75 and ~7.5% in 1980 | Aggressive monetary tightening by Paul Volcker (prime rate >21%) | Oil shocks (embargo), loose monetary policy, high budget deficits, collapse of Bretton Woods |

| 1973–1975 Oil Crisis | 1973–1975 | Inflation doubled in 1973; exceeded 12% in 1974 | Peaked around 9% by May 1975 | Initial adjustments followed later by further tightening | OPEC oil embargo and resulting supply shocks |

| Peak Stagflation (Summer 1980) | Summer 1980 | Near 14.5% | Over 7.5% | Continued Volcker tightening ultimately induced a recession to rein in inflation | Lagging policy response and persistent inflationary expectations following oil shocks |

| COVID‑19 Recession & Inflation Surge | Recession in early 2020; inflation surge 2020–2023 | Early 2020 saw a brief dip then a surge to ~8–9% in 2022 | Spiked at 14.7% (April 2020) then moderated to ~6% by 2022 | Massive fiscal stimulus in 2020 followed by aggressive Fed rate hikes from 2022 onward | Pandemic‑induced supply chain disruptions, abrupt demand shifts, and unprecedented fiscal stimulus |

Confidence Cracks, and Cracks Matter

The March collapse in consumer expectations is not just another data point—it is a potential tipping point. With sentiment at its lowest in over a decade, inflation concerns mounting, and trust in policy wavering, the U.S. consumer—the engine of the economy—is showing signs of fatigue.

While some purchasing behavior may spike temporarily as households move to preempt price increases, the broader trend is unmistakable: caution, concern, and a creeping sense that the path forward is uncertain.

Markets, policymakers, and businesses alike would do well to pay attention. Confidence, once broken, is not easily rebuilt.